When applying for a mobile loan in Nigeria, it’s important to stay updated on the progress of your loan and your repayment status. LairaPlus, a leading mobile loan provider in Nigeria, offers customers a convenient way to check their loan

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

When applying for a mobile loan in Nigeria, it’s important to stay updated on the progress of your loan and your repayment status. LairaPlus, a leading mobile loan provider in Nigeria, offers customers a convenient way to check their loan

When it comes to borrowing money online, one of the most common questions people ask is whether they need a guarantor to obtain a loan. As an online borrowing platform, LairaPlus strives to provide transparent and responsible loan options to

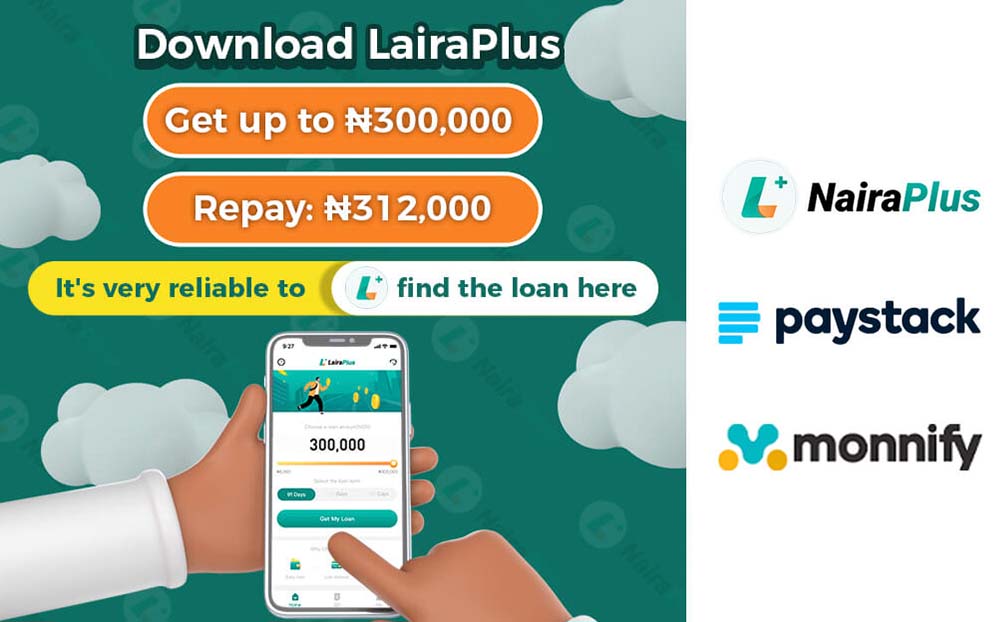

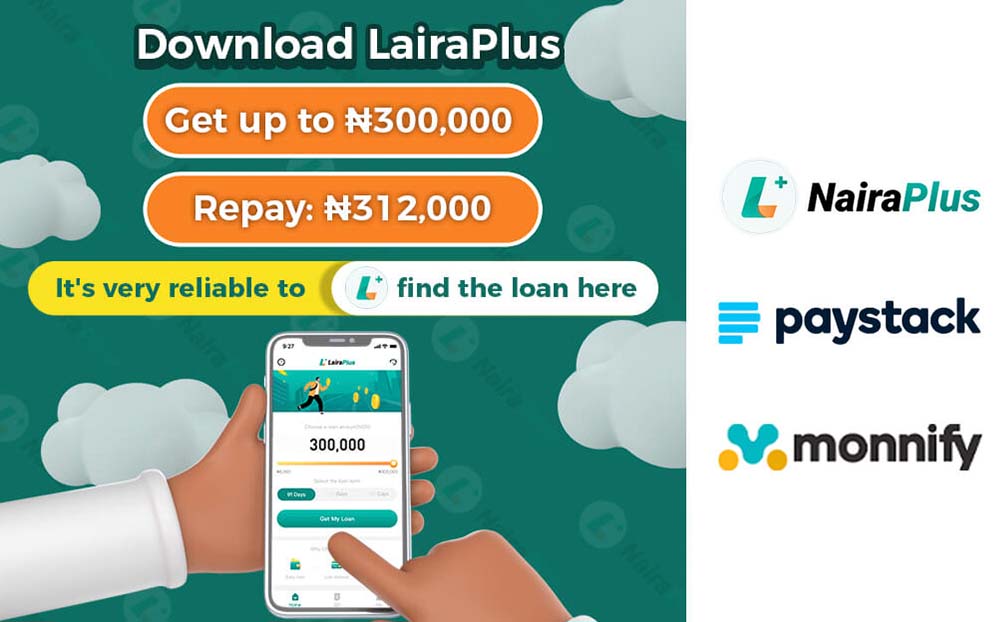

With the increasing popularity of online borrowing, many people are concerned about the interest rates associated with these loans. As an online borrowing platform, LairaPlus aims to provide transparent and responsible loan options to help customers meet their financial needs.

With the popularization of the Internet and the development of financial technology, more and more people choose to obtain funds through online lending platforms. However, many people have doubts about the security of online borrowing. This article will take LairaPlus

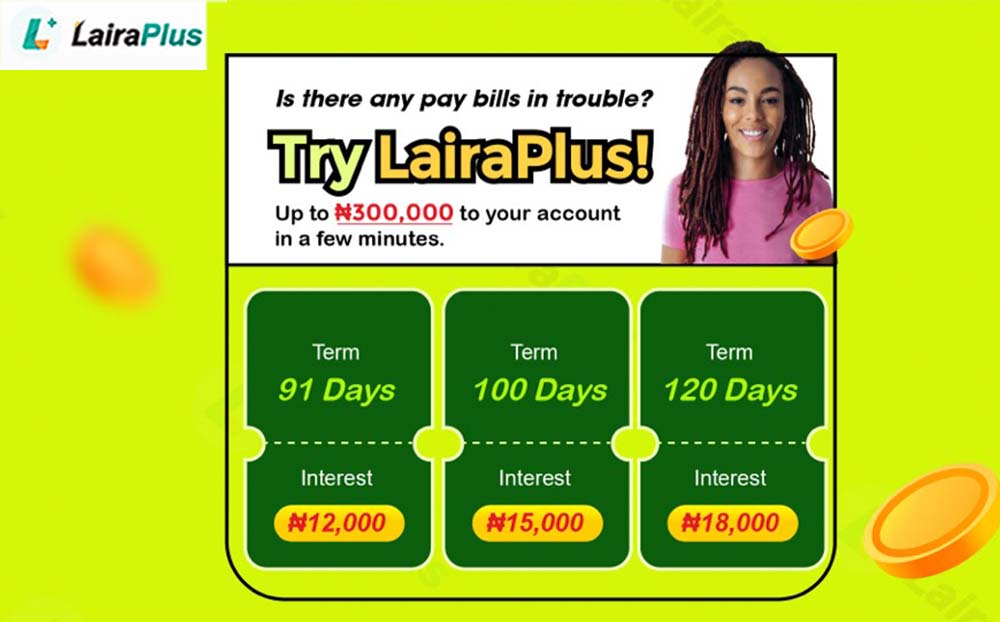

Instant cash loans in 5 minutes can offer quick financial relief, but they also come with several risks. Here are some risks and precautions to consider: High Interest Rates: These loans often come with significantly higher interest rates compared to

Applying for a 5-minute instant cash loan can potentially impact your credit record in several ways: Hard Inquiry on Your Credit Report: When you apply for a loan, the lender usually performs a hard inquiry (or hard pull) on your

The interest rates for instant cash loans in 5 minutes can vary significantly depending on the lender, the amount borrowed, the repayment period, and the borrower’s creditworthiness. These loans often come with higher interest rates compared to traditional loans due

Applying for an instant cash loan in 5 minutes typically involves the following steps: Research and Choose a Lender: Look for reputable online lenders or mobile apps that offer instant cash loans. Read reviews, compare interest rates, fees, and terms

An instant cash loan in 5 minutes refers to a type of loan that allows individuals to borrow money quickly, often within minutes of application approval. These loans are typically offered by online lenders or mobile apps and are designed

Before applying for a 5 minute online loan, it’s essential to take certain precautions and make specific preparations to ensure a smooth and successful borrowing experience. Here’s a list of precautions and preparations: 1. Check Your Credit Report: Review your

In a fast-paced world where financial needs can arise at any moment, the importance of instant personal loans cannot be overstated. These loans are designed to provide rapid financial relief when unexpected expenses or opportunities come your way. LairaPlus, a

In a world where financial needs vary greatly and the unexpected can happen at any time, having a reliable partner for borrowing money is essential. LairaPlus, a leading online lending platform, has become a household name for Nigerians seeking financial

In today’s digital age, the process of securing an instant personal loan in Nigeria has been revolutionized. The days of lengthy paperwork, extended waiting periods, and countless visits to traditional financial institutions are now behind us. With the emergence of

The concept of what is considered a “lot” in personal loans can vary significantly depending on individual financial circumstances, regional factors, and loan purposes. What might be a large loan for one person could be a small loan for another.

Applying for a quick loan in Nigeria typically involves the following steps. Keep in mind that the specific process may vary depending on the lender, but these are the general steps you can expect: Research and Choose a Lender: Start

When it comes to buying a home, one of the biggest challenges can be saving up for a down payment. A down payment is a substantial upfront payment made towards the purchase of a house, and it’s typically a percentage

In Nigeria, like many other parts of the world, life is full of unexpected financial challenges. Whether it’s a medical emergency, a sudden car repair, or any other unforeseen expense, having access to fast cash can make all the difference.

Getting your loan application approved swiftly can be crucial when you’re in need of funds. In this article, we’ll walk you through the steps to ensure a fast loan approval process, with a focus on LairaPlus. 1. Maintain a Healthy

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad