Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

When it comes to buying a home, one of the biggest challenges can be saving up for a down payment. A down payment is a substantial upfront payment made towards the purchase of a house, and it’s typically a percentage of the home’s total price. Many potential homebuyers struggle with the idea of coming up with a large sum of money, especially in today’s real estate market. In such situations, some consider using a personal loan to cover their down payment. But is this a wise financial move, and what should you know before using a personal loan for a home down payment? In this article, we’ll explore the pros and cons of this approach.

Pros of Using a Personal Loan for a Home Down Payment:

Quicker Path to Homeownership: A personal loan can provide you with the funds needed for a down payment much faster than saving for years. This can help you get into the housing market sooner, especially when prices are rising.

Fixed Interest Rates: Personal loans typically come with fixed interest rates, which means your monthly payments remain the same throughout the loan term. This predictability can make it easier to budget for your new home.

Variety of Lenders: Personal loans are offered by banks, credit unions, and online lenders. You have the flexibility to choose the lender that offers the best terms and interest rates, increasing your chances of getting a favorable deal.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

No Collateral Required: Unlike mortgages, personal loans are unsecured, so you don’t need to put your house or other assets at risk. This provides a layer of security in case you face financial difficulties.

Cons of Using a Personal Loan for a Home Down Payment:

Higher Interest Rates: Personal loans often come with higher interest rates compared to mortgage loans. Over the long term, this can result in significantly higher interest costs.

Shorter Loan Terms: Personal loans typically have shorter repayment terms, usually ranging from two to five years. Shorter terms can lead to higher monthly payments, potentially straining your finances.

Limited Loan Amount: The amount you can borrow with a personal loan is generally lower than what you can get with a mortgage. This might not cover the entire down payment, requiring you to have some savings.

Impact on Credit Score: Taking out a personal loan increases your debt-to-income ratio, which can affect your credit score. A lower credit score may result in a higher mortgage interest rate.

Important Considerations:

Debt-to-Income Ratio: Lenders consider your debt-to-income ratio when approving your mortgage application. Adding a personal loan may make it harder to qualify for a mortgage, or you may get a smaller mortgage amount.

Monthly Payments: Calculate your monthly payments for both the personal loan and the mortgage. Ensure you can comfortably manage these payments without overextending your budget.

Loan Terms: It’s crucial to understand the terms of your personal loan and how it will impact your finances. Be aware of the total interest cost and how long it will take to repay the loan.

Credit Score: Monitor your credit score regularly, and work on improving it if needed before applying for a mortgage. A higher credit score can help you secure a better mortgage rate.

Shop Around: Compare the terms and interest rates of different lenders for both personal loans and mortgages. This can help you find the best deal and save money in the long run.

Financial Stability: Ensure you have a stable source of income and an emergency fund in place. Buying a home is a significant financial commitment, and you’ll want to be prepared for unexpected expenses.

In conclusion, while using a personal loan for a home down payment can be a viable option, it’s important to weigh the pros and cons carefully. Consider your financial situation, credit score, and the impact on your debt-to-income ratio. If you decide to proceed, shop around for the best loan terms and interest rates. Ultimately, the goal is to make homeownership a reality without jeopardizing your long-term financial well-being.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

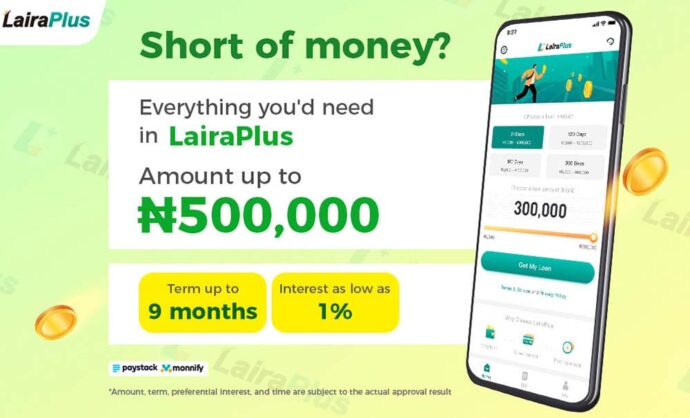

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT