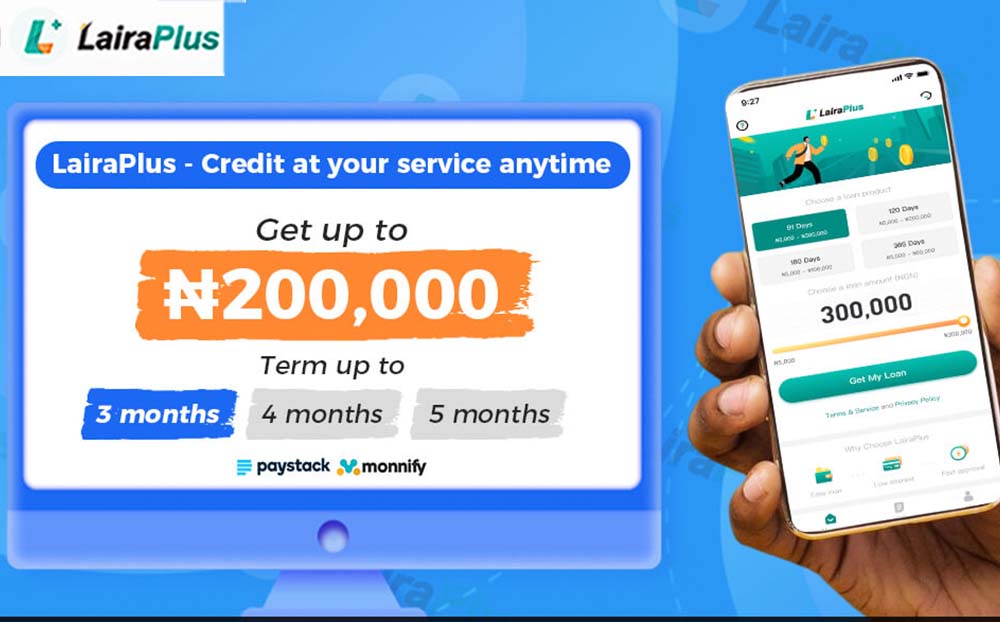

With the rise of online borrowing platforms, many people are interested in knowing how much money they can borrow through these channels. As an online borrowing platform, LairaPlus strives to provide responsible and transparent loan options to meet the financial