Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Rejection is never a pleasant experience, especially when it comes to personal loan applications. LairaPlus, as a reputable online lending platform, understands that financial needs can be urgent and critical. In this comprehensive article, we will explore the steps and strategies to take if your personal loan application with LairaPlus has been rejected and how you can reapply successfully.

Understanding Loan Rejection

Before delving into the reapplication process, it’s crucial to understand why personal loan applications get rejected:

Creditworthiness: Lenders assess your credit history to gauge your ability to repay the loan. A poor credit score or limited credit history can lead to rejection.

Income and Affordability: Lenders evaluate your income to determine whether you can comfortably repay the loan. Insufficient income may result in rejection.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Incomplete or Incorrect Information: Errors or omissions in your application can lead to rejection. Ensure all provided information is accurate and complete.

High Debt-to-Income Ratio: If your existing debt obligations are high in comparison to your income, lenders may view you as a high-risk borrower.

Steps to Take After Loan Rejection

If your personal loan application with LairaPlus has been rejected, don’t lose hope. Here’s what you can do:

1. Understand the Reasons

LairaPlus will provide reasons for the rejection. Carefully review the provided explanation to understand why your application was declined. This insight will guide your next steps.

2. Review Your Credit Report

Obtain a copy of your credit report to ensure its accuracy. Look for any errors or discrepancies that might have negatively impacted your credit score. If you find errors, dispute them with the credit bureau.

3. Improve Your Credit Score

If a poor credit score was a factor in the rejection, work on improving it. Pay your bills on time, reduce outstanding debt, and avoid applying for new credit accounts for some time.

4. Address Outstanding Debts

If a high debt-to-income ratio was a concern, consider paying down existing debts. This can lower your debt burden and improve your chances of loan approval.

5. Increase Your Income

Increasing your income through additional sources of employment or side gigs can enhance your loan eligibility.

6. Wait and Reapply

If your financial situation has improved, consider waiting for a reasonable period before reapplying. This can give you a better chance of approval.

Strategies for a Successful Reapplication with LairaPlus

When you’re ready to reapply for a personal loan with LairaPlus, keep these strategies in mind:

1. Choose the Right Loan Amount

Select a loan amount that aligns with your financial capacity and needs. Avoid requesting excessive amounts that may lead to rejection.

2. Provide Accurate Information

Ensure that all the information provided in your application is accurate and up-to-date. Double-check details such as income, employment, and contact information.

3. Explain Changes

If you’ve made significant improvements in your financial situation since the previous application, consider including a brief explanation in your new application. LairaPlus may appreciate your commitment to responsible borrowing.

4. Consider a Co-Signer

If your credit or financial situation remains challenging, you might explore the option of having a co-signer with a stronger credit profile. This can increase your chances of approval.

Facing rejection on a personal loan application with LairaPlus is not the end of your borrowing journey. It’s an opportunity to address any issues that led to the rejection and work toward a stronger financial position. By understanding the reasons for rejection, improving your creditworthiness, and implementing a thoughtful reapplication strategy, you can increase your chances of securing the personal loan you need to meet your financial goals with LairaPlus. Remember that responsible borrowing and persistence can lead to success in the loan application process.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

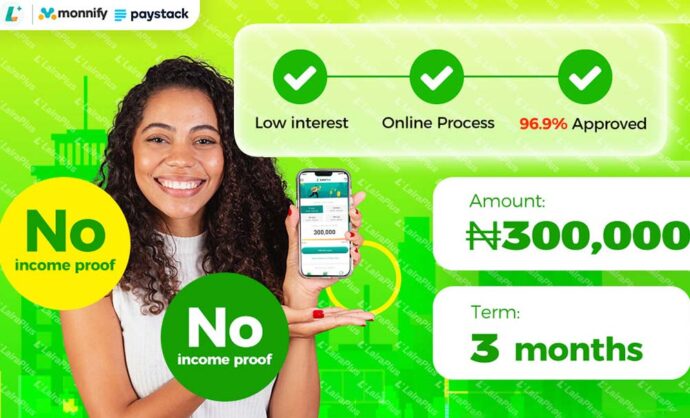

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT