When applying for a mobile loan in Nigeria, it’s important to stay updated on the progress of your loan and your repayment status. LairaPlus, a leading mobile loan provider in Nigeria, offers customers a convenient way to check their loan

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

When applying for a mobile loan in Nigeria, it’s important to stay updated on the progress of your loan and your repayment status. LairaPlus, a leading mobile loan provider in Nigeria, offers customers a convenient way to check their loan

When it comes to borrowing money online, one of the most common questions people ask is whether they need a guarantor to obtain a loan. As an online borrowing platform, LairaPlus strives to provide transparent and responsible loan options to

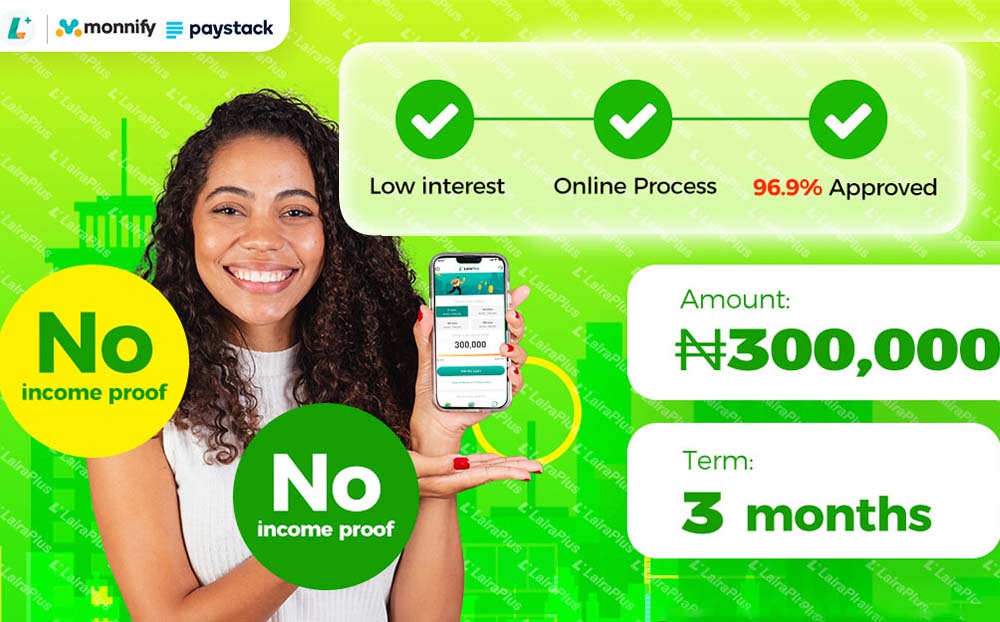

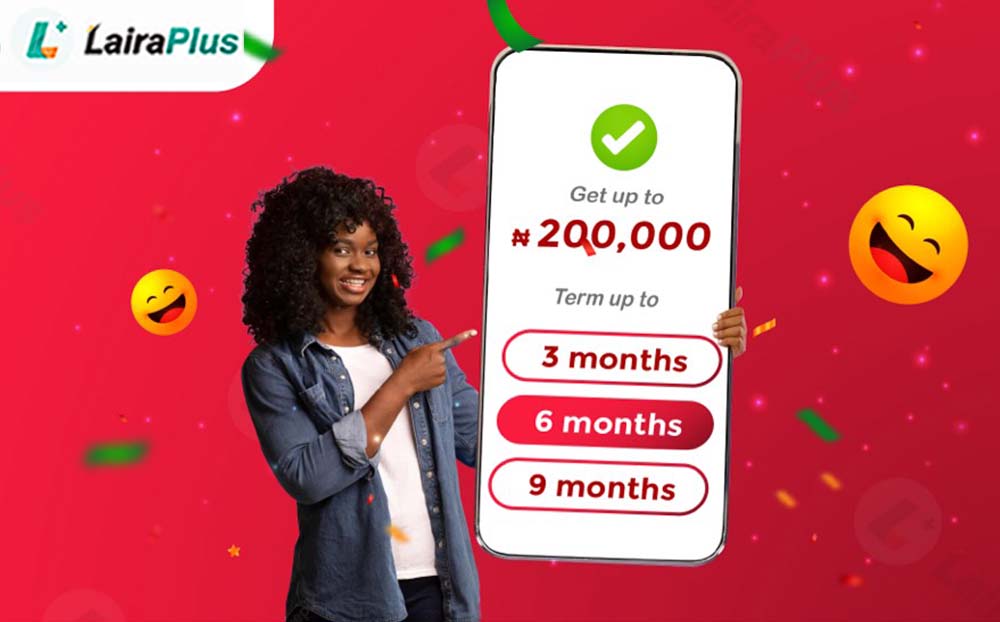

With the rise of online borrowing platforms, many people are interested in knowing how much money they can borrow through these channels. As an online borrowing platform, LairaPlus strives to provide responsible and transparent loan options to meet the financial

Applying for a 5-minute instant cash loan can potentially impact your credit record in several ways: Hard Inquiry on Your Credit Report: When you apply for a loan, the lender usually performs a hard inquiry (or hard pull) on your

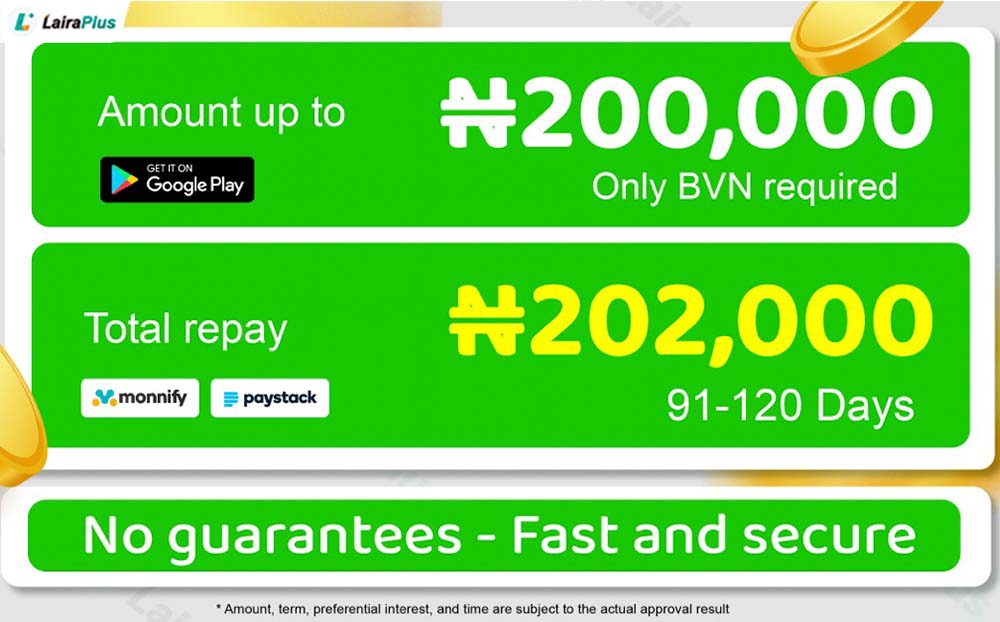

In recent years, the availability of loan apps has made it easier for individuals to access financial assistance quickly and conveniently. However, a common requirement for most loan apps, especially in countries like Nigeria, is the Bank Verification Number (BVN).

Life is unpredictable, and financial circumstances can change unexpectedly. When you’ve taken out a personal loan with LairaPlus and find it challenging to meet the repayment deadline due to unforeseen circumstances, you may wonder if there’s an option for extending

Rejection is never a pleasant experience, especially when it comes to personal loan applications. LairaPlus, as a reputable online lending platform, understands that financial needs can be urgent and critical. In this comprehensive article, we will explore the steps and

Getting a loan is a significant financial decision that requires careful consideration to ensure it aligns with your needs and financial goals. This article will provide you with key factors to consider before applying for a loan, with a focus

₦10,000 Emergency Loan: How LairaPlus Helps You Navigate Financial Crises Life is full of unforeseen circumstances, and sometimes you may face sudden financial emergencies that demand quick access to cash. In such situations, LairaPlus can be your lending partner, providing

Do I Need a Bank Account for Online Lending? Online lending, as a modern financial tool, offers borrowers a convenient way to access loans. However, a common question arises: Is having a bank account necessary for online lending? In this

In today’s fast-paced world, financial needs can arise unexpectedly, and having quick access to funds has become more crucial than ever. Fortunately, there are several lending apps available that offer a convenient way to borrow money. If you’re searching for

A Step-by-Step Guide: How to Borrow ₦50,000 from the LairaPlus App In today’s digital age, borrowing money has become more convenient and accessible than ever before, thanks to innovative lending apps like LairaPlus. If you’re wondering how to borrow ₦50,000

In life, emergencies can arise unexpectedly, requiring quick access to funds for resolution. Cash loan platforms offer a convenient and swift solution for urgent borrowing needs. In this regard, LairaPlus has garnered attention as a reputable platform providing an efficient

Where can I borrow money immediately in Nigeria? In times of unexpected financial emergencies or urgent cash needs, finding a reliable source to borrow money immediately becomes crucial. In Nigeria, a nation of diverse economic activities and growing financial services,

Simplifying Borrowing: The Easiest Loan to Secure Right Now with LairaPlus In the ever-evolving landscape of financial solutions, finding the easiest loan to secure can be a game-changer for individuals seeking quick and hassle-free access to funds. LairaPlus, a leading

Credit Requirements for a Personal Loan with LairaPlus When it comes to obtaining a personal loan, understanding the credit requirements is crucial. LairaPlus is committed to providing accessible and convenient lending solutions to its users. In this article, we’ll delve

Borrowing ₦10,000, a Quick Borrowing Solution with LairaPlus: Your Fast Fix Life is full of unexpected twists, and sometimes you need rapid financial support to face them. Whether it’s an unforeseen shopping expense, a sudden trip, emergency repairs, or simply

Exploring the Borrow Limits of Cash App: LairaPlus When it comes to financial flexibility and meeting urgent cash needs, Cash App borrow limits play a crucial role. Among the options available, LairaPlus stands out as a reliable platform with competitive

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad