Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

₦10,000 Emergency Loan: How LairaPlus Helps You Navigate Financial Crises

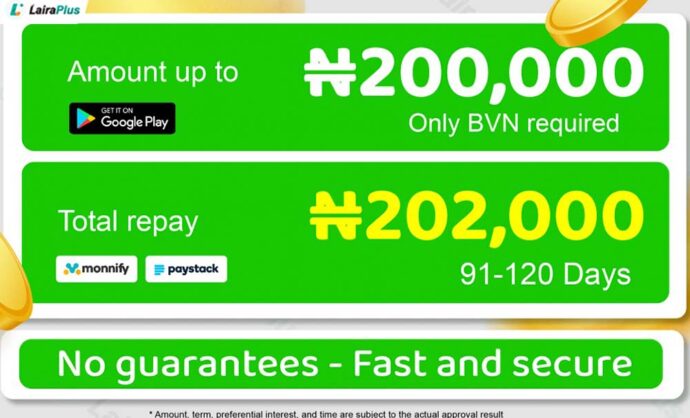

Life is full of unforeseen circumstances, and sometimes you may face sudden financial emergencies that demand quick access to cash. In such situations, LairaPlus can be your lending partner, providing assistance through emergency loans. This article delves into how LairaPlus can offer you an emergency loan of ₦10,000 and help you overcome financial crises.

1. Swift Response to Urgent Needs:

LairaPlus is committed to delivering rapid loan services to meet your urgent financial requirements. Whether you’re facing a medical emergency, sudden car repairs, educational expenses, or any other pressing financial need, LairaPlus can swiftly provide the necessary funds to help you address the emergency, preventing further financial hardship.

2. Streamlined Application Process:

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

LairaPlus simplifies the loan application process, making it easy for you to provide the necessary information and documents. You can access the application form conveniently through their official website or app, where you’ll provide personal details, financial information, and loan specifics. This streamlined process helps expedite approval times, allowing you to access the needed funds promptly.

3. Flexible Repayment Options:

LairaPlus understands that everyone’s financial situation is different, which is why they offer various repayment options. You can choose from automatic deductions, online payments, or cash deposits to repay the loan in a way that suits you best. This flexibility helps alleviate the burden of repayment and ensures you can meet your scheduled payments.

4. No Restrictions on Loan Purpose:

LairaPlus typically doesn’t restrict the purpose of the loan, meaning you have the freedom to choose how to use the borrowed amount. Whether you need to cover urgent medical expenses, unexpected repairs, sudden travel costs, or any other emergency expenditure, LairaPlus provides a flexible loan solution.

5. Consideration for Credit History:

Unlike many traditional lenders, LairaPlus is often willing to work with borrowers whose credit histories may not be ideal. While they may conduct a credit check, they place more emphasis on your ability to repay and the purpose of the loan. This means that even if you have a less-than-perfect credit score, you still have a chance to secure an emergency loan.

6. Secure Personal Information:

LairaPlus is committed to safeguarding customers’ personal information. They have stringent security measures in place to protect the information you provide during transmission and storage. This means you can trust them with your data and have confidence that your personal information won’t be compromised.

7. Online Support and Customer Service:

LairaPlus offers online support and customer service to address your queries and provide assistance. Whether you encounter any issues during the application process or throughout the loan period, they are ready to offer support.

In summary, LairaPlus provides a viable solution for addressing ₦10,000 emergency financial needs by offering a quick, flexible, and simplified loan process that caters to borrowers’ actual requirements. Whether you’re facing unexpected expenses or not, LairaPlus stands ready to support you in navigating financial crises and moving forward. If you require urgent funds, consider partnering with LairaPlus as they strive to provide the assistance you need.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT