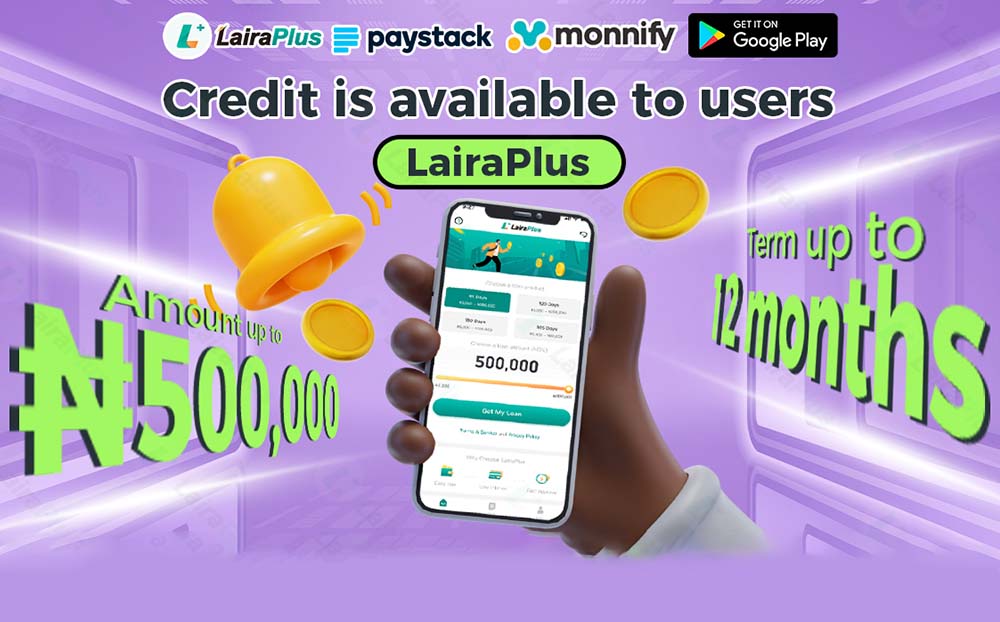

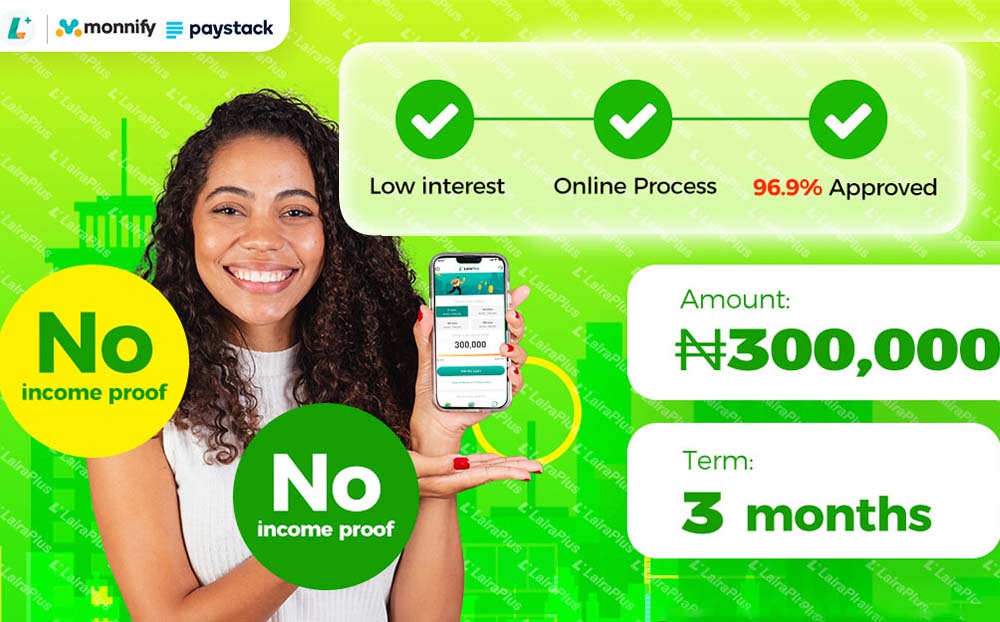

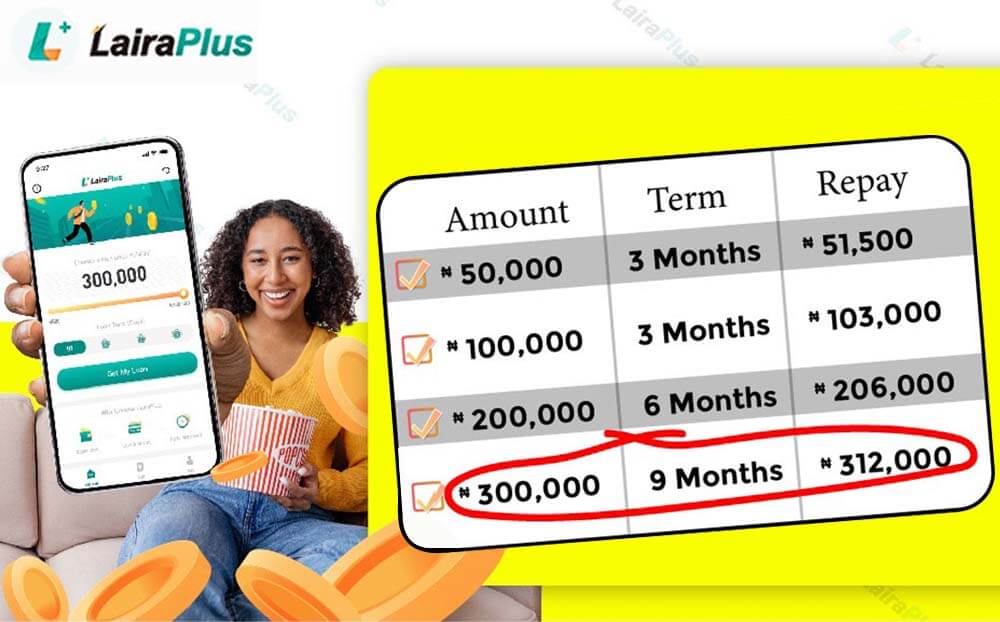

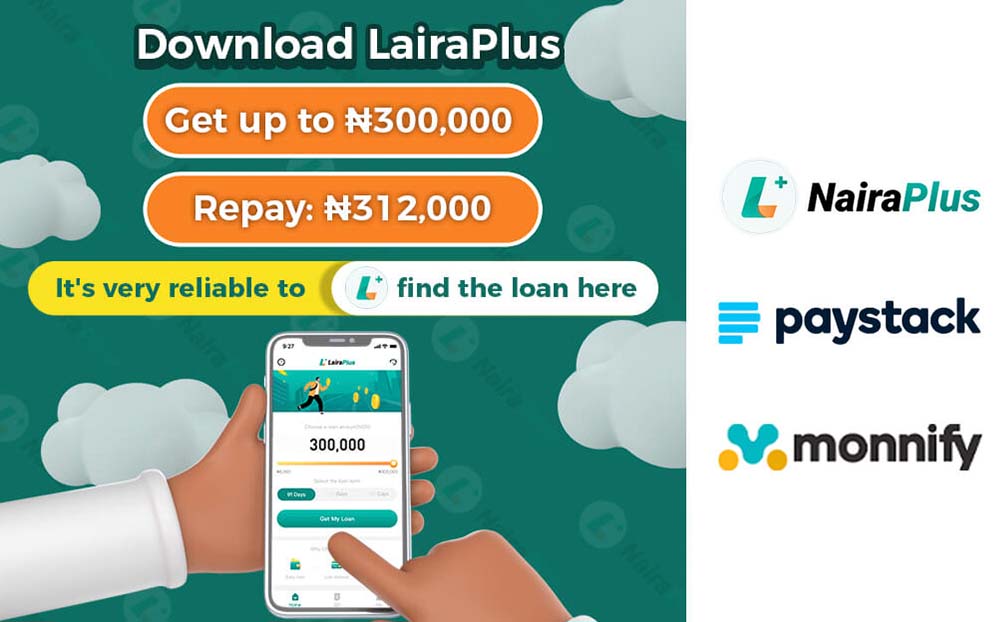

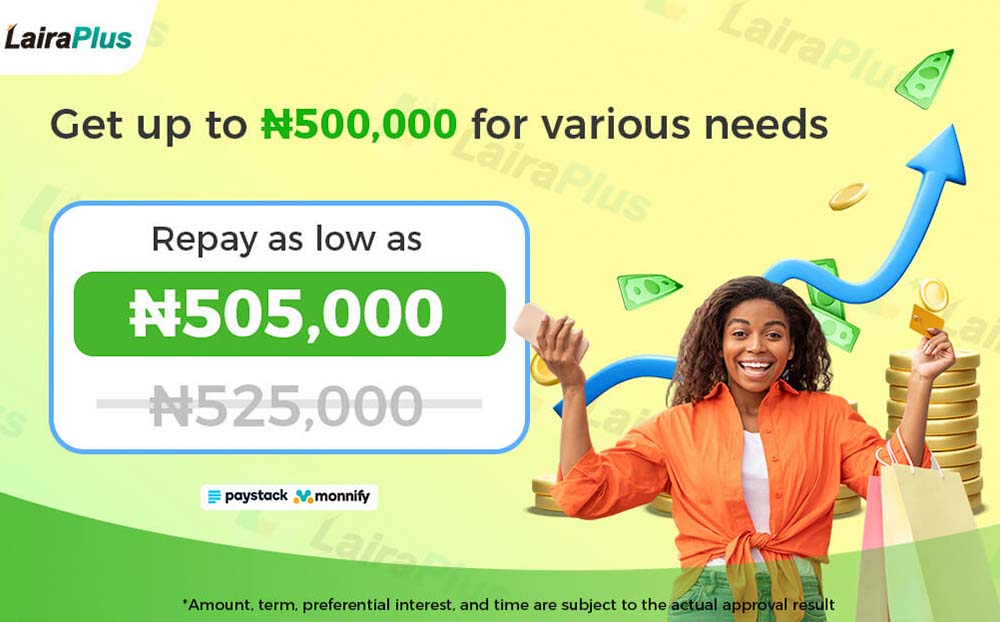

In Nigeria, low-interest loan apps have gained popularity due to their convenience and competitive interest rates. One such app, LairaPlus, offers competitive and low-interest loans to individuals and businesses. In this article, we will explore the fees and charges associated