Home » Blog » How long does it take for a low-interest loan app in Nigeria to approve my loan application?

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

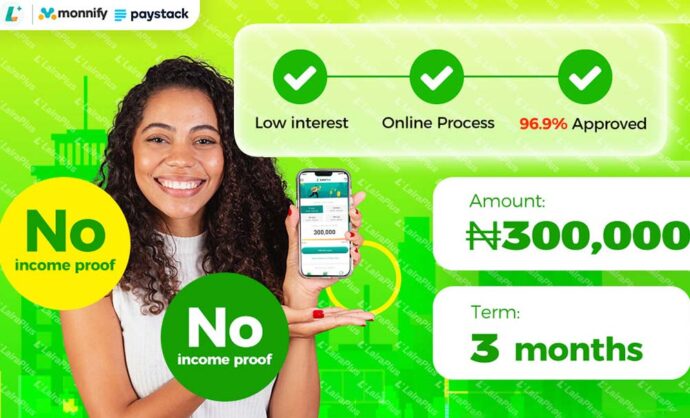

In Nigeria, the time it takes for a low-interest loan app to approve a loan application can vary depending on several factors. One such app, LairaPlus, has a relatively quick and efficient loan approval process. In this article, we will explore the loan approval time for low-interest loan apps in Nigeria using the LairaPlus app as a case study.

Firstly, it is important to note that loan approval times can vary significantly depending on the loan amount, purpose, and creditworthiness of the applicant. LairaPlus uses an advanced credit evaluation model to assess the creditworthiness of borrowers quickly and efficiently. Typically, the loan approval process through LairaPlus takes anywhere between 1 to 3 business days.

The loan approval time for low-interest loan apps in Nigeria can be influenced by several factors:

Credit Evaluation: The credit evaluation process involves assessing the credit history, repayment track record, and financial stability of the applicant. A comprehensive credit evaluation may take longer than a basic one, resulting in a delay in loan approval.

Loan Amount: The loan amount requested by the applicant plays a crucial role in the approval time. Typically, larger loan amounts require more comprehensive credit evaluations and may result in longer approval times.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Purpose of Loan: The purpose of the loan is also a consideration for low-interest loan apps in Nigeria. Loans for specific purposes such as education or home improvement may require additional documentation and verification processes, thus increasing the approval time.

Collateral: Some low-interest loan apps in Nigeria may require collateral to secure the loan. The evaluation and verification of collateral documentation can add to the overall approval time.

Banking Relationship: The banking relationship of the applicant with the lender can influence the loan approval time. If the applicant has a preexisting relationship with the lender or provides evidence of a reliable source of income, the approval process may be faster.

Once the loan application is approved, the funds are typically deposited directly into the bank account of the applicant within 24 hours. LairaPlus provides transparent communication throughout the loan process, ensuring that applicants have a clear understanding of the status of their loan application at all times.

It is essential to note that while LairaPlus and other low-interest loan apps in Nigeria aim to provide efficient and speedy loan approvals, there can be instances where the process may be delayed due to additional verification requirements or documentation issues. Therefore, it is advisable to apply for a loan well in advance to avoid any last-minute surprises.

In conclusion, understanding the loan approval time for low-interest loan apps in Nigeria is crucial to ensure that you have a clear expectations regarding the process. Loan approval times can vary depending on several factors such as credit evaluation, loan amount, purpose of loan, collateral requirements, and banking relationships. LairaPlus provides a relatively efficient and speedy loan approval process, but it is essential to be prepared for any potential delays that may arise during the application process.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT