Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

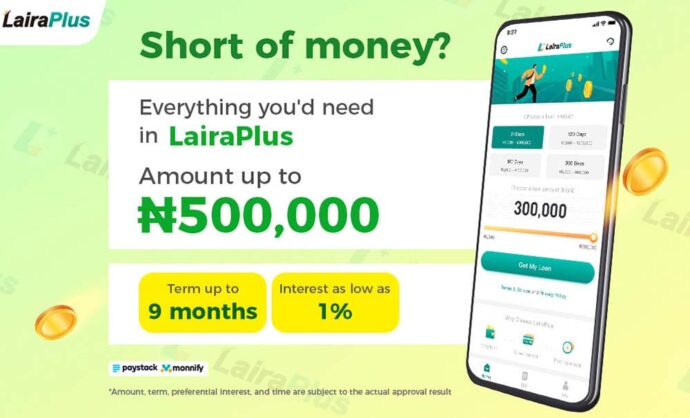

In Nigeria, the rise of mobile finance has revolutionized the way people access loans. One such loan app, LairaPlus, has emerged as a leading provider of low-interest loans, offering an efficient and convenient solution for quick loan approvals. In this article, we will explore how to use LairaPlus to obtain a quick loan in Nigeria.

Firstly, it is important to download the LairaPlus app from the Google Play Store or the iOS App Store. Once the app is installed on your device, you can create an account by providing your basic information such as name, email address, and phone number.

After creating an account, you will need to complete the Know Your Customer (KYC) verification process. This involves uploading copies of your identity document, a recent utility bill. The KYC process ensures that all borrowers meet the legal requirements and reduces the risk of fraud.

Once your KYC is complete, you can start applying for loans. The LairaPlus app provides an intuitive loan application process that allows you to select the loan amount, duration, and repayment schedule that best suits your needs. The app also displays the interest rate and other associated fees clearly, giving you a comprehensive understanding of the total cost of the loan.

One of the unique features of LairaPlus is its fast loan approval process. The app uses advanced credit evaluation models to assess the creditworthiness of borrowers quickly and efficiently. Typically, loan approvals are granted within a matter of hours, sometimes even faster. This speed and efficiency make LairaPlus an excellent option for individuals and businesses in need of quick access to funds.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

If your loan application is approved, the funds will be deposited directly into your bank account within 24 hours. This convenience allows you to access the borrowed funds quickly and efficiently without having to visit a bank or other financial institutions.

It is important to note that using LairaPlus for quick loans should be done responsibly. It is crucial to repay the loan on time to maintain a good credit record and avoid any penalties or additional fees. Late repayments can also affect your credit score, making it more difficult to obtain loans in the future.

In conclusion, LairaPlus is an excellent low-interest loan app in Nigeria that offers quick and convenient loan options for individuals and businesses. With its efficient loan approval process and direct deposit feature, it allows borrowers to access funds quickly and easily. However, it is essential to use the app responsibly and repay loans on time to maintain a good credit record. If you’re looking for a reliable and efficient loan app in Nigeria with low interest rates, LairaPlus is a great option.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT