Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

With the popularization of the Internet and the development of financial technology, more and more people choose to obtain funds through online lending platforms. However, many people have doubts about the security of online borrowing. This article will take LairaPlus as an example to explore the security of online borrowing and help you better understand the relevant issues of online borrowing.

1、 Loan security

The security of online lending platforms is one of the most concerning issues for borrowers. LairaPlus focuses on protecting the information security and financial security of borrowers. The following are the measures taken by LairaPlus to ensure loan security:

Strict information review: LairaPlus will conduct strict review of borrower information, including identity authentication, income proof, credit evaluation, etc. The borrower’s information that has passed the review will be strictly kept confidential to ensure information security.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Secure payment methods: LairaPlus supports multiple payment methods, including bank transfers, third-party payments, etc. During the payment process, LairaPlus will protect the borrower’s financial security through encryption technology and security protocols.

Risk reserve: LairaPlus has established a risk reserve to ensure the financial security of borrowers. When the borrower is unable to repay on time, LairaPlus will use risk reserves for advance payments based on risk assessment.

2、 Risk and Prevention

Although LairaPlus has taken various measures to ensure the security of loans, there are still some risks. The following are common risks and preventive measures:

Fraud risk: Criminals may use online lending platforms for fraudulent activities. Borrowers need to pay attention to distinguishing the authenticity and legality of the platform, and choose a legitimate and qualified online lending platform. When submitting personal information and applying for a loan, it is important to carefully verify the authenticity of the relevant information.

Overdue repayment risk: Although LairaPlus will ensure the borrower’s financial security through risk reserves and other measures, there is still a risk of overdue repayment. To avoid overdue repayment, the borrower should fully understand the repayment terms and schedule in the loan agreement when applying for the loan, and repay on time according to the agreement.

Information leakage risk: Online lending platforms have the risk of information leakage, especially sensitive personal information. Borrowers should properly safeguard their personal information and avoid disclosing it to criminals. At the same time, borrowers should also pay attention to the platform’s privacy policy and understand how the platform protects personal information.

High interest loan risk: Online lending platforms may have high interest loan issues. When choosing a lending platform, borrowers should pay attention to the rationality of interest rates and fees to avoid falling into the trap of high interest loans. At the same time, one should also understand relevant laws and regulations to protect their legitimate rights and interests.

Online borrowing, as a convenient financing method, has gradually been accepted by consumers. However, we also need to pay attention to the security issues and risks associated with online borrowing. When choosing an online lending platform, we need to choose a legitimate, legitimate, and qualified platform, and understand the relevant measures taken by the platform to ensure loan security. At the same time, we also need to raise our own security awareness, pay attention to protecting personal privacy and information security, and avoid being exploited by criminals. If you have any questions or need assistance, please feel free to contact our customer service or official website.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

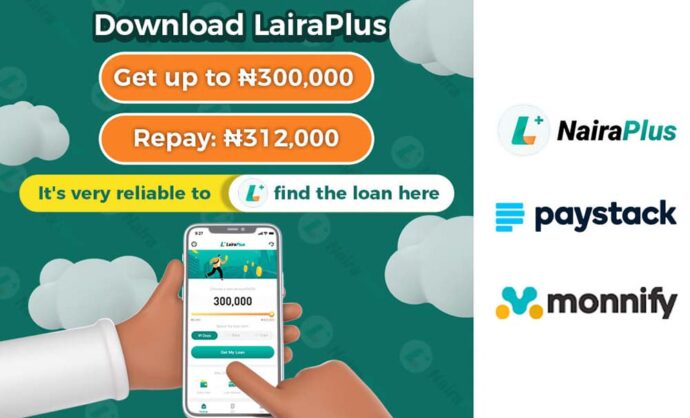

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT