Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

With the popularity of the internet and the development of financial technology, more and more people choose to borrow money through online loan platforms. This kind of borrowing method has the advantages of convenience, low threshold, and fast approval, but it also has certain risks. This article takes LairaPlus as an example to discuss the requirements for online borrowing, helping you better understand related matters.

Firstly, the borrowing conditions:

Online loan platforms usually set certain borrowing conditions to ensure the credit risk of borrowers is controllable. LairaPlus requires borrowers to meet the following conditions:

Be aged between 18 and 60 years old, with full civil capacity;

Have a stable income source and repayment ability;

Have no bad credit record and a good credit rating;

Provide real, valid identity proof and bank account information.

Secondly, the borrowing process:

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Registration and certification: borrowers need to register an account on the LairaPlus platform, and carry out procedures such as real-name authentication and bank card binding.

Submit loan application: borrowers need to fill out the loan application form with information such as the loan amount, loan period, and repayment method, and upload relevant supporting documents.

Credit assessment: LairaPlus will carry out credit assessments for borrowers, including checking credit reports and making phone calls for callbacks.

Review and disbursement: after review, LairaPlus will decide whether to disburse the loan and the amount based on the borrower’s credit assessment results and loan purpose.

Repayment and settlement: borrowers need to repay the loan according to the agreed repayment method and time to avoid overdue repayment. When all the repayments are made, borrowers can apply for a settlement certificate.

Thirdly, notes:

Online borrowing has risks, so borrowers need to borrow reasonably based on their repayment ability;

Borrowers need to provide real and valid supporting documents and information to avoid risks from false information;

LairaPlus will strictly review the loan purpose to ensure that it is legal and compliant;

Borrowers should avoid disclosing personal financial information to others to avoid information leakage;

In case of phone callbacks, please keep the phone open and cooperate with customer service to verify relevant information;

Please do not disclose personal information such as passwords or personal identification numbers to others to avoid property losses.

Fourthly, summary:

Online borrowing has gradually been accepted by consumers as a convenient financing method. At the same time, we should also recognize the risks and notes of online borrowing. When choosing an online loan platform, we need to choose a formal, legal, and qualified platform and provide real and valid supporting documents according to the platform’s requirements. During the loan process, we need to remain vigilant, pay attention to protect personal privacy and information security, avoid being taken advantage of by criminals. At the same time, we should also borrow reasonably based on our repayment ability to avoid excessive loans brought by risks. As a professional online loan platform, LairaPlus has always been committed to providing convenient and secure financing services for borrowers. We hope that this article can help you better understand related matters about online borrowing through introducing LairaPlus as an example. If you have any questions or need help, please feel free to contact our customer service or official website.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

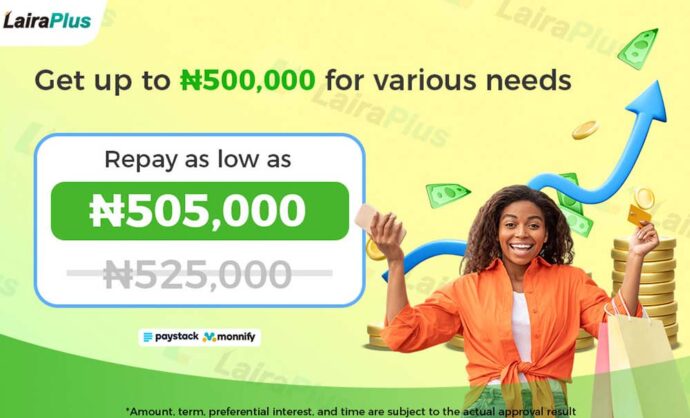

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT