Home » Blog » I have difficulty repaying my personal loan when it is due. Can I apply for an extension?

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Life is unpredictable, and financial circumstances can change unexpectedly. When you’ve taken out a personal loan with LairaPlus and find it challenging to meet the repayment deadline due to unforeseen circumstances, you may wonder if there’s an option for extending your loan repayment period. In this comprehensive article, we’ll dive into the topic of loan repayment extensions with LairaPlus, exploring the process, eligibility criteria, and steps to take if you’re facing difficulties in meeting your loan obligations.

Understanding Loan Repayment Extensions

A loan repayment extension, often referred to as a loan extension or forbearance, is an arrangement that allows borrowers to postpone or extend their loan repayment period beyond the original due date. It can be a valuable option when borrowers encounter temporary financial hardships, unexpected expenses, or other challenges that make on-time repayments difficult.

The LairaPlus Approach to Loan Repayment Extensions

LairaPlus values its customers and strives to provide flexible solutions when financial circumstances change. While specific policies may vary, here is a general overview of how LairaPlus approaches loan repayment extensions:

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

1. Contact LairaPlus Customer Support

If you foresee difficulty in meeting your loan repayment deadline or have already missed a payment, the first step is to get in touch with LairaPlus customer support as soon as possible. Prompt communication is essential in these situations.

2. Explain Your Situation

When you contact customer support, be prepared to explain the reasons for your repayment challenges. Whether it’s a temporary job loss, medical expenses, or other unexpected financial burdens, providing clear and honest information can help LairaPlus better understand your situation.

3. Review Available Options

LairaPlus customer support will discuss the available options with you. These options may include loan repayment extensions, adjusted repayment schedules, or other arrangements tailored to your specific needs.

4. Demonstrate Willingness to Repay

LairaPlus may require you to demonstrate your commitment to repaying the loan. This could involve providing a revised repayment plan, setting up automatic payments, or making a partial payment if possible.

5. Understand Terms and Conditions

Before agreeing to a loan repayment extension, carefully review the terms and conditions provided by LairaPlus. Understand any additional fees or interest that may apply during the extended repayment period.

6. Formalize the Extension Agreement

If you and LairaPlus reach an agreement on a loan repayment extension, ensure that the arrangement is formalized in writing. This document should outline the new repayment schedule, any associated costs, and the revised terms.

7. Stay in Contact

Throughout the extended repayment period, maintain open communication with LairaPlus. If your financial situation changes or you encounter further difficulties, inform them promptly to explore potential solutions.

Eligibility for Loan Repayment Extensions

Eligibility for loan repayment extensions with LairaPlus may depend on various factors, including:

Facing challenges in meeting your personal loan repayment can be stressful, but LairaPlus is committed to working with borrowers to find suitable solutions. If you find yourself in a situation where extending your loan repayment period is necessary, don’t hesitate to reach out to LairaPlus customer support. Remember that open communication, honesty about your circumstances, and a willingness to cooperate are key to finding a solution that works for both you and LairaPlus. With the right approach, you can navigate temporary financial difficulties and continue on your path to financial stability.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

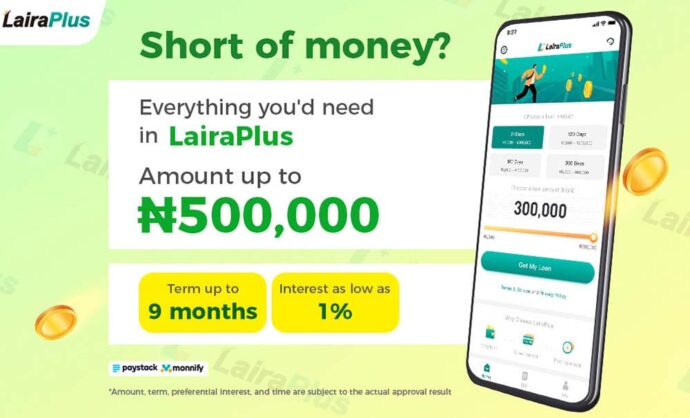

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT