Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Personal credit loans are a common financial tool that helps individuals achieve various financial goals, from handling emergency expenses to purchasing significant assets. However, after borrowing, creating a reasonable repayment plan is crucial to ensure that the loan is repaid on time while maintaining a healthy financial situation. LairaPlus is a financial technology company specializing in personal credit loans, and this article will explore how to create a reasonable repayment plan for such loans, helping you manage your finances and successfully clear your debt.

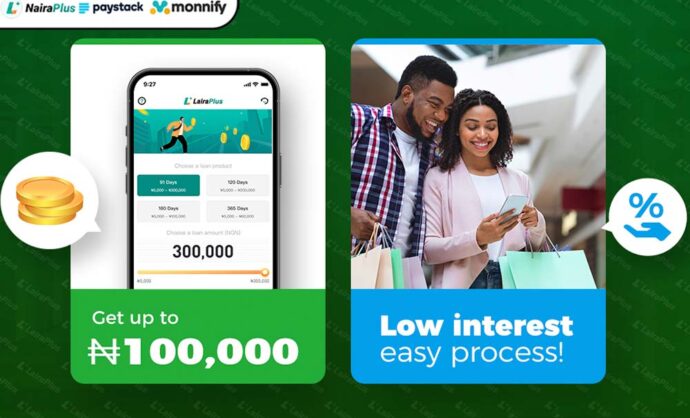

LairaPlus is a financial technology company focused on providing personal credit loan solutions. The company’s mission is to help individuals achieve their financial goals by offering fast, transparent, and flexible loan products. LairaPlus’s platform combines innovative technology and customer-centric approaches to ensure that customers can easily access the funds they need.

Here are some key features of LairaPlus:

LairaPlus offers a fast and convenient online loan application process. Customers can access the platform at any time, fill in the necessary information, and submit their applications. This process typically takes only a few minutes, eliminating the lengthy waiting times associated with traditional loan applications.

LairaPlus is committed to providing transparent loan terms. Customers can clearly understand interest rates, repayment terms, and related fees during the application process. This transparency helps customers make informed decisions about whether to accept the loan.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

LairaPlus uses intelligent risk assessment technology to quickly evaluate customers’ credit risk. This ensures that customers receive loan approval responses in a short amount of time.

LairaPlus allows customers to choose flexible repayment options based on their financial situation. Customers can select monthly repayment amounts and repayment terms that align with their financial capacity, ensuring that repayments do not create undue financial pressure.

LairaPlus implements strict security measures to protect customers’ personal and financial information. Customers can rest assured that their sensitive information will not be misused or disclosed.

Creating a reasonable repayment plan for a personal credit loan is essential to ensure that you clear your debt on time and maintain a healthy financial situation. Here are some steps and recommendations to help you establish an effective repayment plan:

First and foremost, you need to determine your repayment capacity. This involves assessing the amount you can allocate for repayments each month. Consider your monthly income, daily expenses, and other debts to determine your disposable income available for repayments.

Carefully analyze the loan terms, including the loan amount, interest rate, and repayment term. These terms will directly impact your repayment plan. You can use online loan calculators to estimate monthly repayment amounts under different conditions, allowing you to better understand the loan’s impact.

Based on your repayment capacity and loan terms, create a detailed budget. Include the loan repayment in your budget and ensure that you have enough funds to cover other living expenses and expenditures each month.

Consider creating an emergency fund while developing your repayment plan. This fund can be used to cover unexpected expenses, such as medical bills or car repairs, without relying on additional borrowing.

Consider automating your loan repayments. Many loan providers allow you to set up automatic deductions, ensuring that you do not forget to make your monthly repayments. This can help you avoid late fees and maintain a consistent repayment schedule.

By following these steps and incorporating LairaPlus’s expert advice, you can create a reasonable repayment plan for your personal credit loan. This plan will help you manage your finances effectively, meet your repayment obligations on time, and work toward a debt-free future.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT