Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

The maximum amount you can borrow at one time varies widely and depends on several factors, including:

Lender’s Policy: Different lenders have different maximum loan limits. Some lenders offer small, short-term loans, while others may provide larger amounts based on eligibility criteria.

Creditworthiness: Your credit history, income, and existing debts influence the amount a lender may offer you. A strong credit history and higher income might qualify you for a larger loan.

Loan Type: The type of loan you’re applying for can impact the maximum amount. For instance, personal loans, payday loans, or installment loans may have different caps on the amount you can borrow.

Collateral: Secured loans, where you offer collateral (such as a car or property), might allow you to borrow larger sums compared to unsecured loans.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

State Regulations: Loan regulations and laws vary by state or country. Some jurisdictions have specific limits on loan amounts to protect borrowers.

Lender’s Assessment: Lenders often assess your ability to repay the loan. They may offer an amount based on what they believe you can comfortably repay without financial strain.

To determine the maximum loan amount you can borrow urgently, it’s advisable to reach out directly to potential lenders or visit their websites to understand their specific loan limits, eligibility criteria, and application process. This allows you to tailor your loan request according to your immediate financial needs and the options available to you.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

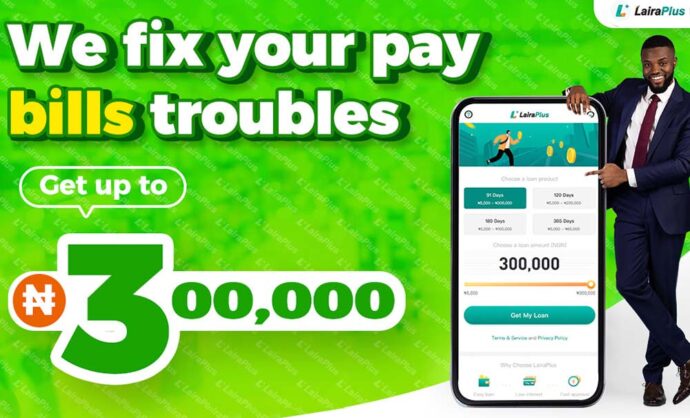

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT