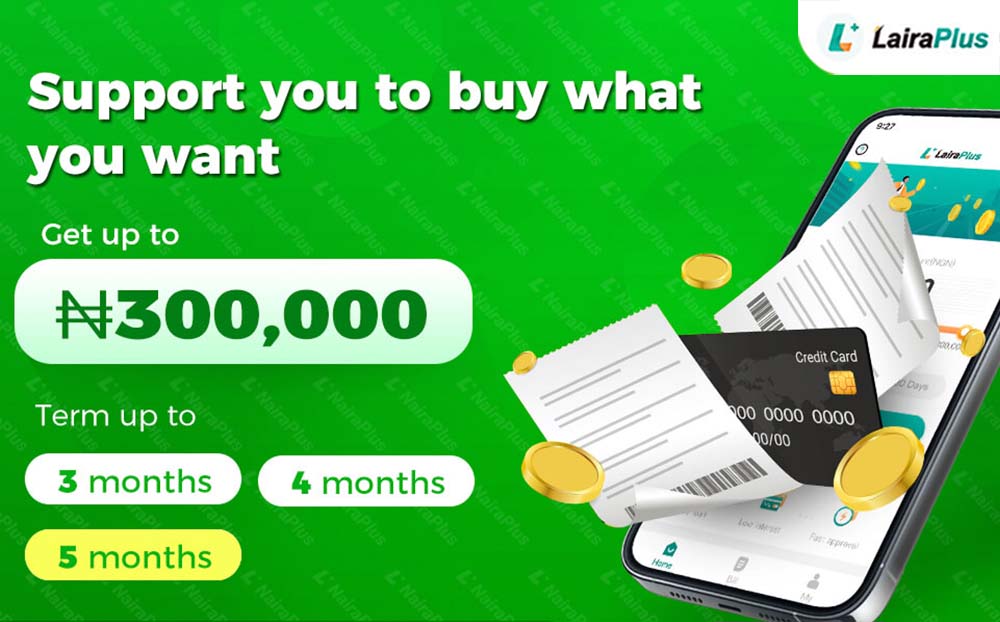

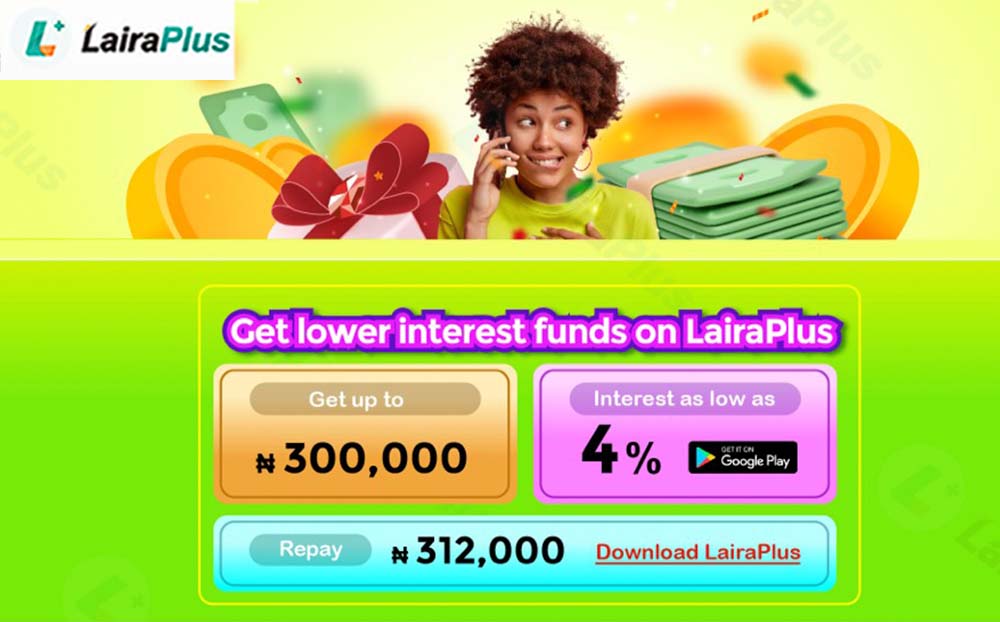

Securing a loan with low interest is a goal for many borrowers in Nigeria. In a year as dynamic as 2023, where financial needs can evolve rapidly, finding a trusted loan app with competitive interest rates is paramount. LairaPlus emerges

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Securing a loan with low interest is a goal for many borrowers in Nigeria. In a year as dynamic as 2023, where financial needs can evolve rapidly, finding a trusted loan app with competitive interest rates is paramount. LairaPlus emerges

In the dynamic financial landscape of Nigeria, access to quick and convenient loans is more critical than ever. Whether it’s addressing unforeseen medical expenses, seizing an opportunity, or simply managing daily financial needs, instant loan apps have become indispensable. Among

Qualifying for a quick loan app in Nigeria, like LairaPlus, typically involves meeting specific eligibility criteria set by the lender. While these criteria may vary slightly from one lender to another, here are common requirements to qualify for a quick

Yes, I can provide information about quick loans and specifically about LairaPlus in Nigeria. Quick Loans: Quick loans, also known as fast loans or instant loans, are a type of personal loan that provides borrowers with rapid access to funds.

To obtain a quick loan of ₦500,000, you can consider the following steps: Check Your Eligibility: Review the eligibility criteria of the lender you plan to approach. Different lenders have varying requirements, which may include a minimum age, income level,

In an era where financial needs can arise unexpectedly, the ability to access quick personal loans has become an essential component of modern financial services. Online personal loan apps have emerged as a convenient solution to address these needs promptly.

The safety of a quick loan service in Nigeria depends on various factors, including the lender‘s reputation, regulatory compliance, and security measures. While I can’t provide real-time information, I can offer some guidance on what to look for when considering

Quick loans can be a viable option when you need money urgently, but it’s essential to consider both the advantages and potential drawbacks before making a decision. Here are some factors to keep in mind: Advantages of Quick Loans: Speed:

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad