Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Quick loans can be a viable option when you need money urgently, but it’s essential to consider both the advantages and potential drawbacks before making a decision. Here are some factors to keep in mind:

Advantages of Quick Loans:

Speed: As the name suggests, quick loans provide rapid access to funds. This can be invaluable in emergency situations, such as unexpected medical expenses or urgent home repairs.

Convenience: Quick loans are typically available through online platforms or apps, making them easy to apply for and access from the comfort of your home.

Minimal Documentation: Many quick loan providers require minimal documentation, simplifying the application process and reducing paperwork.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

No Collateral: Most quick loans are unsecured, meaning you don’t need to provide collateral (like your car or house) to secure the loan.

Flexible Use: You can use quick loan funds for various purposes, from covering medical bills to consolidating debt or seizing a time-sensitive opportunity.

Drawbacks of Quick Loans:

Higher Interest Rates: Quick loans often come with higher interest rates compared to traditional bank loans. This is because they carry more risk for lenders due to the quick approval and minimal credit checks.

Shorter Repayment Terms: Quick loans may have shorter repayment terms, which can lead to higher monthly payments. It’s essential to ensure you can meet these obligations.

Potential for Debt Accumulation: The ease of obtaining quick loans can lead to borrowing more than you can comfortably repay, potentially resulting in a cycle of debt.

Limited Loan Amounts: Quick loans may not provide access to substantial sums of money, which may be insufficient for certain significant financial needs.

Risk of Predatory Lenders: In some cases, borrowers may encounter predatory lenders or fraudulent loan apps. It’s crucial to research and choose reputable lenders to avoid scams.

In conclusion, quick loans can be a good option when you need money urgently, provided you understand the terms and the potential costs involved. It’s important to assess your financial situation, explore alternative sources of funds (such as emergency savings), and only borrow what you can responsibly repay. Always review the terms and conditions of the loan carefully and consider the long-term impact on your finances. If used wisely and responsibly, quick loans can serve as a valuable financial tool during times of need.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

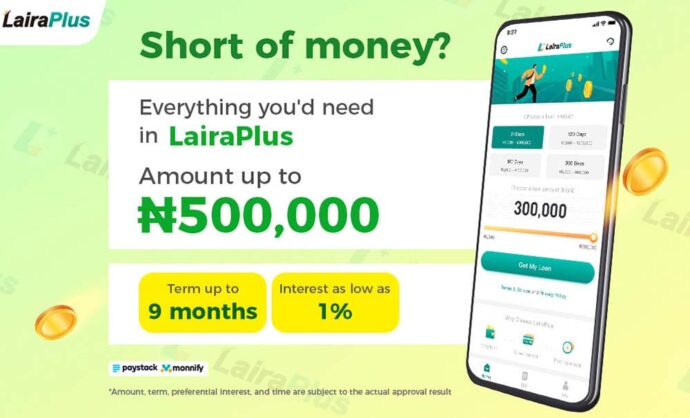

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT