The minimum age to take out a loan typically varies by country and region, but it is generally 18 years old in many places. Here are some key points to consider: Legal Age: In most countries, 18 is the legal

Free

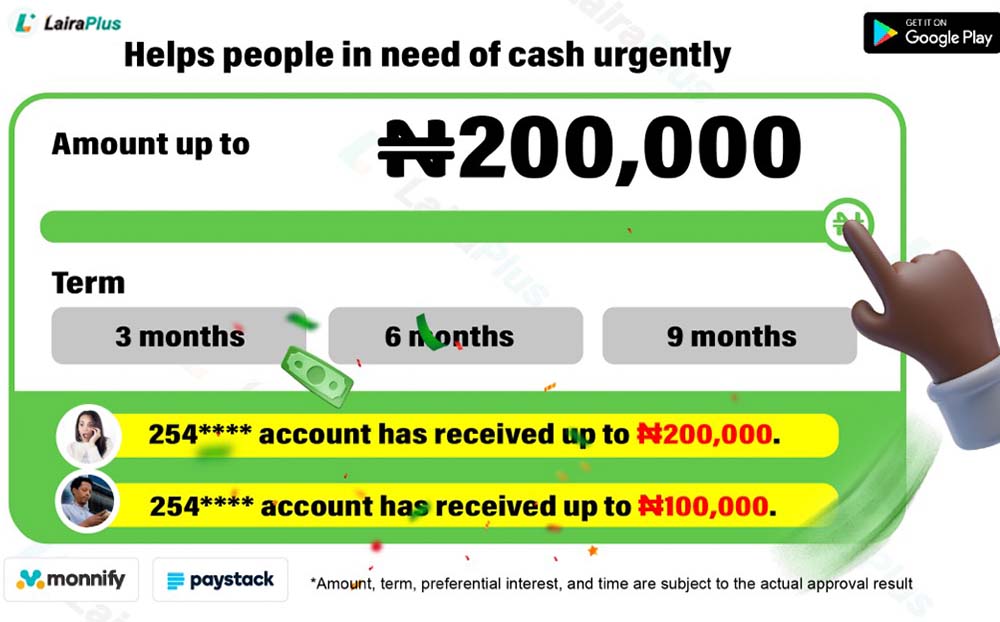

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

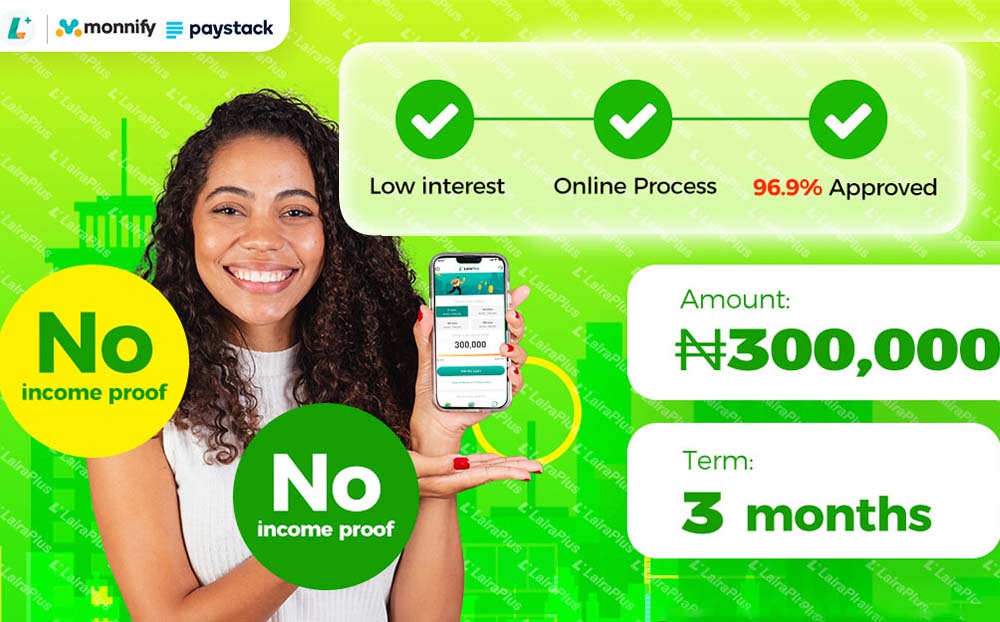

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

The minimum age to take out a loan typically varies by country and region, but it is generally 18 years old in many places. Here are some key points to consider: Legal Age: In most countries, 18 is the legal

In Nigeria, there are several types of personal loans available to meet various financial needs. The specific types of personal loans may vary from one financial institution to another, but the following are some common types: Salary Advance Loans: These

When it comes to buying a home, one of the biggest challenges can be saving up for a down payment. A down payment is a substantial upfront payment made towards the purchase of a house, and it’s typically a percentage

Is There an Additional Fee for Early Repayment of Online Simple Loans? Early repayment is a way to pay off a loan before the loan term ends, helping borrowers get out of debt sooner. However, for online simple loans, borrowers

Managing Personal Cash Loan Repayments When Your Financial Situation Changes Life is full of uncertainties, and financial situations can change unexpectedly. If you’re a borrower with a personal cash loan, it’s important to know how to handle your loan repayments

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad