Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

In Nigeria, there are several types of personal loans available to meet various financial needs. The specific types of personal loans may vary from one financial institution to another, but the following are some common types:

Salary Advance Loans: These loans are typically offered to employees who receive their salaries through a specific bank. The loan amount is often based on the borrower’s monthly income and is repaid from their next salary payment.

Personal Installment Loans: These loans allow borrowers to access a lump sum of money and repay it in equal installments over a predetermined period, usually ranging from a few months to several years.

Quick Cash Loans: Quick cash loans are designed for emergency expenses and often have a fast application and approval process. These loans may be available through mobile apps and online platforms.

Business Loans for Individuals: Some lenders offer personal loans to individuals who want to start or expand small businesses. These loans are intended for business purposes and are often unsecured.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Education Loans: These loans are designed to cover the cost of education, including tuition, books, and living expenses. They may be offered to students, parents, or individuals seeking further education or training.

Wedding Loans: Wedding loans are intended to help cover the expenses associated with wedding ceremonies and related events. They are typically unsecured and have specific terms for weddings.

Medical Loans: These loans are for covering medical expenses, including surgeries, hospital bills, and medical treatments. They may be unsecured or secured, depending on the lender.

Travel Loans: Travel loans are used to fund vacations and travel-related expenses. These loans can provide financing for airfare, accommodations, and other travel costs.

Car Loans: While car loans are typically associated with vehicle financing, some lenders offer personal loans that can be used to purchase a car. These loans may be secured or unsecured.

Home Renovation Loans: Home renovation loans are used to finance home improvement projects, repairs, or renovations. They may be secured or unsecured.

Asset Finance Loans: These loans are designed to help individuals acquire assets, such as furniture, electronics, or appliances. The purchased item often serves as collateral for the loan.

Agricultural Loans: Some lenders offer personal loans for agricultural purposes, which can be used for farming and related expenses.

Debt Consolidation Loans: These loans are used to consolidate multiple debts into a single loan, making it easier to manage and potentially lowering the interest rate.

It’s important to carefully consider your financial needs and goals when choosing the type of personal loan that’s right for you. Additionally, compare interest rates, terms, and fees from different lenders to find the most suitable loan option in Nigeria.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

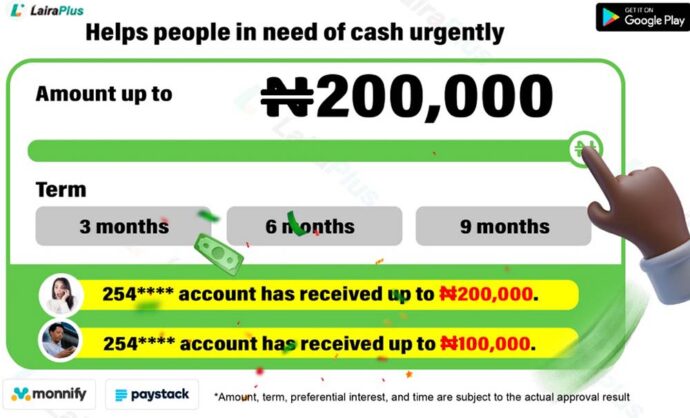

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT