The minimum age to take out a loan typically varies by country and region, but it is generally 18 years old in many places. Here are some key points to consider: Legal Age: In most countries, 18 is the legal

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

The minimum age to take out a loan typically varies by country and region, but it is generally 18 years old in many places. Here are some key points to consider: Legal Age: In most countries, 18 is the legal

In Nigeria, there are several types of personal loans available to meet various financial needs. The specific types of personal loans may vary from one financial institution to another, but the following are some common types: Salary Advance Loans: These

Is There an Additional Fee for Early Repayment of Online Simple Loans? Early repayment is a way to pay off a loan before the loan term ends, helping borrowers get out of debt sooner. However, for online simple loans, borrowers

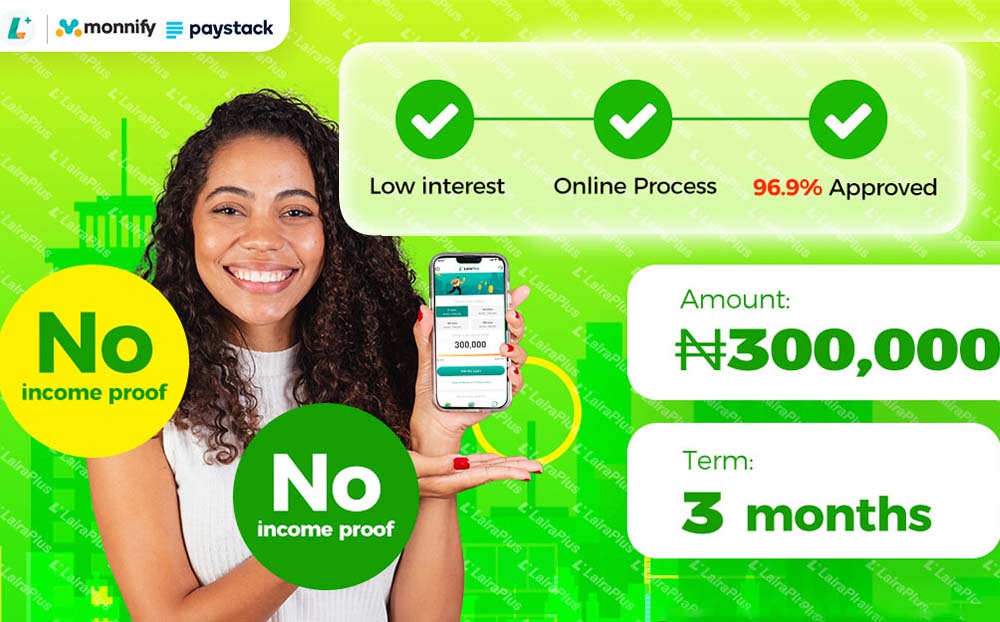

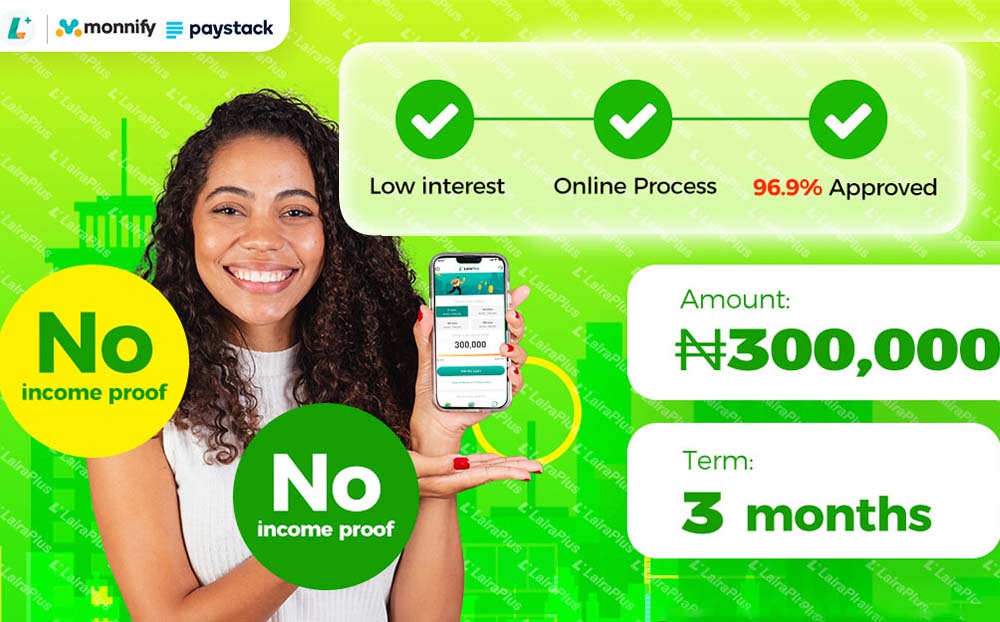

Online cash loans have become an essential choice for many to address urgent financial needs in today’s society. Compared to traditional lending methods, online loans offer a more convenient and rapid avenue to meet the financial requirements of individuals and

Ensuring Timely Repayment of Personal Cash Loans: LairaPlus‘ Guidance Making timely repayments on personal cash loans is crucial for maintaining a good credit history and financial stability. LairaPlus understands borrowers’ needs and offers a range of methods to ensure you

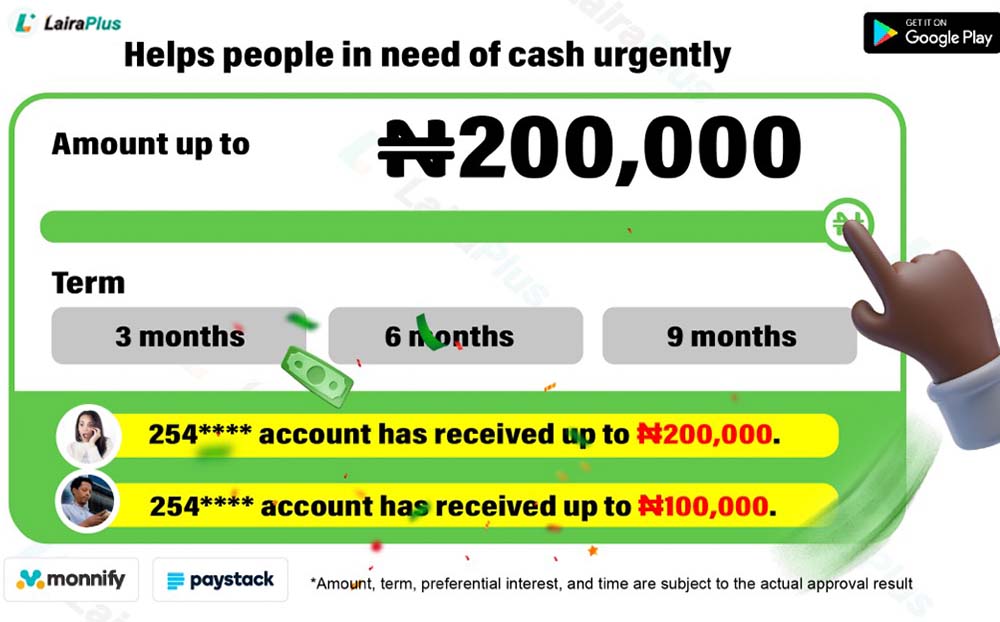

LairaPlus Personal Loans: A Convenient Path to Fulfill Your Financial Needs In today’s modern society, personal loans have become a common means to meet a wide range of financial needs. As a leading online loan platform, LairaPlus offers individuals a

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad