Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

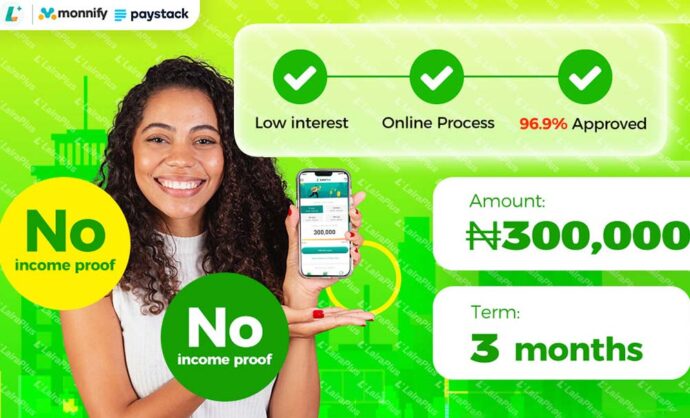

Online cash loans have become an essential choice for many to address urgent financial needs in today’s society. Compared to traditional lending methods, online loans offer a more convenient and rapid avenue to meet the financial requirements of individuals and businesses. LairaPlus is a notable loan provider in Nigeria’s online lending market, offering various loan options. In this article, we will delve into LairaPlus and the loan terms associated with online cash loans, helping borrowers gain a better understanding of this crucial aspect.

LairaPlus: Leading the Way in Nigeria’s Online Loans

LairaPlus is a prominent online loan provider in Nigeria, dedicated to offering fast and convenient loan services to individuals and businesses. The company has built a solid reputation and garnered attention from numerous borrowers. One crucial aspect is loan terms, which determine the repayment responsibilities and overall loan costs that borrowers must bear.

Types of Loan Terms in Online Cash Loans

In the online cash loan market, loan terms can typically be categorized into the following types:

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Short-term Loans: These loans often have very short terms, usually ranging from a few weeks to several months. Short-term loans are suitable for borrowers facing immediate, short-lived financial needs, such as addressing medical emergencies or paying unexpected bills.

Medium-term Loans: Medium-sized loans typically have terms that span from several months to a year. This type of loan is used for more substantial expenses like home renovations, purchasing a vehicle, or meeting operational costs for small businesses.

Long-term Loans: Long-term loans generally have extended repayment terms, potentially spanning several years. These loans are typically utilized for larger projects, such as buying a home, making entrepreneurial investments, or significant business expansions.

LairaPlus Loan Terms

As a key player in the online lending market, LairaPlus offers various loan terms to cater to the diverse needs of different borrowers. Their loan terms typically fall into short-term, medium-term, and long-term categories, with specific terms varying based on individual borrower needs and creditworthiness.

Short-term Loans: LairaPlus typically provides options for short-term loans with terms usually ranging from several weeks to a few months. These loans cater to borrowers in need of quick solutions for short-term financial requirements, provided they can repay the loan within a short timeframe.

Medium-term Loans: For borrowers who require more time to repay their loans, LairaPlus also offers medium-term loan options. These loans typically come with terms ranging from several months to a year, providing borrowers with greater repayment flexibility.

Long-term Loans: Long-term loans, which entail more extended repayment periods, are also available through LairaPlus. These loans can span several years and are suitable for borrowers needing structured repayment plans for larger loan amounts, such as for home purchases or other significant investments.

How to Choose the Right Loan Term

Selecting the appropriate loan term is a critical decision that should align with individual or business-specific requirements. Consider the following factors to help determine the right loan term:

Financial Goals: Begin by clearly defining your financial goals. Identify the purpose and plans for the loan to determine the required loan term.

Repayment Capacity: Thoroughly assess your repayment capacity. Ensure you have enough income to make timely repayments, avoiding late payments and additional charges.

Loan Purpose: Consider the loan’s intended use; different projects may require varying loan terms. Ensure the chosen term aligns with the nature of the project.

Financial Planning: Take future financial plans and expenses into account. Choose a loan term that harmonizes with future financial commitments and plans.

Interest Rates and Fees: Compare interest rates and associated fees among loans with different terms. Sometimes, longer-term loans may result in higher overall costs, so exercise caution.

As a prominent participant in Nigeria’s online lending market, LairaPlus offers multiple loan term options to meet a range of borrowers’ needs. Borrowers should carefully consider their financial objectives, repayment capacity, and loan purpose when choosing the appropriate loan term. Thorough financial planning and prudent decision-making contribute to effective loan management and achieving financial goals. The flexibility and diversity of online cash loans provide valuable solutions for borrowers in various financial situations.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT