Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Is There an Additional Fee for Early Repayment of Online Simple Loans?

Early repayment is a way to pay off a loan before the loan term ends, helping borrowers get out of debt sooner. However, for online simple loans, borrowers often worry about whether they will incur additional fees for repaying their loan ahead of schedule. This article will delve into whether there are extra fees for early repayment in online simple loans and introduce how LairaPlus handles early repayment, providing advantages for borrowers.

Advantages of Early Repayment

First, let’s understand the advantages of early repayment:

Reduced Interest Costs: By making early repayments, borrowers can reduce the total interest amount paid, lowering the overall cost of the loan. This means significant savings.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Debt Freedom: Early repayment allows borrowers to get out of debt burden earlier, leading to improved financial health. It also contributes to enhancing credit scores by demonstrating good repayment ability.

Financial Flexibility: Early repayment offers borrowers more financial flexibility, enabling them to plan future expenses and savings more effectively.

Early Repayment Policies for Online Simple Loans

Each online simple loan provider has its own early repayment policy, and these policies may vary among lenders. Let’s delve into early repayment policies:

Additional Fees: Some online simple loan providers may charge extra fees for early repayment. These fees can include prepayment penalties or early repayment processing fees. The amount and policy of these fees may vary depending on the loan provider, so borrowers should carefully review the relevant terms in the loan contract before making an early repayment.

No Additional Fees: On the other hand, some online simple loan providers, such as LairaPlus, may allow borrowers to make early repayments without incurring extra fees or penalties. This policy makes it easier for borrowers to manage their finances and repay their loans ahead of schedule without unnecessary additional expenses.

Early Repayment Calculation: For loans that allow early repayment, the loan provider typically calculates the exact early repayment amount. This typically includes the outstanding principal and interest. Borrowers should contact the loan provider to determine the exact early repayment amount and help plan their repayment accordingly.

LairaPlus’s Early Repayment Policy

LairaPlus is a fintech company committed to providing transparent and competitive loan terms for borrowers. In LairaPlus’s early repayment policy, borrowers can benefit from the following:

No Additional Fees: LairaPlus allows borrowers to make early repayments without incurring extra fees or penalties. This means borrowers can clear their loan balance ahead of schedule without worrying about additional financial burdens.

Transparent Policy: LairaPlus offers a transparent early repayment policy, ensuring that borrowers have a clear understanding of the conditions and calculation methods for early repayment. This helps build trust and enables borrowers to better manage their finances.

Early Repayment Calculation: LairaPlus calculates early repayment amounts clearly, allowing borrowers to know the exact amount before making early repayments. This helps borrowers plan their repayments effectively.

How to Make an Early Repayment

To make an early repayment, borrowers typically need to follow these steps:

Contact the Loan Provider: First, borrowers should get in touch with the loan provider, expressing their intention to make an early repayment and inquiring about the details of the early repayment policy.

Understand the Early Repayment Amount: The loan provider will provide the exact early repayment amount, including the outstanding principal and interest.

Make the Repayment: Borrowers can then proceed to make the repayment according to the provided early repayment amount, clearing the remaining loan balance.

In conclusion, whether there is an additional fee for early repayment of online simple loans depends on the policy of the loan provider. Before choosing a loan product and making early repayment, borrowers should carefully review the relevant terms in the loan contract and communicate with the loan provider to understand the specific policy and fees. LairaPlus is dedicated to offering a transparent and competitive early repayment policy, making it easier for borrowers to manage their finances and achieve debt freedom without unnecessary additional costs.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

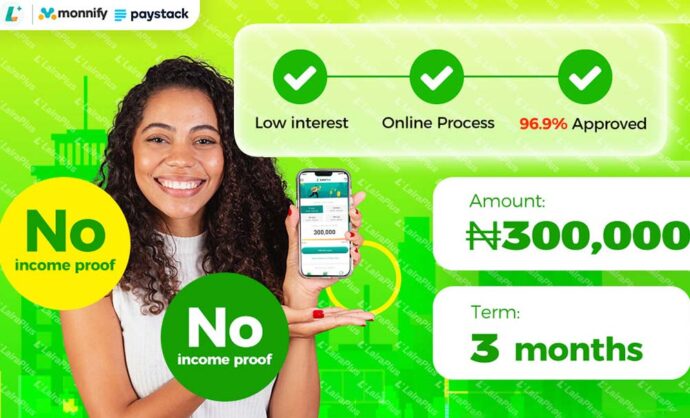

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT