Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Applying for an instant cash loan in 5 minutes typically involves the following steps:

Research and Choose a Lender: Look for reputable online lenders or mobile apps that offer instant cash loans. Read reviews, compare interest rates, fees, and terms to find a lender that suits your needs.

Gather Necessary Information: Before starting the application process, gather essential documents and information. This may include personal identification (such as a driver’s license or passport), proof of income, bank account details, and other relevant financial documents.

Visit the Lender’s Website or App: Access the lender’s website or mobile app to begin the application process. You’ll need to create an account or log in if you already have one.

Fill Out the Application Form: Complete the application form with accurate personal and financial details. Be prepared to provide information about your income, employment status, address, and bank account.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Submit the Application: Review the information provided for accuracy and completeness. Once you’re satisfied, submit the application.

Approval Process: The lender will assess your application, often using automated systems to make quick decisions based on the provided information.

Receive Approval and Funds: If approved, the lender will notify you of the loan approval and transfer the funds directly into your verified bank account, usually within minutes.

Remember, the process can vary slightly depending on the lender and their specific requirements. Additionally, while some lenders claim to offer loans in minutes, the actual time for approval and fund transfer might differ based on various factors like verification processes, banking systems, and the completeness of your application.

Always carefully review the terms and conditions, including interest rates, fees, repayment schedule, and any penalties for late payments, to ensure you understand the obligations before accepting the loan.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

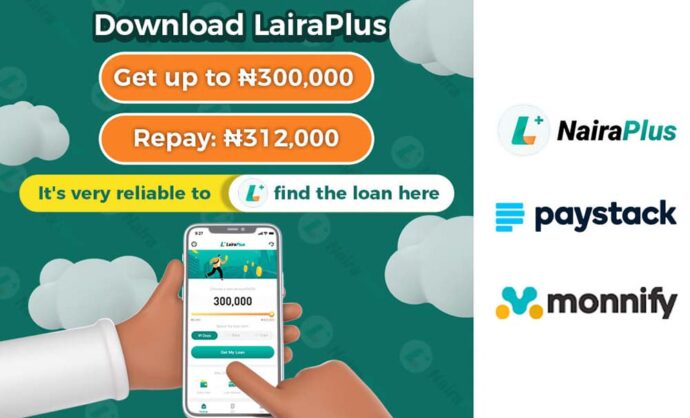

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT