Applying for a 5-minute instant cash loan can potentially impact your credit record in several ways: Hard Inquiry on Your Credit Report: When you apply for a loan, the lender usually performs a hard inquiry (or hard pull) on your

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Applying for a 5-minute instant cash loan can potentially impact your credit record in several ways: Hard Inquiry on Your Credit Report: When you apply for a loan, the lender usually performs a hard inquiry (or hard pull) on your

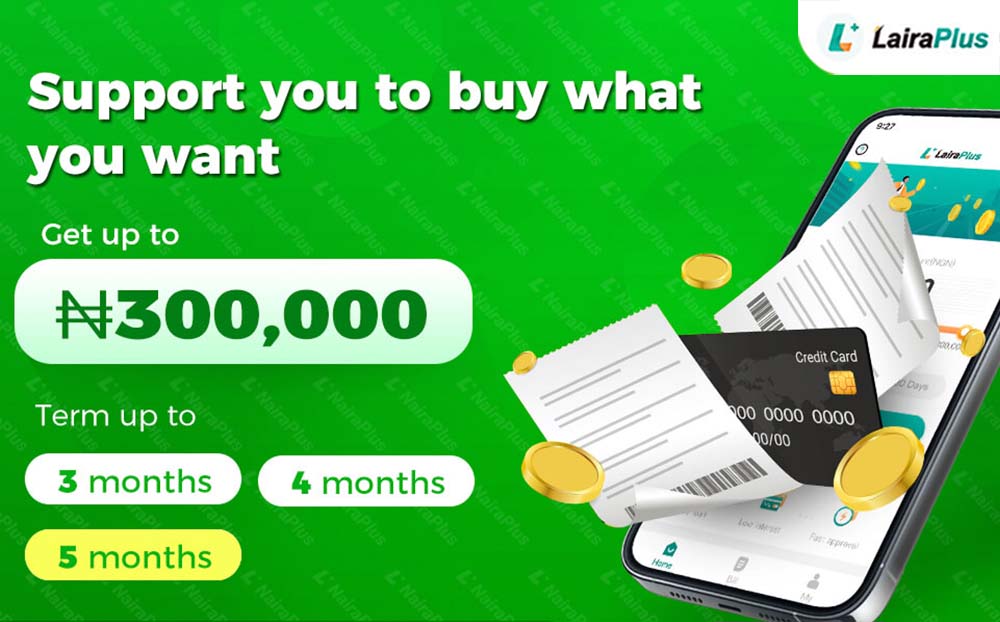

Applying for an instant cash loan in 5 minutes typically involves the following steps: Research and Choose a Lender: Look for reputable online lenders or mobile apps that offer instant cash loans. Read reviews, compare interest rates, fees, and terms

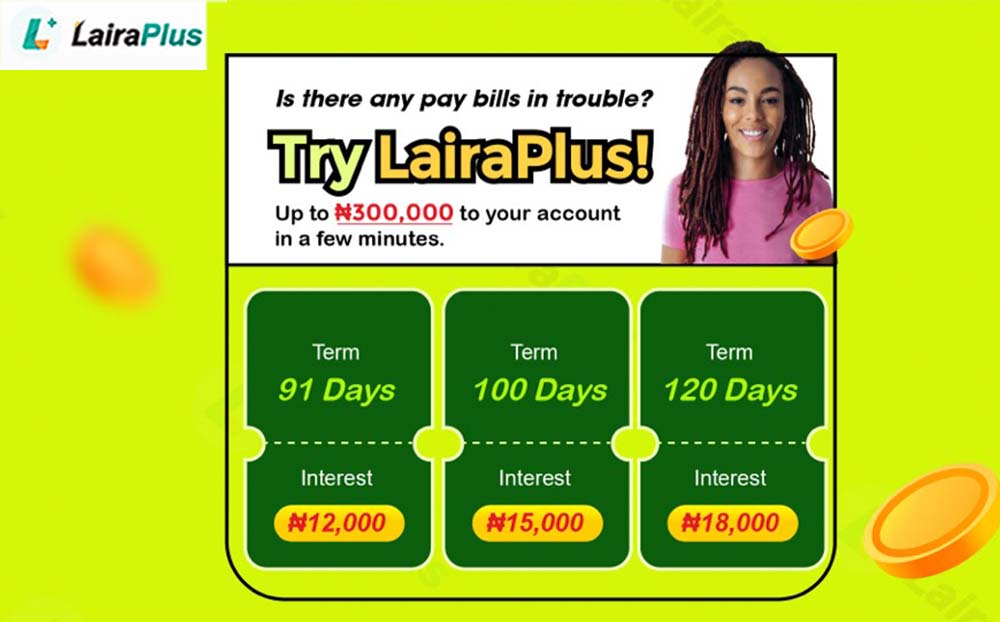

An instant cash loan in 5 minutes refers to a type of loan that allows individuals to borrow money quickly, often within minutes of application approval. These loans are typically offered by online lenders or mobile apps and are designed

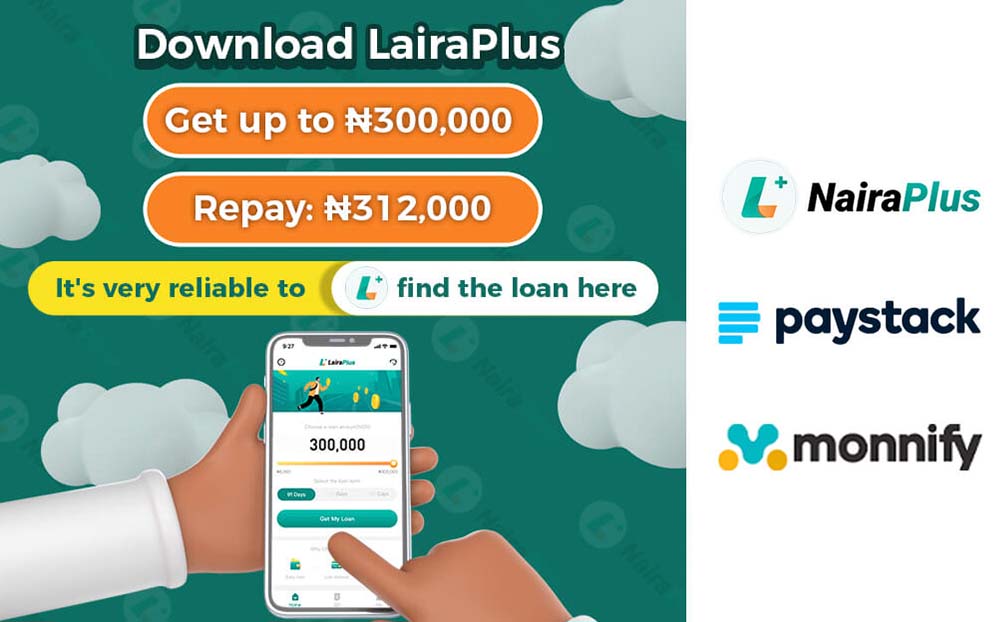

In the unpredictable journey of life, unforeseen financial challenges can emerge when least expected. When the need for urgent funds arises, waiting for a traditional loan approval can be impractical. This is where LairaPlus, a leading online lending platform, steps

In the dynamic and bustling financial landscape of Nigeria, access to instant cash loans has become increasingly essential. Whether you’re facing an unforeseen emergency or seizing an opportunity, knowing where to obtain quick funds is a valuable asset. LairaPlus, a

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad