When applying for a mobile loan in Nigeria, it’s important to stay updated on the progress of your loan and your repayment status. LairaPlus, a leading mobile loan provider in Nigeria, offers customers a convenient way to check their loan

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

When applying for a mobile loan in Nigeria, it’s important to stay updated on the progress of your loan and your repayment status. LairaPlus, a leading mobile loan provider in Nigeria, offers customers a convenient way to check their loan

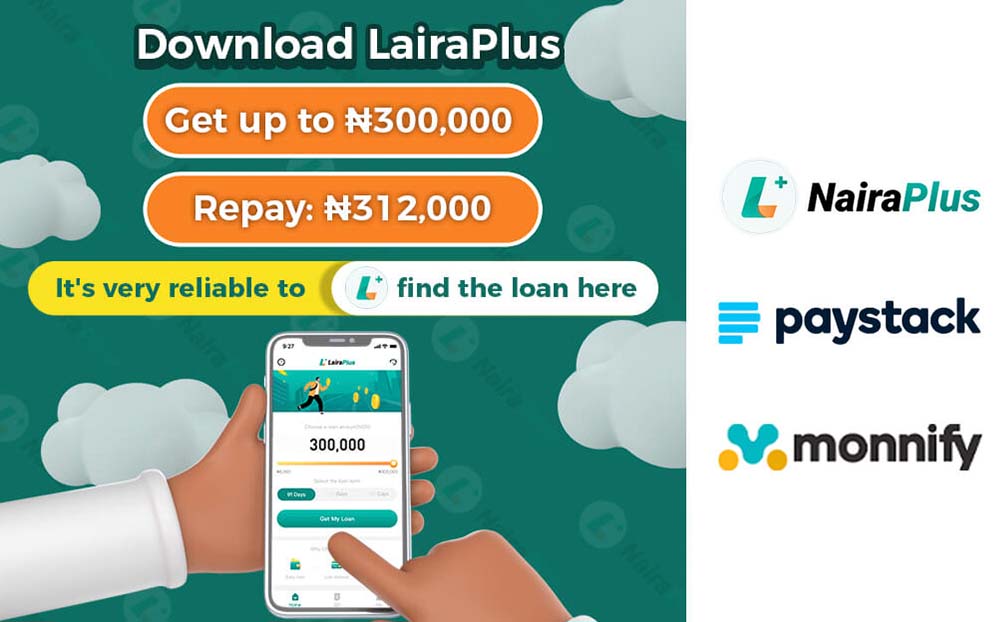

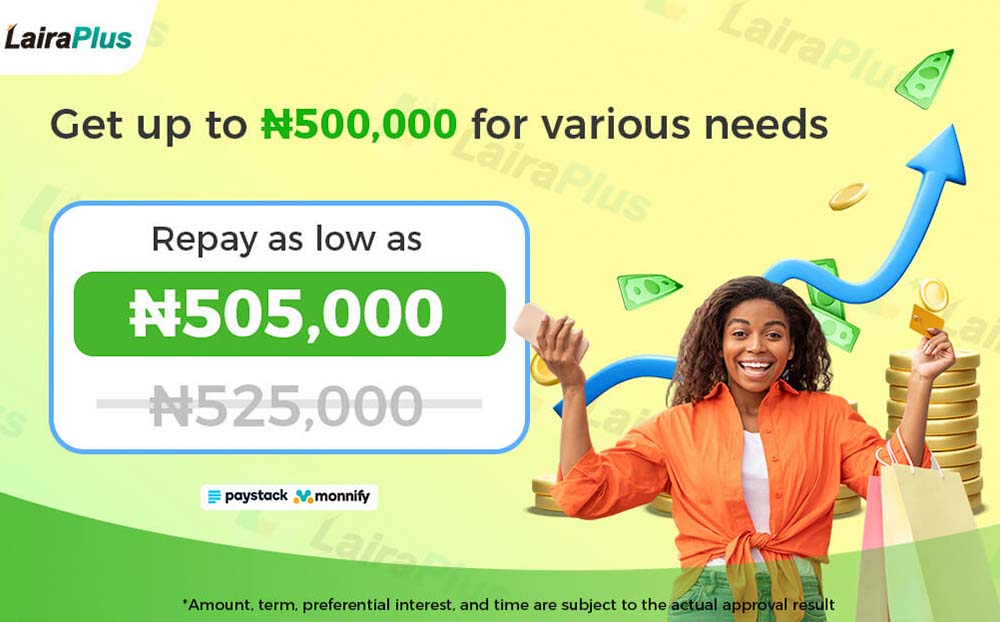

With the rise of online borrowing platforms, many people are interested in knowing how much money they can borrow through these channels. As an online borrowing platform, LairaPlus strives to provide responsible and transparent loan options to meet the financial

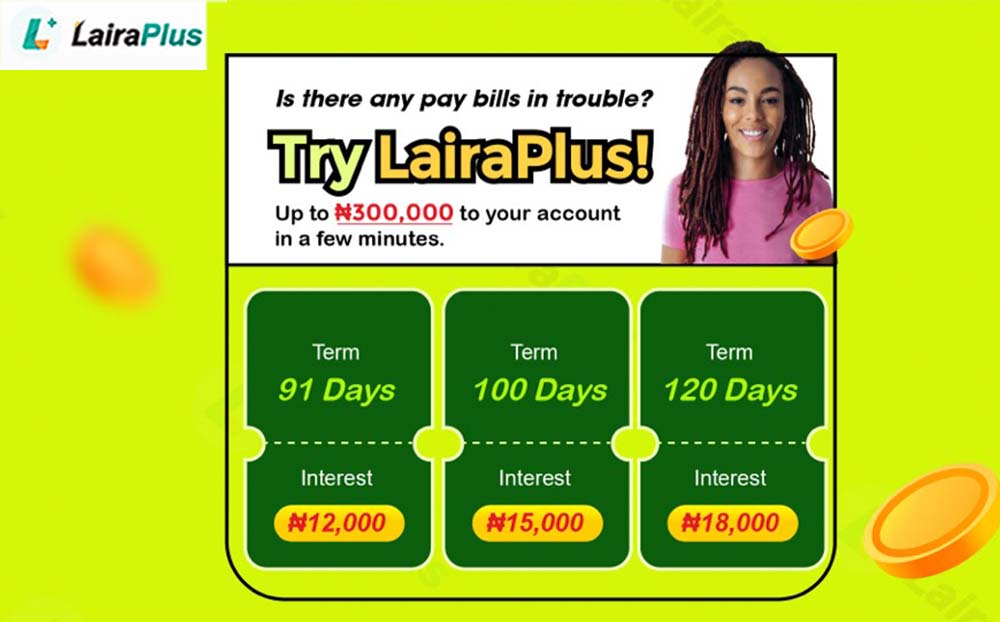

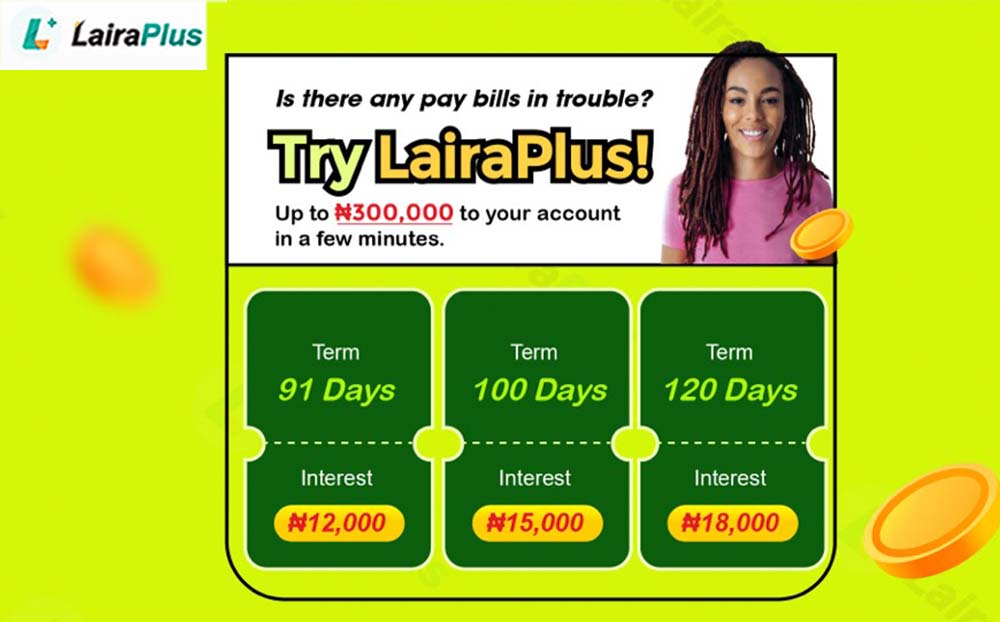

The interest rates for instant cash loans in 5 minutes can vary significantly depending on the lender, the amount borrowed, the repayment period, and the borrower’s creditworthiness. These loans often come with higher interest rates compared to traditional loans due

Applying for an instant cash loan in 5 minutes typically involves the following steps: Research and Choose a Lender: Look for reputable online lenders or mobile apps that offer instant cash loans. Read reviews, compare interest rates, fees, and terms

An instant cash loan in 5 minutes refers to a type of loan that allows individuals to borrow money quickly, often within minutes of application approval. These loans are typically offered by online lenders or mobile apps and are designed

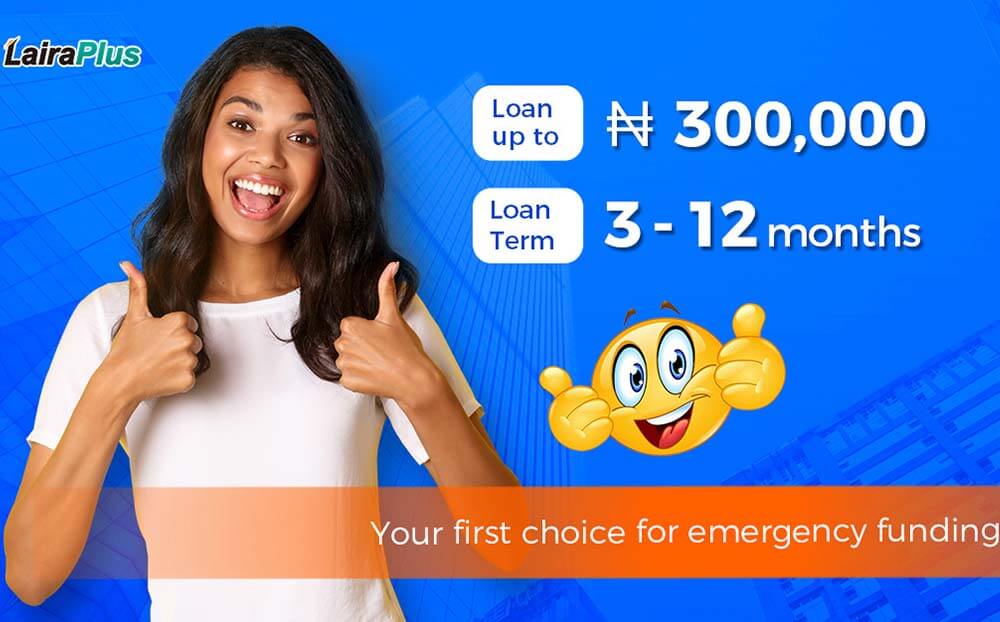

When the need for urgent funds arises, waiting for loan approvals can be stressful. Enter LairaPlus, a leading financial institution in Nigeria renowned for its swift and efficient 5 minute online loan services. 1. Rapid Approval Process: LairaPlus prides itself

In a fast-paced world where financial needs can arise at any moment, the importance of instant personal loans cannot be overstated. These loans are designed to provide rapid financial relief when unexpected expenses or opportunities come your way. LairaPlus, a

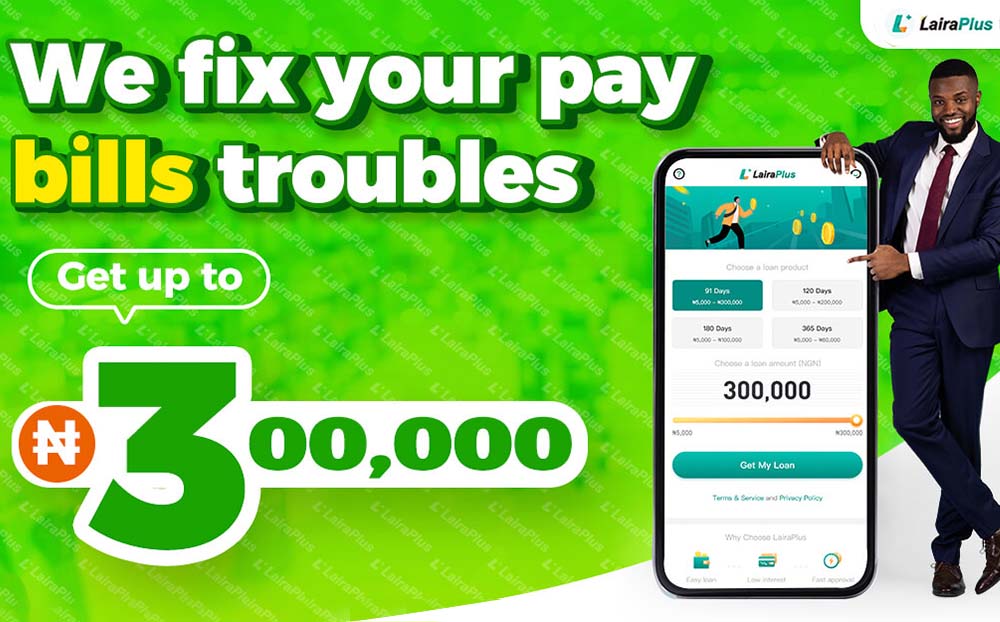

In a world where financial needs vary greatly and the unexpected can happen at any time, having a reliable partner for borrowing money is essential. LairaPlus, a leading online lending platform, has become a household name for Nigerians seeking financial

Life is full of unexpected twists and turns, and sometimes these surprises come with a hefty price tag. Whether it’s a medical emergency, a sudden car repair, or any other unforeseen expense, having access to fast cash can make all

Life often throws unexpected financial challenges our way. Whether it’s a sudden medical expense, a car repair, or any other unforeseen cost, having quick access to cash can make all the difference. LairaPlus, with its instant cash loan in 5

In life, urgent financial needs can arise at any moment, whether it’s a medical emergency, unexpected vehicle repairs, or other sudden expenses. During these times, getting quick access to cash support is crucial. LairaPlus is an application that offers instant

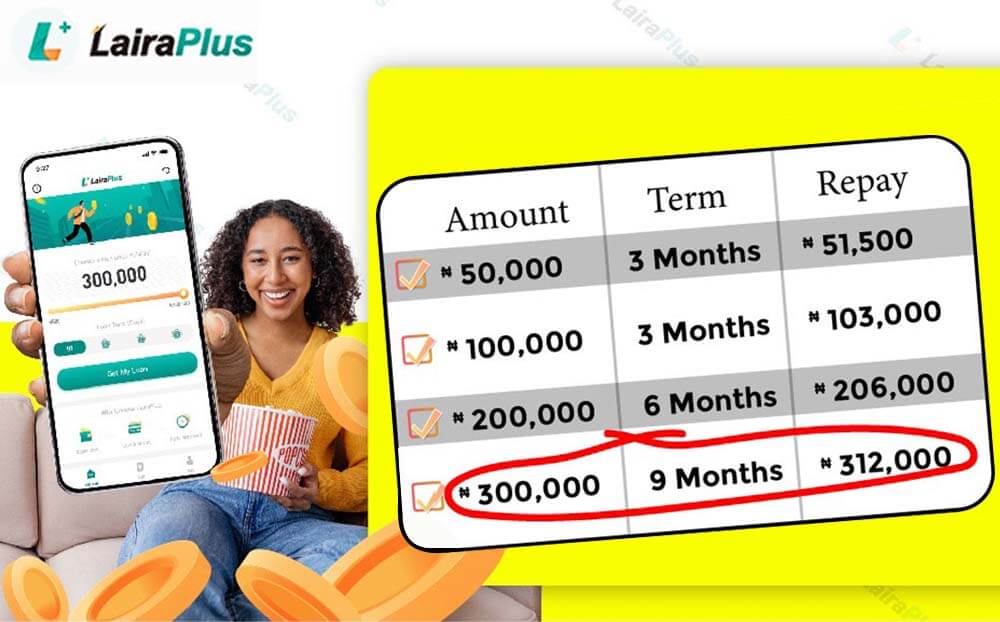

Online personal loans are a convenient way to address short-term and mid-term financial needs, but choosing the right loan term is crucial. LairaPlus is a professional online loan platform, and we understand that different loan terms are suitable for different

Applying for a loan may seem complex, but following a set of basic steps can make the process simpler and smoother. In this 1000-word article, we will provide you with a detailed guide to the basic loan application process, with

In today’s fast-paced world, unexpected financial emergencies can strike at any moment, leaving individuals in need of quick cash solutions. One option that has gained significant popularity in recent years is online personal loans. These loans offer convenience and accessibility,

Applying for Multiple Instant Loans on LairaPlus: LairaPlus is a platform that offers instant loan services, allowing you to access much-needed funds whenever required. However, whether you can apply for multiple instant loans simultaneously involves certain rules and considerations. In

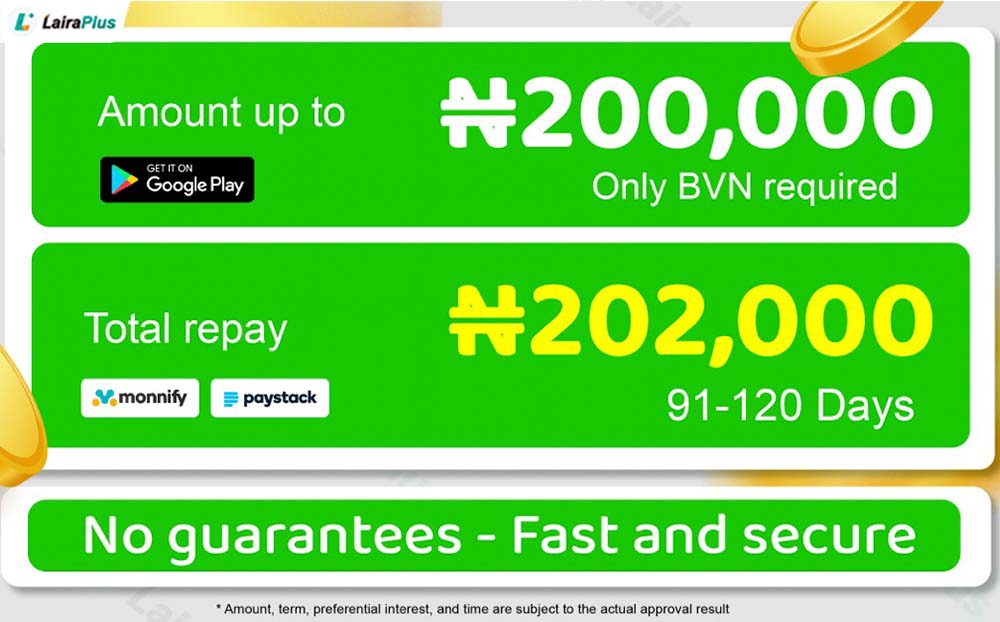

Do I Need a Bank Account for Online Lending? Online lending, as a modern financial tool, offers borrowers a convenient way to access loans. However, a common question arises: Is having a bank account necessary for online lending? In this

Approval Time for Online Borrowing: Efficient Process with LairaPlus In today’s fast-paced world, time is of the essence, especially when financial needs are urgent. The swift approval process of online borrowing has become a key attraction for borrowers. As a

LairaPlus Personal Loans: A Convenient Path to Fulfill Your Financial Needs In today’s modern society, personal loans have become a common means to meet a wide range of financial needs. As a leading online loan platform, LairaPlus offers individuals a

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad