Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Applying for a loan may seem complex, but following a set of basic steps can make the process simpler and smoother. In this 1000-word article, we will provide you with a detailed guide to the basic loan application process, with a particular focus on LairaPlus.

1. Determine the Loan Purpose:

Before applying for a loan, clarify your loan’s purpose. Is it for buying a home, paying for education, purchasing a car, or another purpose? Defining the purpose helps in selecting the appropriate loan type.

2. Assess Loan Needs:

Determine how much loan funding you need. Conduct a thorough financial analysis, considering project costs, existing savings, and other funding sources.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

3. Check Your Credit Record:

Before applying, review your credit record. Ensure that your credit record is accurate, and if there are any issues, address them promptly.

4. Research Different Loan Options:

Understand various loan types, including personal loans, mortgages, car loans, and more. Compare their interest rates, terms, repayment methods, and fees.

5. Choose the Right Loan Type:

Select the loan type that matches your needs and financial situation. LairaPlus offers multiple loan options to meet various needs.

6. Budget Planning:

Create a loan repayment plan and budget. Ensure that you have sufficient funds to make timely repayments.

7. Prepare Necessary Documents:

Gather the required loan application documents, such as proof of income, identification, financial statements, and more. Ensure that your documents are complete and accurate.

8. Complete the Loan Application:

Fill out the loan application form, providing accurate personal information and financial data. Make sure to read and understand all questions.

9. Choose Loan Term and Interest Rate:

Select the loan term and interest rate type. Fixed interest rates remain constant throughout the loan term, while variable rates may fluctuate based on market conditions.

10. Submit the Application:

Submit the completed loan application and necessary documents to LairaPlus or your chosen loan institution. Ensure that all documents are complete and accurate.

11. Approval Process:

Once the application is submitted, the loan institution will begin reviewing your application. This process may take some time and may require additional information.

12. Approval and Contract Signing:

If your application is approved, you will receive a loan contract. Carefully read the contract to understand the repayment plan and other terms.

13. Accept Loan Funds:

Once you’ve signed the loan contract, the loan funds will be deposited into your account. You can begin using these funds for your loan’s intended purpose.

14. Start Repayment:

Begin making on-time payments according to the contract’s specified repayment plan. Ensure that you make payments promptly to maintain a good credit record.

15. Loan Management Afterward:

Throughout the loan term, regularly monitor your repayments and financial status. If you encounter any issues, promptly contact the loan institution.

The basic loan application process involves preparation, application, approval, contract signing, and repayment phases. Following these steps and selecting the appropriate loan type can make the entire process smoother. LairaPlus is committed to providing transparent and efficient loan services to help you achieve your financial goals.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

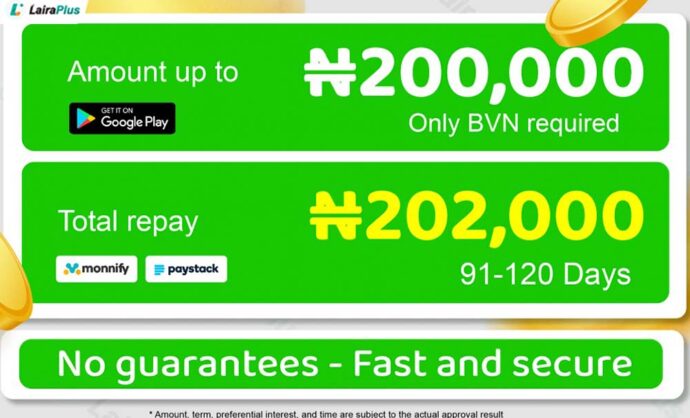

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT