A credit score of 805 is considered excellent and is one of the highest credit scores you can achieve. With such a high credit score, you have positioned yourself as a responsible and reliable borrower. Lenders view individuals with excellent

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

A credit score of 805 is considered excellent and is one of the highest credit scores you can achieve. With such a high credit score, you have positioned yourself as a responsible and reliable borrower. Lenders view individuals with excellent

Applying for a loan may seem complex, but following a set of basic steps can make the process simpler and smoother. In this 1000-word article, we will provide you with a detailed guide to the basic loan application process, with

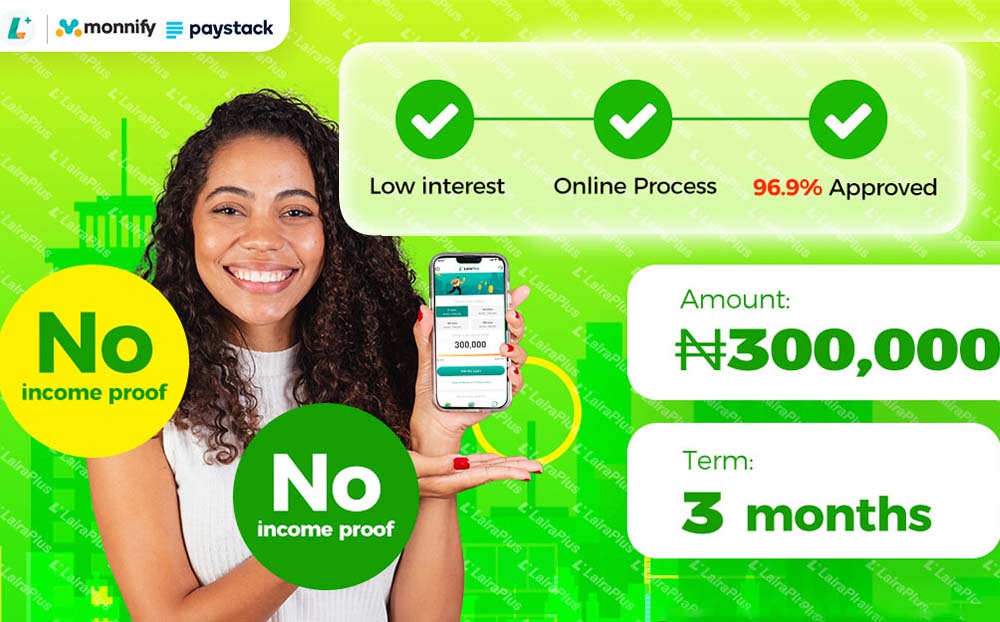

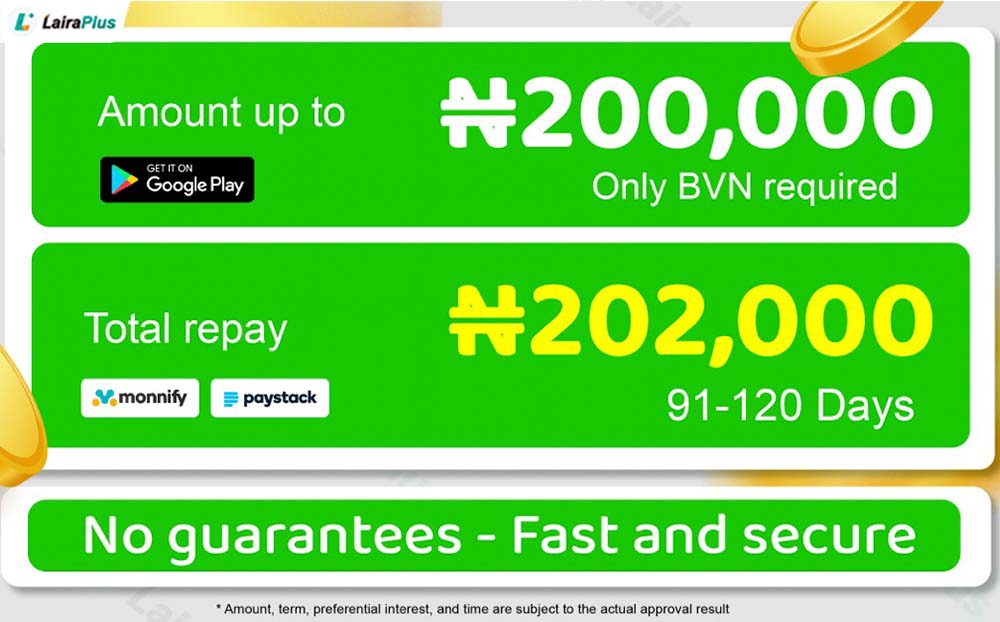

Prerequisites for Applying for Online Borrowing: Embarking on the LairaPlus Journey Online borrowing has become an integral part of modern finance, with LairaPlus standing as a prominent player in this wave of change. To successfully apply for online borrowing, understanding

Early Repayment Option with LairaPlus Loans: Is It Supported and Is There a Fee? LairaPlus, as an online loan platform, offers borrowers a convenient way to access funds for various needs. One common question that borrowers often have is whether

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad