Home » Blog » What is the interest rate for an instant cash loan in 5 minutes? Are there any hidden fees?

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

The interest rates for instant cash loans in 5 minutes can vary significantly depending on the lender, the amount borrowed, the repayment period, and the borrower’s creditworthiness. These loans often come with higher interest rates compared to traditional loans due to their quick accessibility and limited credit checks.

Interest rates for instant cash loans can range from relatively reasonable rates to considerably higher percentages, sometimes even exceeding annual percentage rates (APRs) of 100% or more for short-term loans.

Regarding hidden fees, while many reputable lenders disclose their fees transparently, borrowers should be cautious and thoroughly read the loan agreement before accepting the loan. Some potential fees that might not be immediately obvious include:

Origination Fees: These fees are charged for processing the loan and are sometimes included in the loan amount.

Late Payment Fees: If you miss a repayment, lenders may charge late fees or penalties.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Prepayment Penalties: Some lenders charge a fee if you repay the loan before the agreed-upon time.

Additional Charges: There might be additional fees for certain services, such as expedited fund disbursement or extending the loan duration.

To ensure transparency and avoid hidden fees:

If anything in the terms seems unclear or if you suspect hidden fees, it’s advisable to seek clarification from the lender before accepting the loan. Reputable lenders should be willing to explain all costs and fees associated with the loan.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

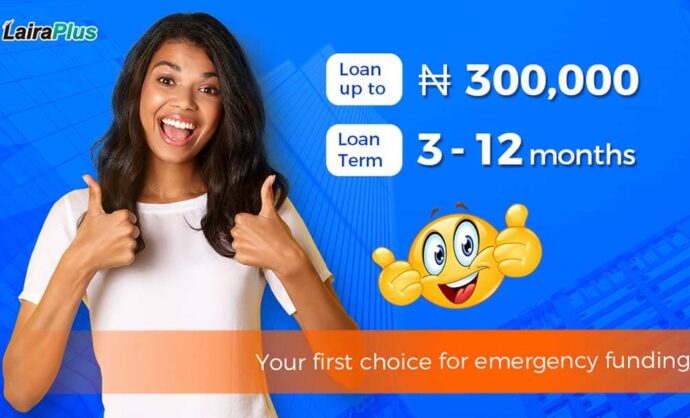

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT