Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

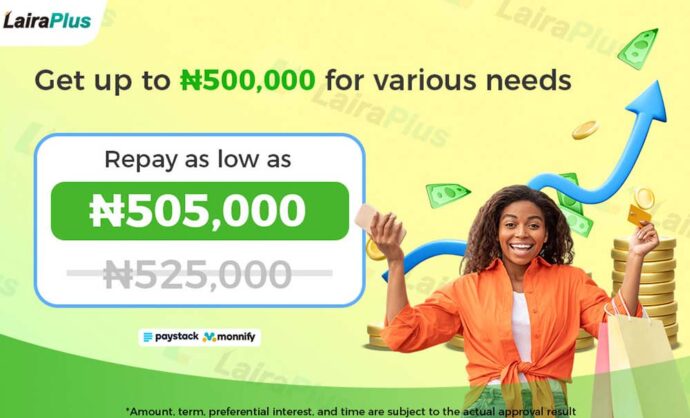

In a fast-paced world where financial needs can arise at any moment, the importance of instant personal loans cannot be overstated. These loans are designed to provide rapid financial relief when unexpected expenses or opportunities come your way. LairaPlus, a leading online lending platform, has simplified the process of accessing instant personal loans, offering a host of benefits to its users. In this article, we will explore the numerous advantages of instant personal loans and how LairaPlus excels in this regard.

Instant Personal Loans: A Quick Overview:

Instant personal loans are unsecured loans that provide borrowers with quick access to funds. Unlike traditional loans, these loans often have a simplified application process, reduced documentation requirements, and a speedy approval and disbursement timeline. These features make them an attractive financial tool for addressing urgent financial needs and opportunities.

Benefits of Instant Personal Loans:

Rapid Access to Funds:

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

One of the primary advantages of instant personal loans is the speed at which funds are made available. In many cases, borrowers can receive approval and have the loan amount deposited into their bank account within minutes. This swiftness is particularly valuable when dealing with emergencies.

Minimal Documentation:

Traditional loans typically involve significant paperwork, which can be time-consuming and burdensome. Instant personal loans, including those offered by LairaPlus, reduce the documentation requirements, making the application process efficient and straightforward.

Flexible Loan Amounts:

Instant personal loans come in various denominations, allowing borrowers to select the loan amount that precisely matches their financial needs. Whether it’s a small expense or a substantial investment, you can customize your loan amount accordingly.

Transparent Fee Structure:

Transparency is crucial, and LairaPlus prioritizes this by providing borrowers with a clear fee structure. This includes details about interest rates, fees, and repayment terms, ensuring that borrowers are well-informed when making financial decisions.

User-Friendly Interface:

Online lending platforms like LairaPlus offer user-friendly interfaces that simplify the application process. Whether you’re tech-savvy or new to digital financial services, these interfaces are designed to accommodate all users.

No Collateral Required:

Many instant personal loans are unsecured, meaning you don’t need to pledge valuable assets as collateral to access funds. This reduces the burden on borrowers who may not have assets to secure a loan.

Data Security and Privacy:

Data security is paramount, and reputable lending platforms, including LairaPlus, employ stringent security measures to safeguard personal and financial information. Users can trust that their data is protected, ensuring confidentiality and privacy.

LairaPlus: Your Instant Personal Loan Partner:

LairaPlus excels in providing all these benefits and more. The platform is designed to meet the urgent financial needs of Nigerians by offering quick access to personal loans with minimal documentation. LairaPlus’s user-friendly interface ensures that the borrowing process is accessible to all users, regardless of their digital expertise.

Furthermore, LairaPlus prioritizes data security and transparency, creating a safe and trustworthy environment for borrowers to access the funds they need promptly.

The benefits of instant personal loans, including rapid access to funds, reduced paperwork, flexibility in loan amounts, and transparency, make them a valuable financial tool for a wide range of situations. LairaPlus, with its commitment to these advantages, stands as a leading platform for Nigerians seeking the convenience of instant personal loans in an ever-changing financial landscape.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT