Downloading a credit loan app via an APK file can carry some risks if not obtained from trusted sources. Here are insights into the safety concerns and potential risks associated with downloading credit loan app APK files: Safety Concerns: Source

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Downloading a credit loan app via an APK file can carry some risks if not obtained from trusted sources. Here are insights into the safety concerns and potential risks associated with downloading credit loan app APK files: Safety Concerns: Source

A “credit loan app download APK” typically refers to the installation file (APK) for a credit or loan application on Android devices. APK: An APK file is the package format used by Android operating systems for distributing and installing apps.

Before applying for a 5 minute online loan, it’s essential to take certain precautions and make specific preparations to ensure a smooth and successful borrowing experience. Here’s a list of precautions and preparations: 1. Check Your Credit Report: Review your

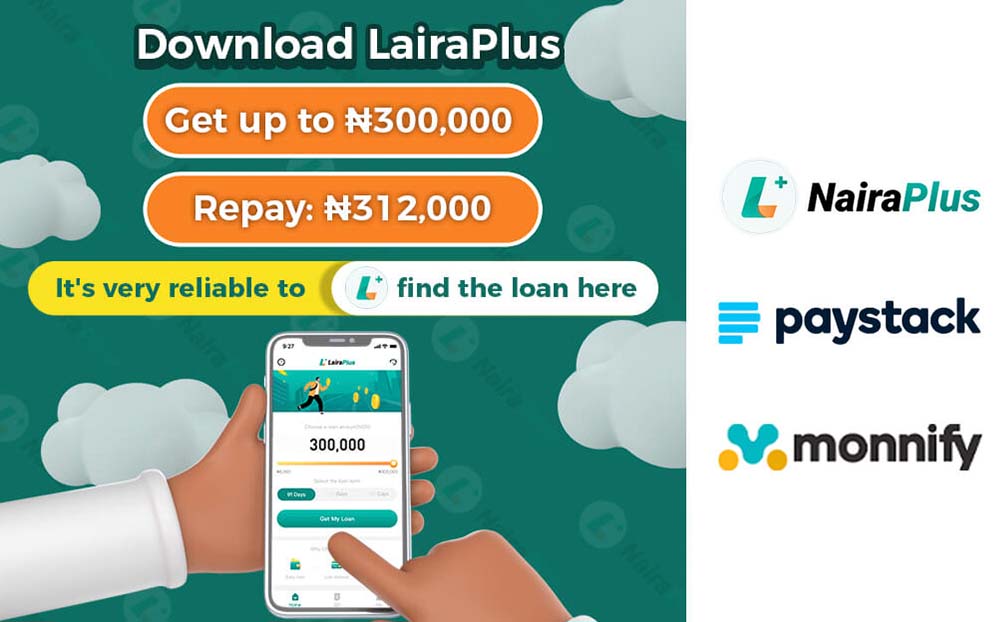

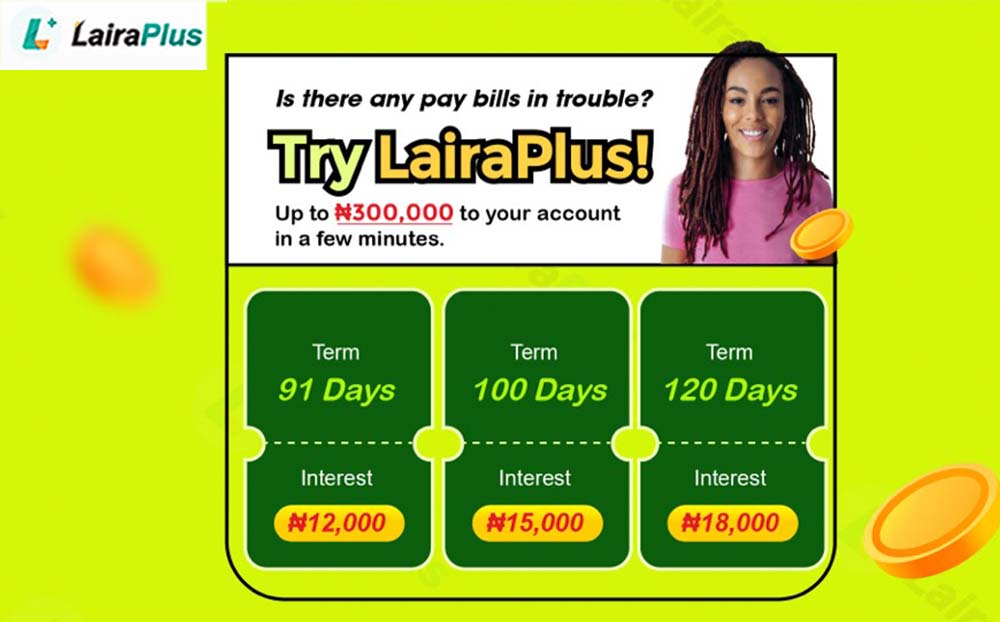

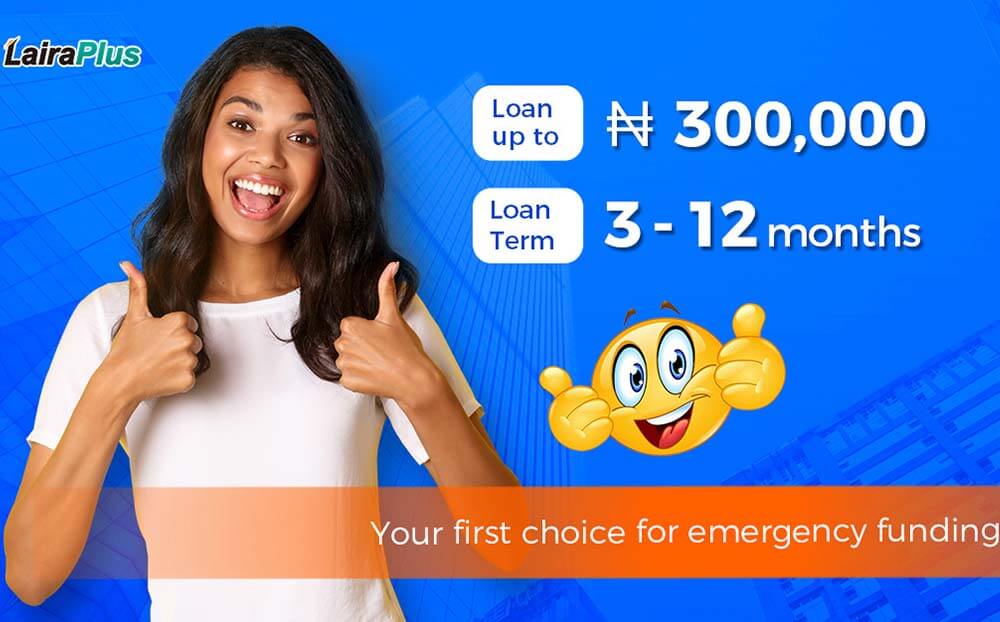

When the need for urgent funds arises, waiting for loan approvals can be stressful. Enter LairaPlus, a leading financial institution in Nigeria renowned for its swift and efficient 5 minute online loan services. 1. Rapid Approval Process: LairaPlus prides itself

The possibility of applying for a larger amount through a 5 minute online loan can vary among lenders. Some online lending platforms may offer higher loan amounts, but the approval and disbursement duration might extend beyond a few minutes due

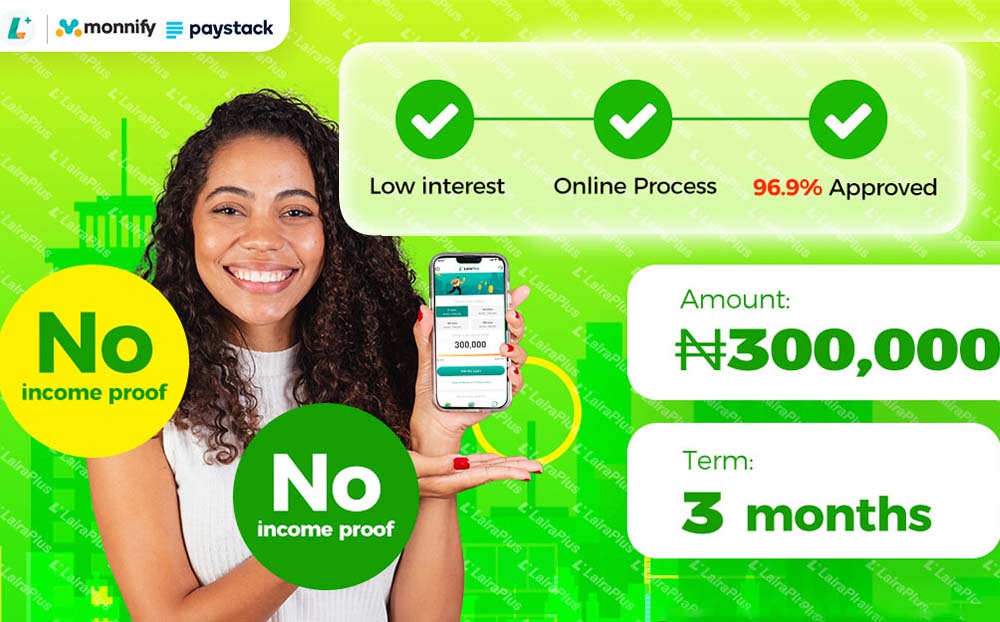

The necessity of a good credit history for a 5 minute online loan application can vary among lenders. Some lenders offering quick online loans might not heavily weigh traditional credit scores in their approval processes. They may prioritize other factors

Securing a quick online loan can be a lifesaver during emergencies or urgent financial needs. Many lenders promise swift processing times, with some even advertising approval within minutes. Yet, once your application is approved, the time it takes for the

The time taken for approval of a 5 minute online loan in Nigeria can vary significantly based on the lending institution or platform. However, in ideal circumstances: Instant Approval: Some online lenders offer instant approval. After submitting the application, you

For a 5-minute online loan application in Nigeria, you typically need to provide the following information: Personal Information: Full name, date of birth, contact details (address, phone number, email), and government-issued identification details (like a national ID card, driver’s license,

Applying for an online loan in Nigeria within 5 minutes involves a few key steps: Choose a Reputable Lending Platform: Select a trusted and reliable online lending platform or app that offers quick loan services in Nigeria. Prepare Required Information:

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad