Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Downloading a credit loan app via an APK file can carry some risks if not obtained from trusted sources. Here are insights into the safety concerns and potential risks associated with downloading credit loan app APK files:

Safety Concerns:

Source Reliability: APK files obtained from reputable app stores like Google Play Store or the official website of the lending institution are generally safer than those from third-party sites.

Malware and Viruses: APK files from unreliable sources might contain malware or viruses that could compromise device security and personal information.

Data Privacy: Unauthorized APKs may pose risks to data privacy, potentially accessing sensitive user information without consent.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

App Updates: APKs from unofficial sources might not receive updates or security patches, leaving devices vulnerable to vulnerabilities.

Potential Risks:

Device Security: Installing APKs from untrusted sources could expose devices to security vulnerabilities or potential hacking attempts.

Data Breaches: Third-party APKs might access personal data, leading to identity theft or unauthorized use of sensitive information.

Financial Risks: Using unofficial APKs for financial transactions could result in financial fraud or loss of funds.

To mitigate these risks:

Use Trusted Sources: Download APK files from the official website of the lending institution or reputable app stores.

Check Permissions: Review app permissions before installation to ensure the app only accesses necessary data.

Enable Security Settings: Enable device security settings to block installations from unknown sources and protect against potential threats.

It’s crucial to prioritize safety and only download credit loan app APKs from trusted sources to safeguard both personal information and device security. If unsure, it’s safer to opt for apps available through official app stores to minimize potential risks.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

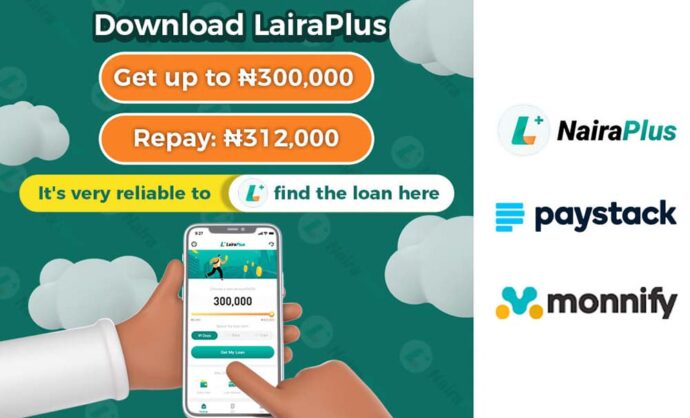

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT