Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

For a 5-minute online loan application in Nigeria, you typically need to provide the following information:

Personal Information: Full name, date of birth, contact details (address, phone number, email), and government-issued identification details (like a national ID card, driver’s license, or passport).

Employment Details: Information about your employment status, such as your employer’s name, your position, and your monthly income. Some lenders might require salary slips or proof of employment.

Bank Account Details: Details of your bank account, including the account number and bank name. This is where the approved loan amount will be disbursed.

Residential Information: Details about your current living situation, such as your residential address and how long you’ve lived there.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Additional Information: Depending on the lender, you might need to provide additional details like references, your Tax Identification Number (TIN), or any other relevant financial information.

Ensure that all information provided is accurate and up-to-date to facilitate a smooth and quick application process. Different lenders may have slightly varying requirements, so it’s essential to review the specific application guidelines of the chosen lending platform.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

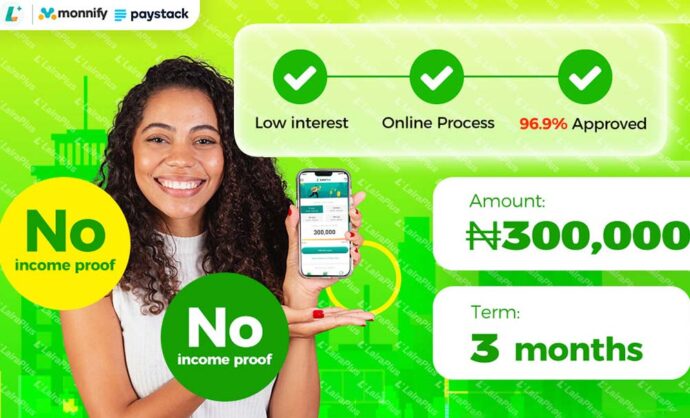

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT