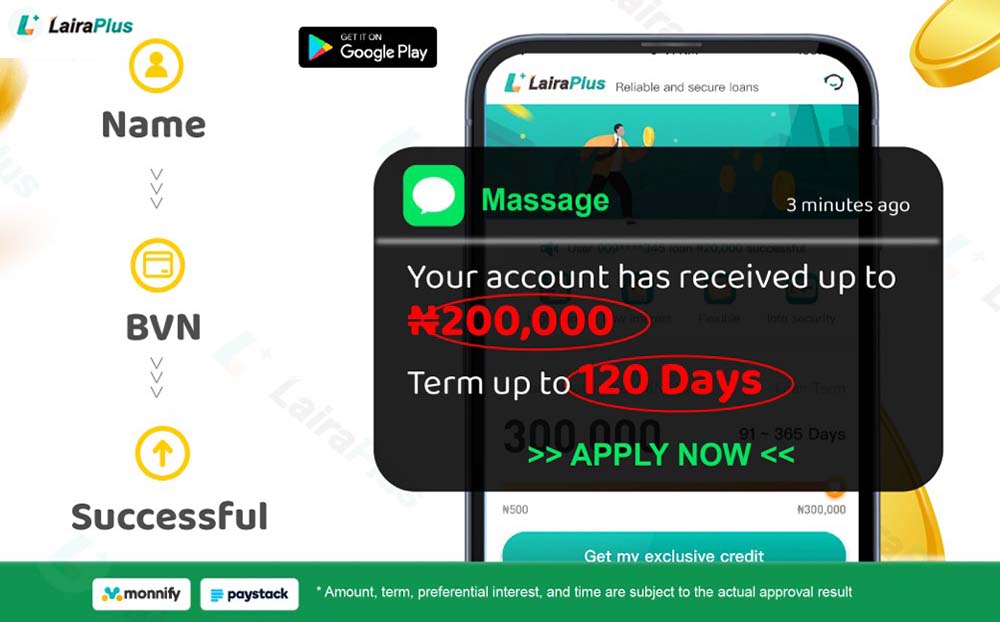

Applying for a quick loan in Nigeria typically involves the following steps. Keep in mind that the specific process may vary depending on the lender, but these are the general steps you can expect: Research and Choose a Lender: Start

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Applying for a quick loan in Nigeria typically involves the following steps. Keep in mind that the specific process may vary depending on the lender, but these are the general steps you can expect: Research and Choose a Lender: Start

To check the status of a personal loan applied through LairaPlus, you should follow these steps: Log In to Your Account: Visit the official LairaPlus website or app. Log in to your account using the credentials you used when applying

The minimum age to take out a loan typically varies by country and region, but it is generally 18 years old in many places. Here are some key points to consider: Legal Age: In most countries, 18 is the legal

Whether you can have overpayments applied to the principal of a personal loan depends on the specific terms and policies of the lender. Here are some key points to consider: Lender Policies: Some lenders allow borrowers to make overpayments that

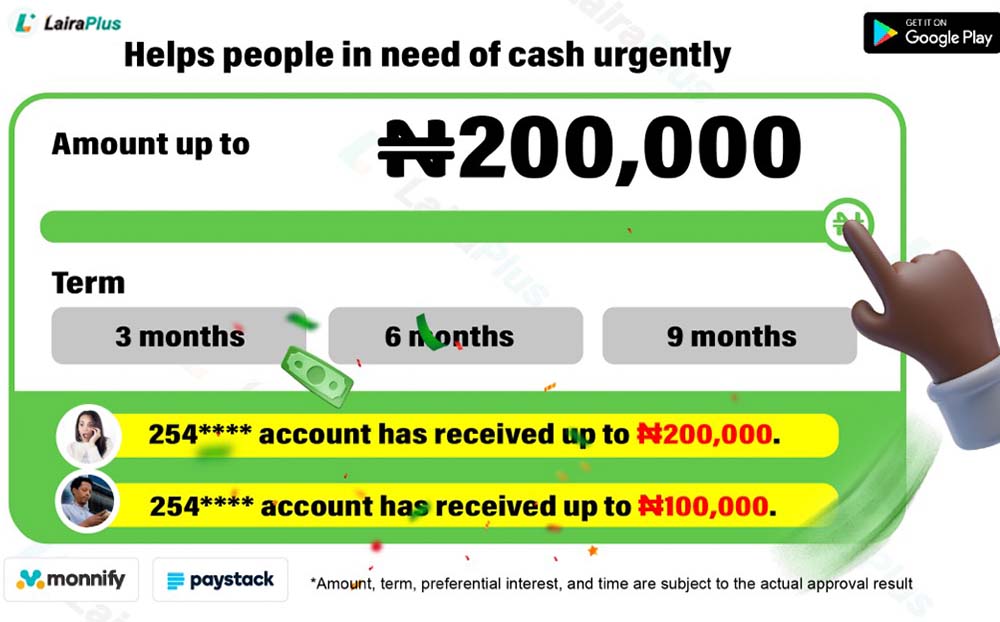

In Nigeria, there are several types of personal loans available to meet various financial needs. The specific types of personal loans may vary from one financial institution to another, but the following are some common types: Salary Advance Loans: These

Yes, a co-applicant of a mobile loan can typically apply for a personal loan separately. Mobile loans and personal loans are different types of financial products, and being a co-applicant for one does not prevent you from applying for the

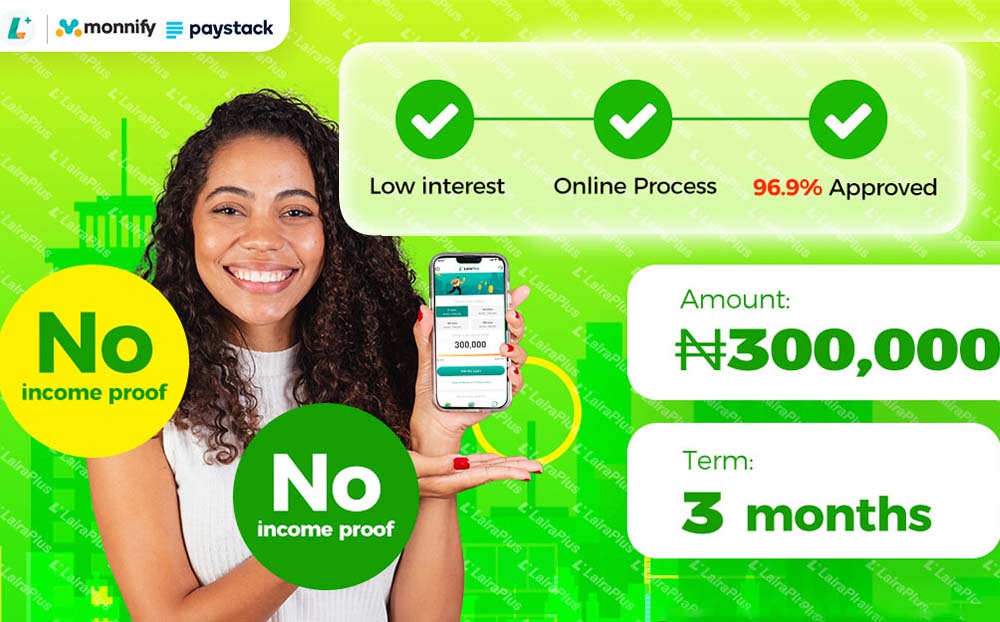

Applying for personal loans online has become a convenient and common way to secure financing for various personal expenses. Here’s everything you need to know about applying for personal loans online: 1. Online Lenders: Numerous online lenders offer personal loans.

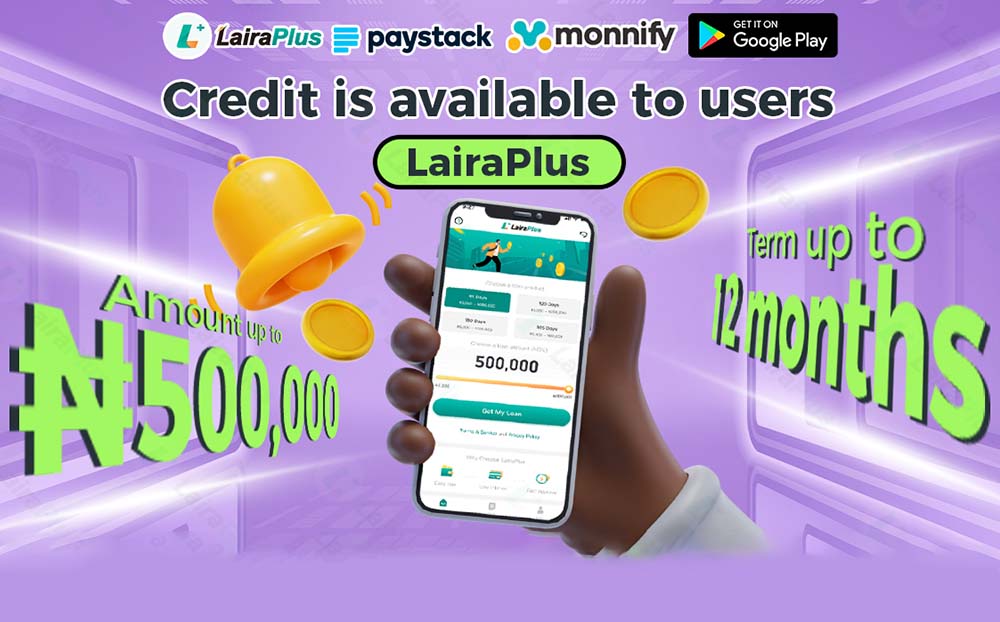

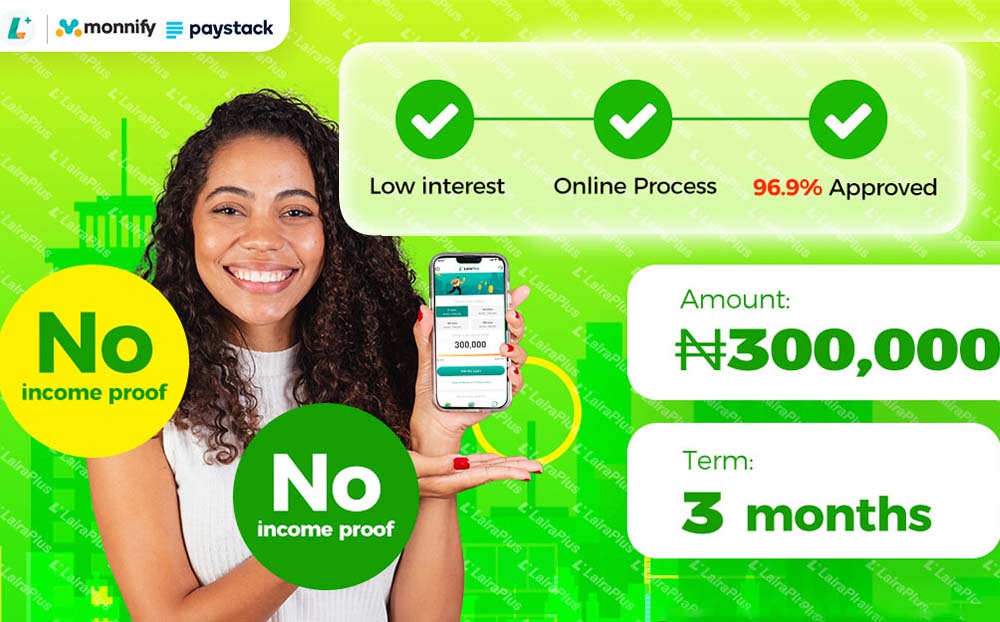

LairaPlus is a leading financial technology company that provides convenient and accessible personal loan solutions through its user-friendly mobile app. If you’re looking to access quick and transparent loans with competitive interest rates, downloading and installing the LairaPlus app is

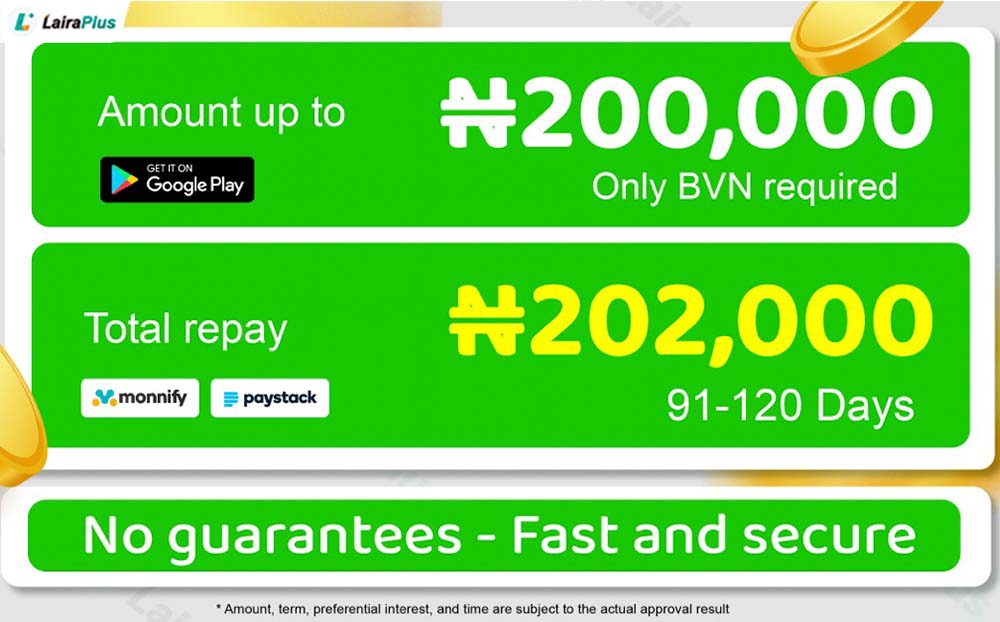

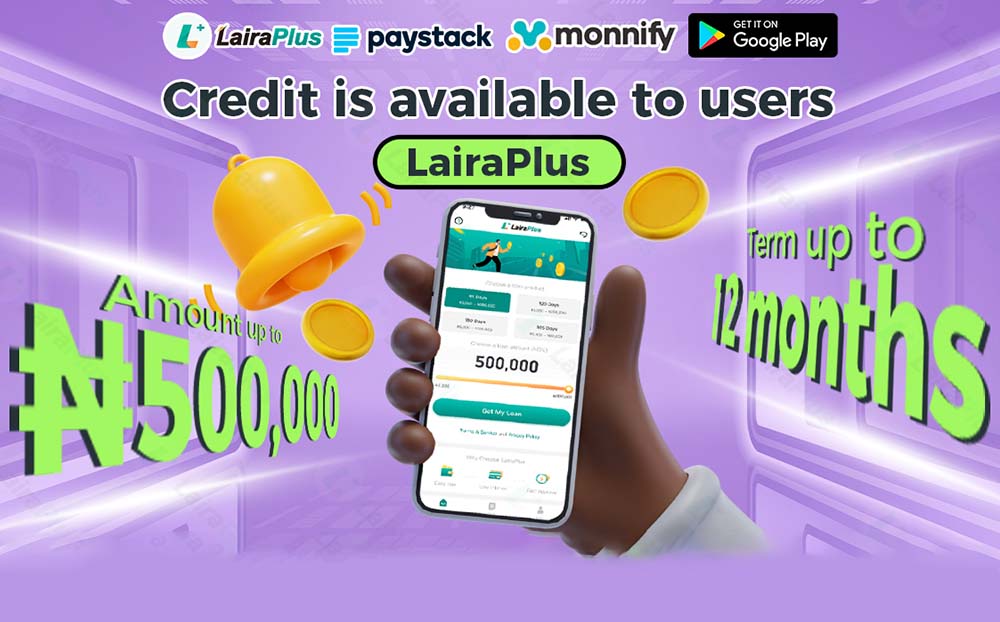

Online personal loans are a convenient way to address short-term and mid-term financial needs, but choosing the right loan term is crucial. LairaPlus is a professional online loan platform, and we understand that different loan terms are suitable for different

Facing a loan denial can be disheartening, especially when you’re in need of financial assistance. However, a loan rejection doesn’t necessarily mean the end of your borrowing journey. LairaPlus understands that situations can change, and it’s committed to helping borrowers

When choosing an online borrowing product, a crucial decision is whether to opt for a fixed interest rate or an adjustable interest rate. Each type of interest rate has its unique features and considerations, and LairaPlus, as an online lending

Online simple loans have become the preferred choice for many individuals when facing urgent financial needs. They offer a quick and convenient way to borrow money. However, before taking out an online simple loan, it’s essential to be aware of

In today’s financial market, there is a wide array of simple loan products to choose from. These loans come with various features and are suited for different borrowing needs and financial situations. However, figuring out how to effectively compare different

The rise of the fintech industry has ushered in a new era of financial services, with online simple loans becoming the preferred choice for many to meet short-term financial needs. Compared to traditional loans, online simple loans offer more convenience

Mobile loans have transformed the lending landscape, offering quick access to funds for individuals facing financial challenges. We will delve into the intricate details of interest rates and fees associated with mobile loans, with insights from LairaPlus. Part One: Interest

How to Apply for Mobile Loans Mobile loans have become an essential financial tool for many, providing quick access to funds in times of need. In this 1000-word article, we will provide a comprehensive guide on how to apply for

Mobile loans have revolutionized the lending landscape, offering borrowers a convenient and accessible way to access financial assistance. We will explore the concept of mobile loans, how they operate, and their significance in today’s financial world, with insights from LairaPlus.

Avoiding the Pitfalls of Mobile Loans,LairaPlus Offers Insights for Smart Borrowing Mobile loans have become increasingly popular for their convenience in addressing financial needs. However, with convenience comes the potential for pitfalls. We will explore how to avoid falling into

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad