Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

In today’s financial market, there is a wide array of simple loan products to choose from. These loans come with various features and are suited for different borrowing needs and financial situations. However, figuring out how to effectively compare different simple loan products to find the one that best suits your needs can be daunting. This article will provide you with a comprehensive guide on how to compare different simple loan products and how LairaPlus offers quality loan products.

1. Interest Rates and Fees

To begin with, when comparing different simple loan products, you should place significant emphasis on interest rates and fees. Different loan products come with varying interest rates and fee structures, which directly affect your repayment burden. Here are some key points to consider:

Annual Percentage Rate (APR): APR is a crucial indicator that encompasses loan interest and all associated fees. By comparing the APRs of different loan products, you can better understand the actual cost of borrowing.

Types of Interest Rates: Different loan products may employ different types of interest rates, such as fixed or adjustable rates. You should understand the pros and cons of each type and determine which one suits your needs.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Additional Fees: Apart from interest rates, also consider any additional fees that may be involved, such as application fees, processing fees, prepayment penalties, and more. These fees can vary between different loan products.

2. Repayment Term

The repayment term is the amount of time you have to repay the loan. Different loan products offer varying repayment term options. To compare them effectively, you need to consider the following factors:

3. Flexibility in Repayment Plans

Understanding whether the repayment plans of different loan products offer flexibility is also crucial. Here are some considerations:

Early Repayment Policies: Some loan products allow early repayment without additional fees, while others may charge extra fees or penalties. Understanding the early repayment policy is essential for future financial planning.

Monthly Payment Amounts: Different repayment plans may result in varying monthly payment amounts. Ensure that the chosen repayment plan fits your budget and cash flow.

4. Loan Amounts

Different loan products may have varying limits on the loan amount you can borrow. You need to determine how much funding you require and select a loan product that allows you to borrow the desired amount.

5. Eligibility

Different loan products may come with varying eligibility requirements. Some may have stricter credit score requirements, while others may be more lenient. Understand your own credit situation and the eligibility requirements of the loan products to determine which one suits you.

6. Customer Service and Support

Last but equally important, consider the customer service and support provided by the loan provider. A responsible and helpful loan provider can offer a better loan experience, helping you address issues and concerns.

How LairaPlus Offers Quality Loan Products

LairaPlus is a fintech company dedicated to providing high-quality loan products for borrowers. Here are some ways in which LairaPlus offers quality loan products:

Competitive Interest Rates: LairaPlus strives to offer competitive interest rates, making borrowing more cost-effective.

Transparent Fee Structure: LairaPlus provides a transparent fee structure, ensuring that you have a clear understanding of all associated costs and avoiding hidden fees.

Early Repayment Policy: LairaPlus allows early repayment without extra fees or penalties, enabling you to better manage your finances.

Exceptional Customer Service: LairaPlus offers top-notch customer service and support to address your questions and provide assistance.

When comparing different simple loan products, carefully consider the factors mentioned above and make sure to choose the product that best suits your financial needs and goals. Whether you need to address emergencies or achieve specific financial objectives, selecting the right loan product is crucial, and LairaPlus is here to continue providing quality loan solutions.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

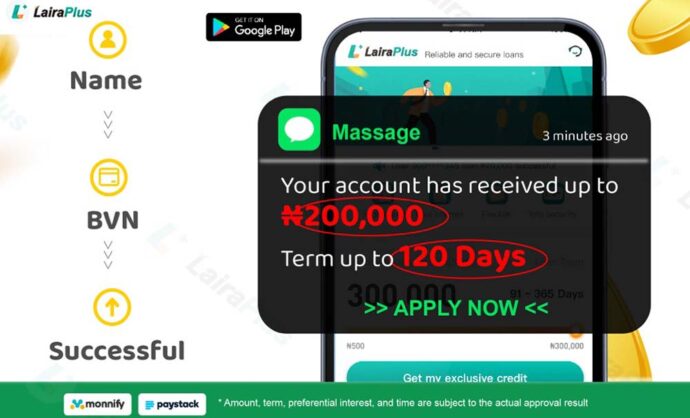

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT