Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

How to Apply for Mobile Loans

Mobile loans have become an essential financial tool for many, providing quick access to funds in times of need. In this 1000-word article, we will provide a comprehensive guide on how to apply for mobile loans, with a focus on the user-friendly experience offered by LairaPlus.

Part One: Introduction to Mobile Loan Application

1. Understanding Mobile Loans:

Mobile loans are financial products that can be applied for and managed using a mobile device, typically through dedicated loan apps like LairaPlus.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

2. Why Choose Mobile Loans:

Discuss the advantages of mobile loans, such as accessibility, convenience, and speed of disbursal.

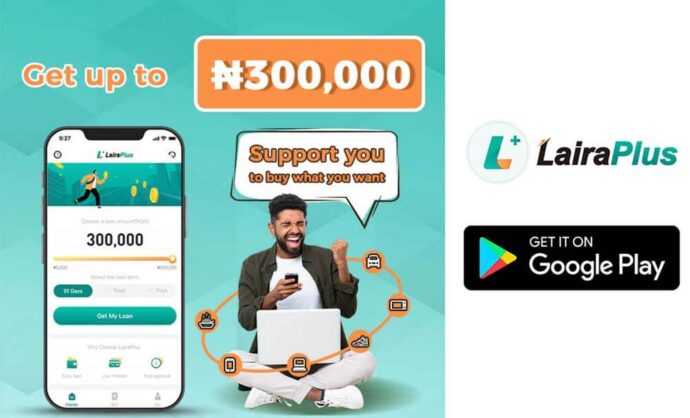

3. LairaPlus: A Trusted Mobile Loan Provider:

Introduce LairaPlus as a reliable mobile loan platform committed to transparency and responsible lending.

Part Two: Applying for a Mobile Loan with LairaPlus

1. Downloading the LairaPlus App:

Explain how borrowers can download and install the LairaPlus app from their device’s app store.

2. Creating an Account:

Walk users through the process of creating an account on LairaPlus, including providing basic personal information.

3. Completing the Profile:

Guide borrowers on how to complete their user profile, which may include additional details such as employment and financial information.

4. Loan Application Process:

Explain how to initiate a loan application within the LairaPlus app, including specifying the loan amount and duration.

5. Providing Necessary Documentation:

Discuss the types of documentation that may be required for verification, such as identification documents or income proof.

6. Credit Assessment:

Explain how LairaPlus assesses the borrower’s creditworthiness, which may include a review of credit scores and financial history.

7. Loan Approval and Disbursement:

Detail the stages of loan approval, including how borrowers are notified of their application status and how funds are disbursed upon approval.

Part Three: Responsible Borrowing Practices

1. Borrowing Within Means:

Emphasize the importance of borrowing only what is needed and can be comfortably repaid.

2. Reading and Understanding Terms:

Encourage borrowers to thoroughly read and understand the terms and conditions, including interest rates and repayment schedules.

3. Setting Up a Repayment Plan:

Guide borrowers on creating a repayment plan to ensure they can meet their financial obligations on time.

4. Contacting LairaPlus Support:

Explain how borrowers can reach out to LairaPlus for assistance or inquiries regarding their loans.

Part Four: LairaPlus’ Commitment to Borrower Support

1. Transparency and Clarity:

Highlight LairaPlus’ commitment to providing transparent and clear loan terms.

2. Financial Education Resources:

Promote LairaPlus’ educational resources to help borrowers make informed financial decisions.

3. Responsiveness and Assistance:

Highlight LairaPlus’ responsive customer support and assistance in times of financial need.

Conclusion:

Applying for mobile loans, especially through user-friendly platforms like LairaPlus, offers convenience and accessibility to financial assistance. By following the steps outlined in this guide and adhering to responsible borrowing practices, individuals can effectively navigate the mobile loan application process and harness the benefits of quick access to funds when needed.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT