Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

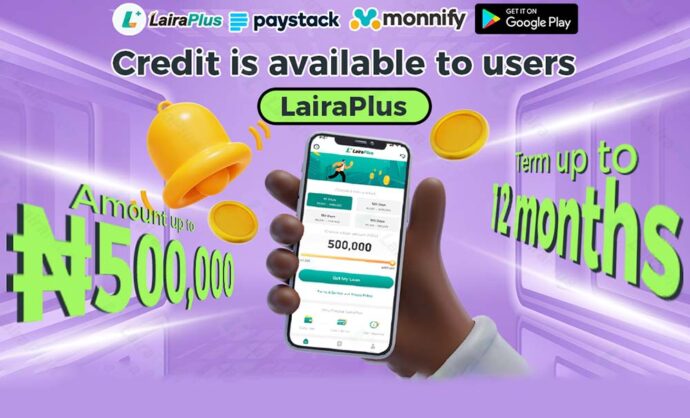

Mobile loans have revolutionized the lending landscape, offering borrowers a convenient and accessible way to access financial assistance. We will explore the concept of mobile loans, how they operate, and their significance in today’s financial world, with insights from LairaPlus.

Part One: Understanding Mobile Loans

1. Introduction to Mobile Loans:

Mobile loans are a type of digital financial service that allows individuals to borrow money using their mobile devices, such as smartphones or feature phones.

2. Accessibility and Convenience:

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

One of the key advantages of mobile loans is their accessibility. They can be accessed anytime and anywhere, making them a lifeline for those facing urgent financial needs.

3. Types of Mobile Loans:

Mobile loans can take various forms, including payday loans, installment loans, and peer-to-peer lending, each with its own set of terms and conditions.

Part Two: How Mobile Loans Work

1. Loan Application Process:

Borrowers typically start by downloading a mobile loan app like LairaPlus. They then complete the application process, providing personal and financial information.

2. Credit Assessment:

Once the application is submitted, the lender assesses the borrower’s creditworthiness. This process may involve reviewing credit scores, income verification, and other factors.

3. Loan Approval and Disbursement:

If approved, the loan is disbursed directly to the borrower’s mobile wallet or bank account. The speed of disbursement is a significant advantage of mobile loans.

4. Repayment Terms:

Borrowers are provided with a repayment schedule, including the due date and amount. Some apps offer flexible repayment options.

Part Three: The Significance of Mobile Loans

1. Financial Inclusion:

Mobile loans have played a pivotal role in promoting financial inclusion, providing access to credit for individuals who are underserved or excluded by traditional banking systems.

2. Addressing Emergencies:

Mobile loans offer a quick solution to unforeseen financial emergencies, such as medical bills, car repairs, or unexpected expenses.

3. Building Credit History:

For individuals with limited or no credit history, responsibly repaying mobile loans can help establish a positive credit history.

4. Convenience and Efficiency:

Mobile loans eliminate the need for physical visits to banks or loan offices, making the borrowing process efficient and user-friendly.

Part Four: LairaPlus’ Role in Mobile Loans

1. Transparency and Fair Practices:

LairaPlus is committed to transparency in its loan offerings. Borrowers can expect clear terms, including interest rates and fees, before committing to a loan.

2. Financial Education:

LairaPlus provides resources and guidance to help borrowers make informed financial decisions, promoting responsible borrowing.

3. Support and Assistance:

In case of repayment difficulties, LairaPlus offers support to borrowers, helping them navigate their financial challenges.

Mobile loans have emerged as a transformative financial tool, offering accessibility, convenience, and financial inclusion. LairaPlus, as a trusted player in the mobile lending industry, strives to provide transparent, fair, and supportive loan services. By understanding how mobile loans work and choosing responsible borrowing practices, individuals can harness the power of mobile loans to meet their financial needs effectively and responsibly.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT