Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Avoiding the Pitfalls of Mobile Loans,LairaPlus Offers Insights for Smart Borrowing

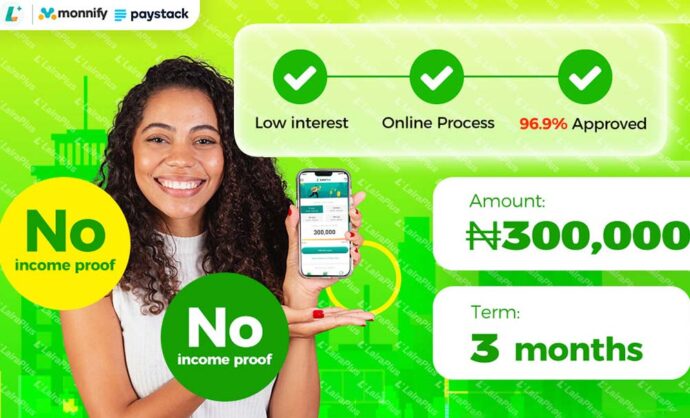

Mobile loans have become increasingly popular for their convenience in addressing financial needs. However, with convenience comes the potential for pitfalls. We will explore how to avoid falling into the traps of mobile loans and provide insights from LairaPlus to help borrowers make informed and responsible borrowing choices.

Part One: Understanding the Mobile Loan Landscape

1. The Appeal and Risks:

Mobile loans offer quick access to funds, making them attractive for urgent needs. However, they can also carry high-interest rates and fees that borrowers should be aware of.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

2. The Role of Transparency:

Understanding the terms, interest rates, and fees associated with mobile loans is crucial. Borrowers should prioritize transparency when choosing a lending platform.

3. The Importance of Responsible Borrowing:

Borrowers should assess their financial situation carefully and borrow only what they can afford to repay on time.

Part Two: LairaPlus’ Advice on Responsible Borrowing

1. Financial Self-Assessment:

LairaPlus encourages borrowers to conduct a thorough self-assessment of their financial situation before taking out a loan. This assessment should include evaluating their income, expenses, and ability to repay the loan.

2. Comparing Loan Options:

Borrowers should compare different loan options, considering factors such as interest rates, fees, and repayment terms. This allows them to choose the loan that best fits their needs.

3. Transparent Contracts:

LairaPlus emphasizes the importance of transparent loan contracts. Borrowers should read and understand all terms, fees, and conditions before signing.

4. Financial Education:

LairaPlus offers financial education resources to help borrowers improve their financial literacy and make more informed decisions.

5. Repayment Planning:

Planning for loan repayment is crucial. Borrowers should create a budget that includes loan repayments to ensure they can meet their financial obligations.

Part Three: Strategies to Avoid Mobile Loan Traps

1. Borrow Only What You Need:

Avoid the temptation to borrow more than necessary. Borrowers should have a clear purpose for the loan and request only the amount required.

2. Be Wary of High-Interest Rates:

High-interest rates can quickly accumulate debt. Borrowers should understand the interest rate on their loan and explore alternatives if it seems excessively high.

3. Avoid Multiple Loans:

Taking out multiple loans simultaneously can lead to a cycle of debt. Borrowers should focus on repaying one loan before considering another.

4. Timely Repayments:

Paying loans on time helps build a positive credit history and avoids late fees. Setting up reminders or automatic payments can assist in this regard.

5. Seek Financial Counseling:

If borrowers find themselves in financial distress, they should consider seeking advice from a financial counselor or credit counselor to help them manage their debt.

While mobile loans can offer a lifeline in times of need, they come with potential traps that borrowers should be cautious of. LairaPlus is dedicated to helping borrowers make responsible borrowing decisions through financial education, transparent contracts, and sound advice. By following the strategies outlined in this article and making informed choices, borrowers can avoid falling into the pitfalls of mobile loans and use them as a responsible financial tool.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT