₦10,000 Emergency Loan: Do I Qualify for LairaPlus? An unexpected financial crisis can strike at any time, and when you’re in urgent need of ₦10,000, LairaPlus may be an option worth considering. However, a common question that arises is whether

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

₦10,000 Emergency Loan: Do I Qualify for LairaPlus? An unexpected financial crisis can strike at any time, and when you’re in urgent need of ₦10,000, LairaPlus may be an option worth considering. However, a common question that arises is whether

When faced with the need for an emergency loan of ₦10,000, there are some key steps and considerations that can help you navigate this challenge: 1. Confirm the Urgency: First and foremost, ensure that your loan need is indeed urgent

An emergency loan can provide crucial financial support in times of need, and LairaPlus, as a reputable loan service provider, offers a convenient application process to meet your ₦10,000 urgent requirements. In this article, we will provide a detailed overview

LairaPlus Personal Loan Approval Criteria: A Comprehensive Guide Applying for a personal loan can be a significant financial decision, and understanding the approval criteria is essential to increase your chances of success. LairaPlus, as a reputable loan service provider, has

Can I Repay My Personal Loan Early, and Will There Be a Penalty? A Guide to LairaPlus When considering repaying your personal loan early, it’s crucial to understand the specific terms and conditions outlined in your loan agreement. Each lending

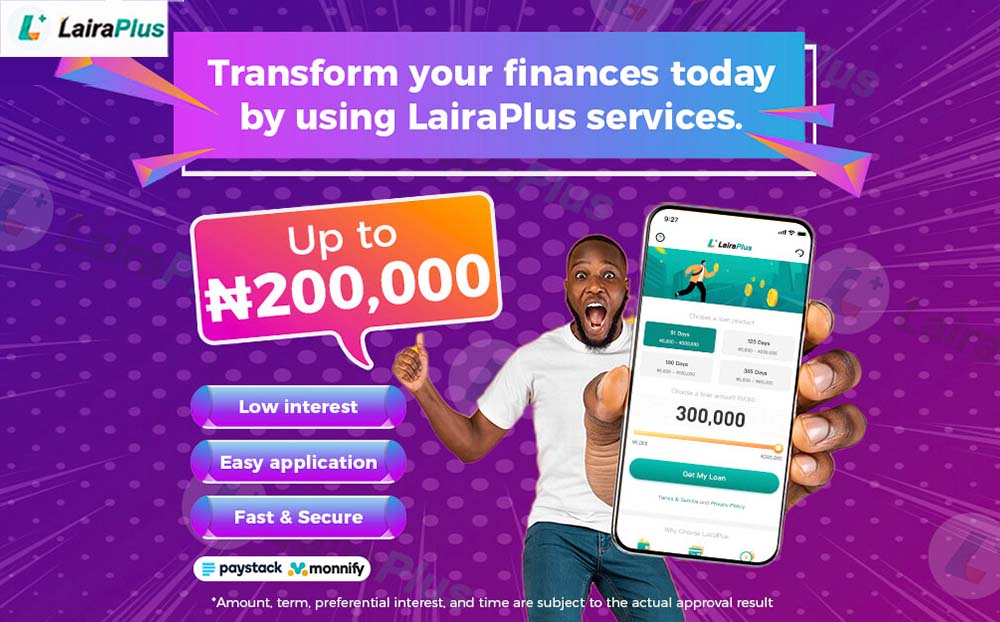

Cash loans are a means of swiftly acquiring funds to address urgent financial needs, and they have found widespread use in many countries’ financial markets. Nigeria’s online cash loan market is no exception, and LairaPlus, as part of this market,

Online cash loans have become an essential choice for many to address urgent financial needs in today’s society. Compared to traditional lending methods, online loans offer a more convenient and rapid avenue to meet the financial requirements of individuals and

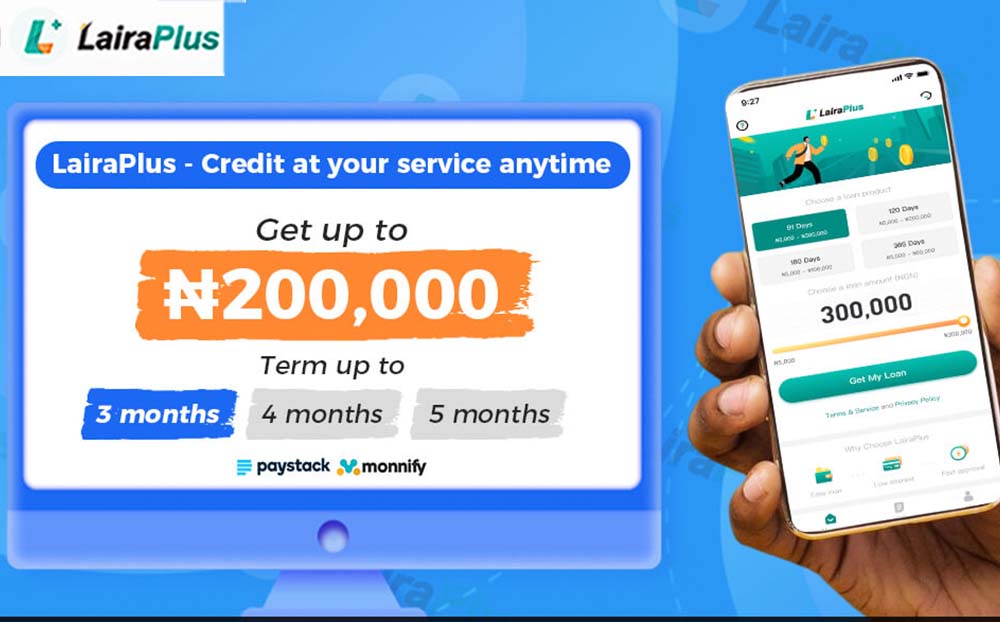

LairaPlus, as part of Nigeria’s online cash loan market, offers fast and convenient loan solutions to customers. The loan amount is a crucial factor that borrowers are concerned about since it determines how much funding you can access to meet

Nigeria, as one of Africa’s largest economies, boasts a burgeoning online cash loan market. This market caters to the growing needs of individuals and businesses for short-term capital. However, the interest rates in Nigeria’s online cash loan market vary among

LairaPlus offers a convenient loan option to help people meet urgent financial needs or address financial issues. However, to ensure loan applicants are eligible, there are specific requirements that must be met. This article will provide a detailed explanation of

Applying for LairaPlus Cash Loans: Simple, Fast, Transparent When you’re facing urgent financial needs or require a quick solution to your financial issues, LairaPlus’s cash loans are a reliable option. This article will provide a detailed guide on how to

Cash loans are a type of short-term borrowing typically used to meet urgent financial needs or address unforeseen expenses. LairaPlus is a company that provides cash loan services, and this article will introduce the concept of cash loans and the

How to Ensure Quick Approval for Your Small Loans Application In situations where you need funds urgently, small loans can be a convenient and fast solution. As a borrower, you would naturally want your loan application to be approved quickly

Personal Information Required for Applying for Small Loans Small loans are a convenient financial tool designed to cater to urgent financial needs. As a reputable financial platform, LairaPlus is committed to offering a streamlined loan application process to ensure that

Online personal small loans are a convenient and quick way to address unexpected financial needs. As a reputable financial platform, LairaPlus is committed to providing a simplified loan application process to ensure that more individuals can easily obtain the small

Microloans are a type of financial product designed to provide borrowers with relatively small amounts of funds to meet short-term financial needs or emergency expenses. This type of loan is characterized by its relatively low amounts and can be used

Differences Between Personal Online Instant Loans and Traditional Borrowing In the modern financial landscape, personal online instant loans have emerged as an innovative financial service with distinct differences from traditional borrowing methods. Here is an in-depth analysis of the contrasts

How to Obtain Online Instant Loans with LairaPlus LairaPlus offers a convenient and efficient solution for obtaining online instant loans, allowing individuals to quickly access the funds they need in times of urgency. Below is a detailed guide on how

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad