Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

LairaPlus Personal Loan Approval Criteria: A Comprehensive Guide

Applying for a personal loan can be a significant financial decision, and understanding the approval criteria is essential to increase your chances of success. LairaPlus, as a reputable loan service provider, has specific standards and criteria for approving personal loans. In this article, we will provide a comprehensive guide to the approval criteria used by LairaPlus.

1. Credit Score and Credit History:

One of the most critical factors in the personal loan approval process is your credit score and credit history. LairaPlus typically evaluates your creditworthiness by checking your credit report and credit score. A higher credit score, usually above 700, indicates a strong credit history and responsible financial behavior, which can increase your chances of approval. However, LairaPlus may also work with individuals who have fair or less-than-perfect credit.

2. Income and Employment Stability:

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Your income and employment stability play a significant role in the approval process. LairaPlus wants to ensure that you have a steady source of income to repay the loan. They typically assess factors such as your monthly income, employment history, and current employment status. Having a stable job and income can enhance your approval prospects.

3. Debt-to-Income Ratio:

LairaPlus considers your debt-to-income ratio (DTI), which is the ratio of your monthly debt obligations to your monthly income. A lower DTI indicates that you have more financial capacity to take on additional debt, making you a more attractive candidate for a personal loan.

4. Loan Amount and Purpose:

The loan amount you request and the purpose of the loan can also impact approval. LairaPlus may have specific criteria regarding the maximum loan amount they are willing to provide and the types of expenses or purposes they consider acceptable. Be sure to align your loan request with their guidelines.

5. Age and Citizenship Status:

You must meet the age and citizenship requirements specified by LairaPlus. Generally, you need to be a legal adult in your country of residence to apply for a personal loan. Some lenders may have additional requirements for non-citizens.

6. Residence and Contact Information:

You need to provide accurate contact information, including your current residence and phone number. This information helps LairaPlus verify your identity and reach out to you during the application process.

7. Documentation and Verification:

LairaPlus may require you to provide documentation to verify the information you’ve provided in your application. This could include recent pay stubs, bank statements, or other financial records. Ensuring the accuracy and completeness of your application and supporting documents is crucial for a smooth approval process.

8. Meeting Legal and Regulatory Requirements:

LairaPlus, like all reputable lenders, operates within the legal and regulatory framework of the regions it serves. Ensuring that you meet these legal and regulatory requirements is fundamental to the approval process.

9. Loan Terms and Conditions:

The specific terms and conditions of the loan, including interest rates, fees, and repayment schedules, are determined based on your creditworthiness and the loan amount requested.

In conclusion, LairaPlus uses a multifaceted approach to assess loan applications, taking into account factors such as credit history, income, employment stability, and more. Understanding these approval criteria can help you prepare a stronger application and increase your likelihood of securing a personal loan with LairaPlus. Remember that each lender may have unique criteria, so it’s essential to review their specific guidelines and policies before applying.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

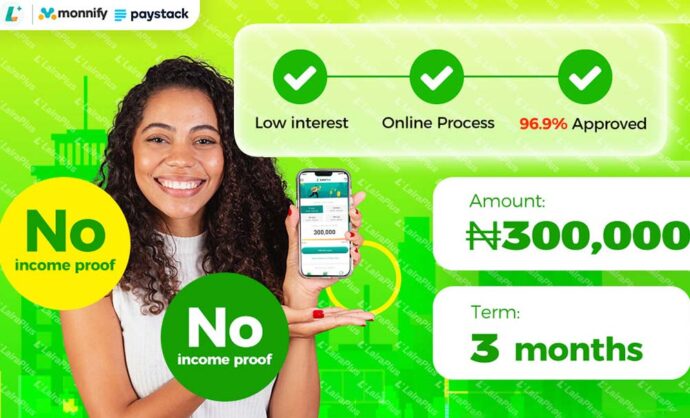

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT