Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

LairaPlus offers a convenient loan option to help people meet urgent financial needs or address financial issues. However, to ensure loan applicants are eligible, there are specific requirements that must be met. This article will provide a detailed explanation of the eligibility criteria for applying for a LairaPlus loan so that potential applicants can understand whether they qualify.

1. Age Requirement

First and foremost, loan applicants for LairaPlus must be 18 years of age or older. This requirement exists because minors are unable to enter legally binding contracts, including loan agreements. Therefore, meeting the age requirement is an essential criterion.

2. Legal Identification

When applying for a LairaPlus loan, you need to provide legal identification documents, typically an ID card. This is to ensure that you are a lawful borrower and are eligible to apply for a loan. Identity verification is a crucial step in the loan approval process.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

3. Stable Income Source

LairaPlus generally requires borrowers to have a stable source of income. This is because the loan company needs to ensure that you have the ability to make repayments on time. Your income can come from various sources, including wages, part-time work, self-employment, or other legitimate sources. In the loan application, you usually need to provide documents or proof of your income situation.

4. Credit Score

While LairaPlus typically does not strictly require applicants to have excellent credit scores, a good credit history can often be helpful in the approval process. If you have a good credit record, you may be offered more favorable loan terms. However, don’t worry if your credit score is not excellent; you can still consider applying for a LairaPlus loan as they typically consider multiple factors when deciding whether to approve an application.

5. Valid Bank Account

LairaPlus requires a valid bank account to transfer the approved loan amount to your specified account. This account is used for fund transfers and repayment arrangements. Ensure you provide accurate bank account information to avoid any transfer issues.

6. Complete Loan Application Materials

To ensure that your loan application is processed promptly, you need to submit complete loan application materials. This includes accurately filling out the application form, providing correct personal information, identification documents, and any other required documents or proof materials. Ensuring your application is complete can expedite the approval process.

7. Compliance with Local Laws and Regulations

Lastly, applicants need to comply with local laws and regulations. Illegal activities or improper financial history may affect the approval of loan applications. LairaPlus adheres to applicable laws and regulations and requires borrowers to do the same.

In summary, applying for a LairaPlus loan requires meeting several criteria, including age requirements, legal identification, a stable income source, a valid bank account, complete application materials, and compliance with local laws and regulations. While credit score is a factor, LairaPlus typically considers multiple factors when deciding whether to approve an application. If you meet these criteria and have an urgent need for funds, LairaPlus loan products may be your solution, providing a fast, convenient path to financial support.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

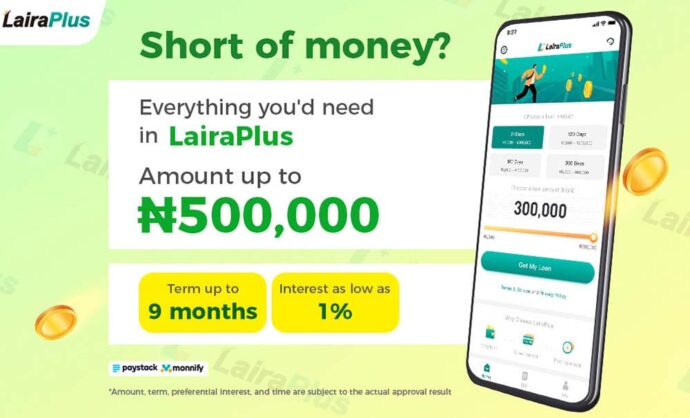

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT