Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

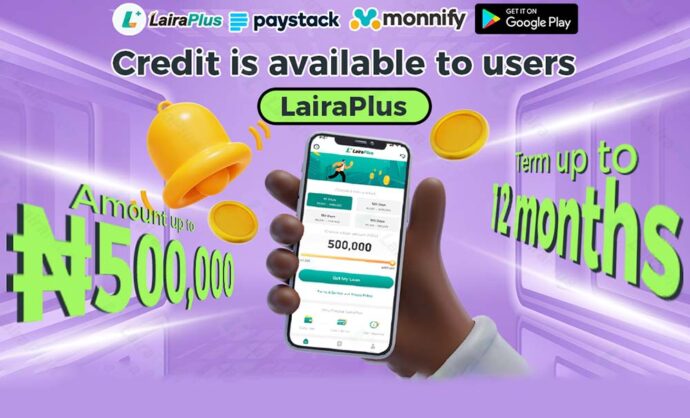

Cash loans are a type of short-term borrowing typically used to meet urgent financial needs or address unforeseen expenses. LairaPlus is a company that provides cash loan services, and this article will introduce the concept of cash loans and the loan products and services offered by LairaPlus.

What Are Cash Loans?

Cash loans are a fast and convenient form of borrowing, usually for small amounts, designed to address immediate financial requirements. Unlike traditional bank loans, cash loans typically do not require collateral and have a quicker approval process, often resulting in funds being disbursed within a short timeframe. This makes cash loans a preferred choice for many individuals facing urgent cash needs.

LairaPlus: Your Reliable Loan Partner

LairaPlus is a company dedicated to providing cash loan services. They are committed to helping customers meet short-term financial needs with quick, transparent, and flexible loan solutions. Below, we will delve into LairaPlus’s loan products and services in detail.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

LairaPlus Loan Products

LairaPlus offers a variety of loan products to cater to different customer needs. Here are some common LairaPlus loan products:

Personal Cash Loans: These are small personal loans designed to address emergency expenses such as medical bills, education costs, or repair expenses. Customers can choose loan amounts and terms based on their needs.

Payday Cash Loans: These loans are typically repaid on the customer’s next payday. They are particularly useful for temporary cash shortages.

Short-Term Cash Loans: LairaPlus’s short-term loan products can help customers address temporary cash needs. These loans usually have shorter terms and can be repaid within a few weeks.

Online Application: LairaPlus offers a straightforward online application process where customers provide essential information and submit their applications.

Transparent Fee Structure: LairaPlus is committed to providing a transparent fee structure, ensuring that customers have a clear understanding of loan interest rates and associated fees.

LairaPlus Loan Process

The LairaPlus loan process typically involves the following steps:

Online Application: Customers can submit an online application on the LairaPlus official website, providing personal information, loan amount, and term during the application process.

Approval: Once the application is submitted, LairaPlus’s team conducts a rapid review and usually provides a response in a short time.

Loan Approval: If the application is approved, customers receive loan contracts and relevant details.

Funds Transfer: Upon agreeing to the loan terms, funds are transferred to the customer’s designated bank account within hours.

Repayment: Customers are required to make timely repayments according to the contract terms. LairaPlus typically offers various repayment options for customer convenience.

Advantages of LairaPlus

As a cash loan provider, LairaPlus offers several advantages:

Quick Approval and Fund Disbursement: LairaPlus is known for its swift approval and fund disbursement process, enabling customers to obtain needed funds rapidly in emergency situations.

Transparent Fee Structure: LairaPlus adheres to a transparent fee structure, ensuring that customers have a clear understanding of loan interest rates and associated costs.

Diverse Loan Products: LairaPlus provides a range of loan products to meet different customer needs, whether short-term or long-term.

Convenient Online Application: Customers can easily submit loan applications online without cumbersome paperwork.

Professional Customer Support: LairaPlus’s customer support team is available to answer customer inquiries and provide assistance.

Loan Responsibility and Caution

While cash loans can provide relief for individuals in need of immediate funds, loans should still be approached with caution. Before applying for a loan, customers should carefully assess their repayment ability and ensure that they can repay the loan on time. Late repayments can result in additional fees and adverse effects on credit scores.

Conclusion

LairaPlus is a company specializing in providing cash loan services, offering quick, transparent, and flexible loan solutions for customers. By understanding the concept of cash loans and LairaPlus’s loan products, customers can better address their short-term financial needs and make informed financial decisions. However, exercising caution and assessing one’s financial situation before applying for a loan is essential.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT