Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Online personal small loans are a convenient and quick way to address unexpected financial needs. As a reputable financial platform, LairaPlus is committed to providing a simplified loan application process to ensure that more individuals can easily obtain the small loans they need. When applying for online personal small loans, borrowers are required to meet certain criteria. Here are some common application requirements:

1. Age Requirement: Typically, borrowers need to be at least 18 years old to apply for a small loan. This age requirement ensures that borrowers have the legal capacity to enter into a loan agreement.

2. Identity Verification: Borrowers need to provide valid identification documents such as an ID card, driver’s license, or other government-issued identification. This helps financial institutions verify the borrower’s identity.

3. Stable Income: Financial institutions usually require borrowers to have a stable source of income. Borrowers need to provide documents such as pay stubs, bank statements, or other proof of income to demonstrate their ability to repay.

4. Credit Rating: While online personal small loans generally do not require strict credit scores, financial institutions may consider the borrower’s credit history. Borrowers with a good credit history are often more likely to be approved.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

5. Bank Account: Borrowers need to have a valid bank account where the loan amount can be quickly deposited and from which repayments can be deducted.

6. Clean Legal Record: Financial institutions will check whether borrowers have any criminal records or negative credit history. Having a clean record improves the likelihood of loan approval.

7. Complete Personal Information: Borrowers need to provide accurate and complete personal information, including contact details and residential address. This information is necessary for verification and communication purposes.

8. Legal Residence: Borrowers should apply for loans from their legal place of residence, typically within their country or region. Some financial institutions may have restrictions on applications from certain areas.

It’s important to note that different financial institutions may have slightly different application requirements. Therefore, it’s advisable to carefully review the specific regulations and requirements of the institution before applying. Additionally, borrowers should thoroughly understand the loan’s interest rates, repayment plans, and potential fees before making a financial decision.

As a professional loan service provider, LairaPlus is dedicated to offering convenient and transparent services for borrowers seeking online personal small loans. By adhering to the above application requirements, borrowers can smoothly apply for and obtain the desired online personal small loans.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

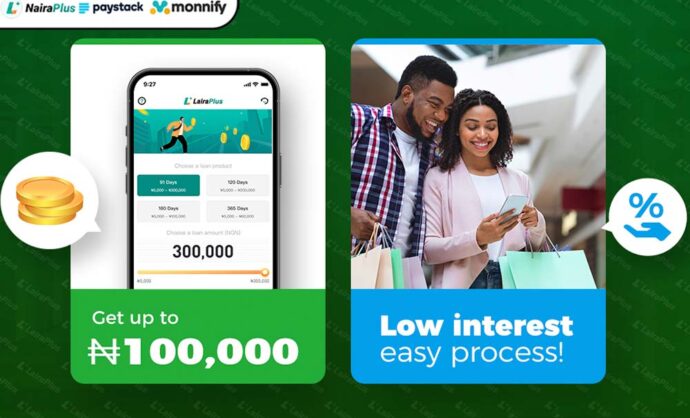

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT