Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Cash loans are a means of swiftly acquiring funds to address urgent financial needs, and they have found widespread use in many countries’ financial markets. Nigeria’s online cash loan market is no exception, and LairaPlus, as part of this market, provides convenient loan solutions to borrowers. This article delves into the approval process for cash loans, shedding light on the role played by LairaPlus.

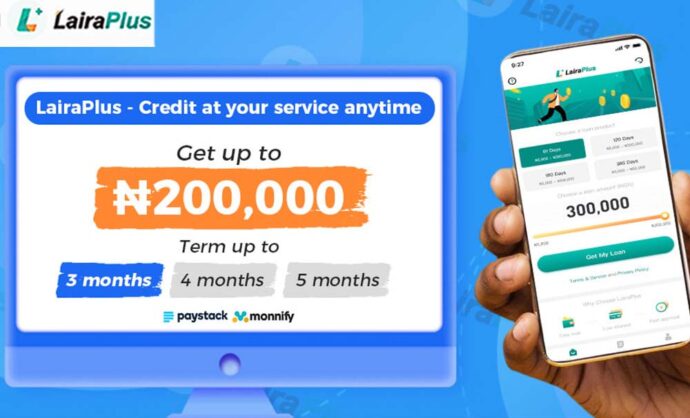

LairaPlus: A Key Player in Nigeria’s Online Loan Market

LairaPlus is a leading online loan provider in Nigeria, dedicated to offering fast and convenient loan services to individuals and businesses. In a competitive market, LairaPlus stands out with its efficient service and flexible loan terms, making it the preferred choice for numerous borrowers.

The Approval Process for Cash Loans

The approval process for cash loans typically includes several key steps. While there may be some variations among different loan providers, the fundamental process steps tend to be similar:

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Loan Application: Borrowers begin by filling out a loan application form, providing personal information, financial details, and specifics regarding the desired loan amount and term. LairaPlus typically offers an online application process, making it convenient for borrowers to submit their applications.

Document Submission: Borrowers typically need to provide supporting documents for their application, such as identification documents, pay stubs, bank statements, and more. These documents aid in verifying the borrower’s identity and financial situation.

Credit Assessment: The loan provider conducts a credit assessment to evaluate the borrower’s credit history and credit score. This helps determine the borrower’s credit risk.

Loan Approval: Following the completion of the credit assessment, the loan provider decides whether to approve the loan application based on the borrower’s creditworthiness, financial situation, and the requested loan amount. The approval process may take some time, but it is generally swift in the online lending market.

Loan Terms: Once the loan is approved, the loan provider presents the borrower with loan terms, including the interest rate, repayment schedule, and any associated fees. Borrowers need to carefully read and understand these terms.

Contract Signing: After accepting the loan terms, borrowers are required to sign a loan contract. The contract outlines the terms and conditions of the loan, including repayment requirements and interest rates.

Disbursement of Funds: Once the contract is signed, the loan provider transfers the loan funds to the borrower’s bank account. This process is typically expedited to meet the borrower’s urgent needs.

Repayment: Borrowers are responsible for making repayments according to the schedule outlined in the contract. This includes repaying the principal amount and paying interest.

LairaPlus’ Role in the Approval Process

LairaPlus plays a crucial role in the approval process for cash loans. As a loan provider, it conducts credit assessments, processes loan applications, provides loan terms, and ultimately transfers funds to borrowers’ accounts. Additionally, LairaPlus is committed to offering transparent and customer-friendly services, ensuring that borrowers understand the loan terms to make informed financial decisions.

How to Improve Loan Approval Chances

For borrowers, improving loan approval chances is paramount. Here are some methods to enhance the likelihood of loan approval:

Maintain a Good Credit History: Maintaining a positive credit history is crucial for loan approval. Timely repayments and avoiding defaults help build a good credit record.

Accurate Loan Application: Ensure that loan applications are filled out accurately with the required documents. Incomplete or incorrect information may delay the approval process.

Choose an Appropriate Loan Amount: Select a loan amount that aligns with your financial situation. Avoid borrowing more than you can comfortably repay.

Thoroughly Review Loan Terms: Before signing the contract, carefully read and understand the loan terms. Ensure you grasp the repayment requirements and any associated fees.

Stable Employment and Income: Having stable employment and verifiable income can increase the chances of loan approval.

Conclusion

Cash loans are a valuable tool for addressing urgent financial needs, and LairaPlus, as a key participant in Nigeria’s online lending market, plays a pivotal role in the approval process. Borrowers should carefully consider their financial objectives, repayment capacity, and loan purpose when selecting the appropriate loan. Comprehensive financial planning and prudent decision-making contribute to effective loan management and achieving financial goals. The flexibility and diversity of online cash loans provide valuable solutions for borrowers in various financial situations.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT