Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

When faced with the need for an emergency loan of ₦10,000, there are some key steps and considerations that can help you navigate this challenge:

1. Confirm the Urgency: First and foremost, ensure that your loan need is indeed urgent and that there are no other available solutions. Sometimes, alternative methods such as borrowing from friends or family, using savings, or budgeting for immediate expenses can be considered.

2. Determine the Loan Amount: Determine the exact amount you need. In this case, you require an emergency loan of ₦10,000.

3. Explore Loan Options: Now, you can start exploring available loan options. You can consider contacting banks, credit unions, online lending platforms, or other loan providers to inquire about their emergency loan products and loan terms.

4. Understand Interest Rates and Fees: Before applying for a loan, make sure to thoroughly understand the interest rates and associated fees. These fees may include interest, processing fees, and possible additional charges. This will help you calculate the total repayment amount.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

5. Submit an Application: After selecting a loan provider, fill out the loan application form. Ensure you provide accurate personal and financial information for a smooth application process.

6. Review the Application: The loan provider will review your application and may request relevant documents to verify your identity and financial situation.

7. Wait for Approval: Once you’ve submitted your application, you’ll need to wait for the loan provider to review and approve your request. This typically takes some time, but they usually strive to process it as quickly as possible.

8. Accept the Loan and Plan Repayment: Upon approval, you’ll need to carefully read and sign the loan agreement to ensure you understand the repayment schedule, interest rates, and related terms. Afterward, the loan funds will be transferred to your specified bank account.

9. Repayment: Finally, based on the terms outlined in the contract, make repayments as scheduled. Adhering to the repayment plan is crucial to maintain your credit record and avoid potential financial issues.

When dealing with an emergency loan, exercise caution and ensure you understand all relevant loan terms and fees. Borrowing is a responsibility and should be approached with care. If you need urgent funds, make sure to select an appropriate loan option and plan for repayment to avoid potential financial difficulties.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

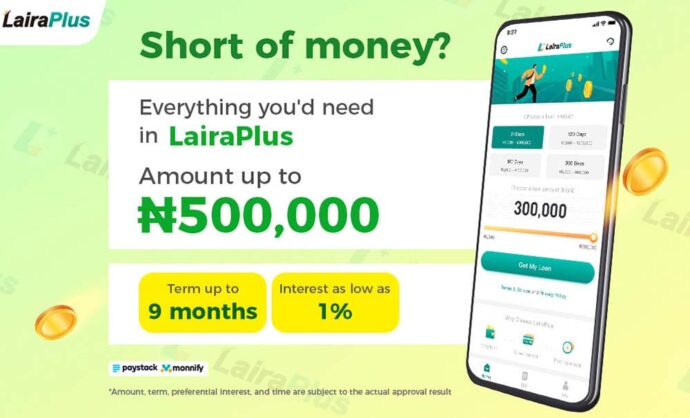

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT