The minimum age to take out a loan typically varies by country and region, but it is generally 18 years old in many places. Here are some key points to consider: Legal Age: In most countries, 18 is the legal

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

The minimum age to take out a loan typically varies by country and region, but it is generally 18 years old in many places. Here are some key points to consider: Legal Age: In most countries, 18 is the legal

Whether you can have overpayments applied to the principal of a personal loan depends on the specific terms and policies of the lender. Here are some key points to consider: Lender Policies: Some lenders allow borrowers to make overpayments that

In Nigeria, there are several types of personal loans available to meet various financial needs. The specific types of personal loans may vary from one financial institution to another, but the following are some common types: Salary Advance Loans: These

Yes, a co-applicant of a mobile loan can typically apply for a personal loan separately. Mobile loans and personal loans are different types of financial products, and being a co-applicant for one does not prevent you from applying for the

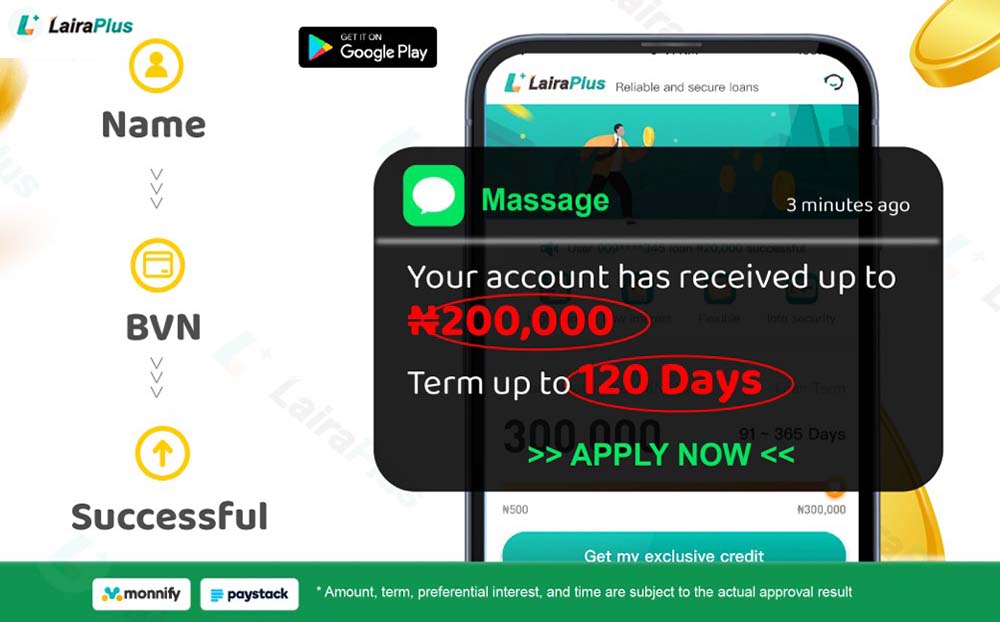

Applying for personal loans online has become a convenient and common way to secure financing for various personal expenses. Here’s everything you need to know about applying for personal loans online: 1. Online Lenders: Numerous online lenders offer personal loans.

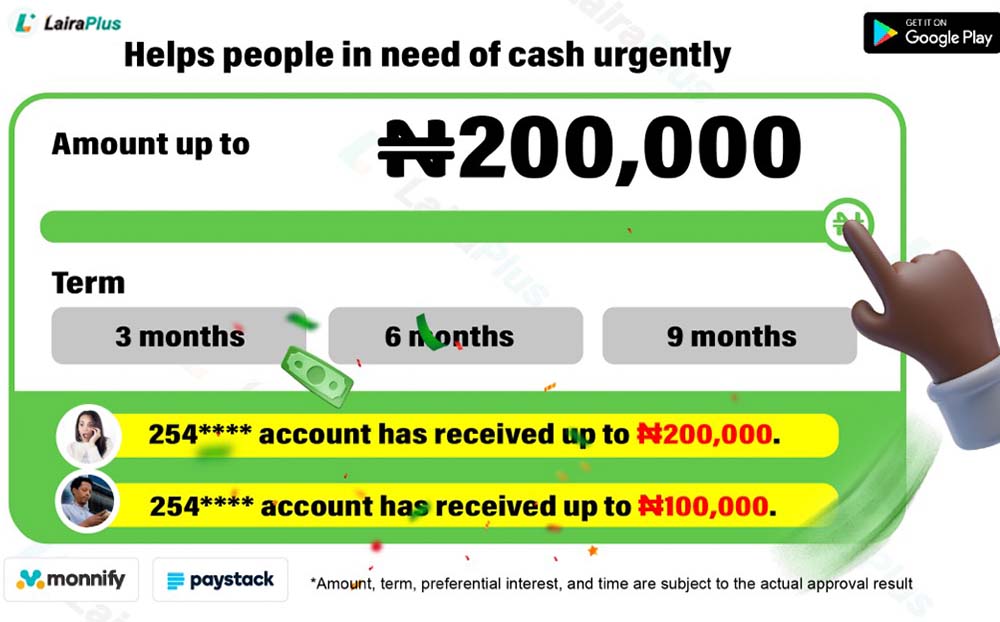

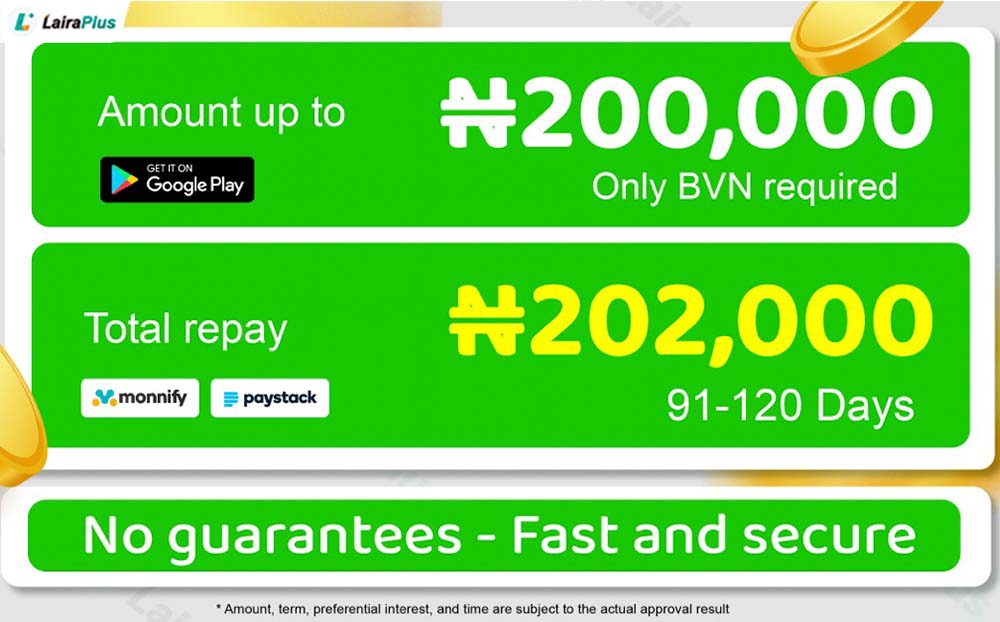

Urgent loan 10,000,LairaPlus Provides You with Emergency Support Financial emergencies can happen to anyone, and when they do, having access to quick and reliable support is essential. Whether it’s an unexpected medical bill, urgent home repairs, or any other sudden

Urgently Need a ₦50,000 Loan? Understanding What to Do If Repayment Is Overdue with LairaPlus When you’re in a tight spot and urgently need ₦50,000, a loan from LairaPlus can be a real lifesaver. However, life can be unpredictable, and

Life is full of unexpected financial challenges, and sometimes you may find yourself in need of urgent funds. Whether it’s for a medical emergency, unforeseen repairs, or other pressing expenses, quick access to cash can be a lifesaver. LairaPlus, offering

Life is full of unexpected twists and turns, and sometimes these twists come with a financial burden. Whether it’s a medical emergency, a sudden car repair, or any other unforeseen expense, having access to quick cash can be a lifesaver.

Urgent Loan 10,000: Rapidly Resolving Financial Needs in 5 Minutes with LairaPlus Life is unpredictable, and financial emergencies can strike when you least expect them. Whether it’s a medical bill, unexpected repairs, or any other unforeseen expense, having access to

Life is full of surprises, and sometimes those surprises come with unexpected financial demands. Whether it’s a medical emergency, a sudden repair, or any other urgent expense, having access to cash within minutes can be a lifesaver. LairaPlus, with its

Life often throws unexpected financial challenges our way. Whether it’s a sudden medical expense, a car repair, or any other unforeseen cost, having quick access to cash can make all the difference. LairaPlus, with its instant cash loan in 5

Life is unpredictable, and financial circumstances can change unexpectedly. When you’ve taken out a personal loan with LairaPlus and find it challenging to meet the repayment deadline due to unforeseen circumstances, you may wonder if there’s an option for extending

Facing a loan denial can be disheartening, especially when you’re in need of financial assistance. However, a loan rejection doesn’t necessarily mean the end of your borrowing journey. LairaPlus understands that situations can change, and it’s committed to helping borrowers

When choosing an online borrowing product, a crucial decision is whether to opt for a fixed interest rate or an adjustable interest rate. Each type of interest rate has its unique features and considerations, and LairaPlus, as an online lending

Online simple loans have become the preferred choice for many individuals when facing urgent financial needs. They offer a quick and convenient way to borrow money. However, before taking out an online simple loan, it’s essential to be aware of

In today’s financial market, there is a wide array of simple loan products to choose from. These loans come with various features and are suited for different borrowing needs and financial situations. However, figuring out how to effectively compare different

The rise of the fintech industry has ushered in a new era of financial services, with online simple loans becoming the preferred choice for many to meet short-term financial needs. Compared to traditional loans, online simple loans offer more convenience

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad