Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

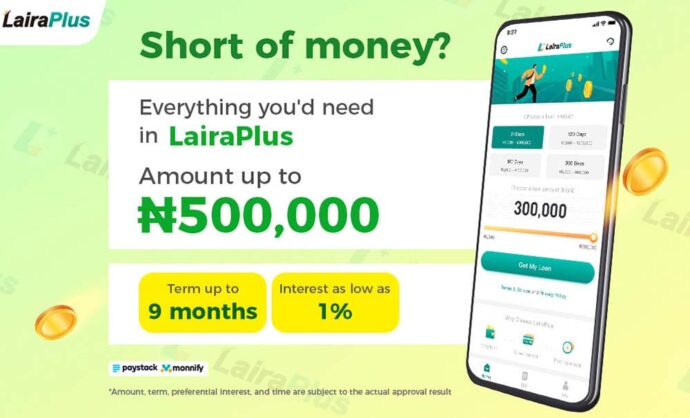

Life is full of surprises, and sometimes those surprises come with unexpected financial demands. Whether it’s a medical emergency, a sudden repair, or any other urgent expense, having access to cash within minutes can be a lifesaver. LairaPlus, with its instant cash loan in 5 minutes, emerges as the top choice for addressing these emergencies. In this article, we’ll delve into how LairaPlus is the best solution for managing unexpected expenses swiftly and efficiently.

1. What Is an Instant Cash Loan in 5 Minutes?

An instant cash loan in 5 minutes means you can obtain the funds you need within an incredibly short timeframe, usually within 5 minutes or less. These loans are tailored to emergencies, ensuring you have access to financial support when you need it most.

2. Streamlined Application Process

LairaPlus offers a simplified application process, sparing you from the hassle of lengthy paperwork and complicated procedures. You can easily download the app, provide essential information, and submit your loan application with minimal fuss. This streamlined approach is a game-changer, particularly during urgent financial situations.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

3. Swift Access to Funds

One of the standout features of LairaPlus is its ability to provide swift access to funds. Once your loan application is approved, the money is promptly transferred to your bank account, ready for immediate use. This rapid response ensures you can address unforeseen expenses without any unnecessary delays.

4. Transparent Loan Terms

LairaPlus takes pride in offering transparent loan terms. You will receive a clear breakdown of the loan amount, interest rate, repayment duration, and any associated fees. This transparency empowers you to make well-informed financial decisions and devise a repayment plan that aligns with your needs.

5. Security and Privacy

LairaPlus prioritizes your security and privacy. Rigorous measures are in place to safeguard your personal and financial information within the app, guaranteeing that it remains confidential and protected from misuse.

6. Versatility for Various Emergencies

The instant cash loans provided by LairaPlus can be utilized to tackle a wide spectrum of emergencies, from medical crises to home repairs and unexpected bills. Regardless of the nature of your financial challenge, LairaPlus is there to offer the necessary support.

7. Mobile Convenience

LairaPlus offers the convenience of managing your finances directly from your mobile device. You can effortlessly access loan information, track your repayments, and stay on top of your financial situation, all from the palm of your hand.

8. Accessible Customer Support

Should you have any questions or require assistance, LairaPlus typically provides accessible customer support through the app. This means you can reach out for help or clarification whenever the need arises.

In conclusion, an instant cash loan in 5 minutes from LairaPlus simplifies the process of obtaining quick funds to address emergencies. With its straightforward application, fast access to cash, transparent terms, and unwavering commitment to security and privacy, LairaPlus stands out as the ultimate solution for handling unforeseen financial challenges. Say goodbye to stress and delays—LairaPlus is here to provide fast and efficient financial support exactly when you need it.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT