Quick loans can be a viable option when you need money urgently, but it’s essential to consider both the advantages and potential drawbacks before making a decision. Here are some factors to keep in mind: Advantages of Quick Loans: Speed:

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Quick loans can be a viable option when you need money urgently, but it’s essential to consider both the advantages and potential drawbacks before making a decision. Here are some factors to keep in mind: Advantages of Quick Loans: Speed:

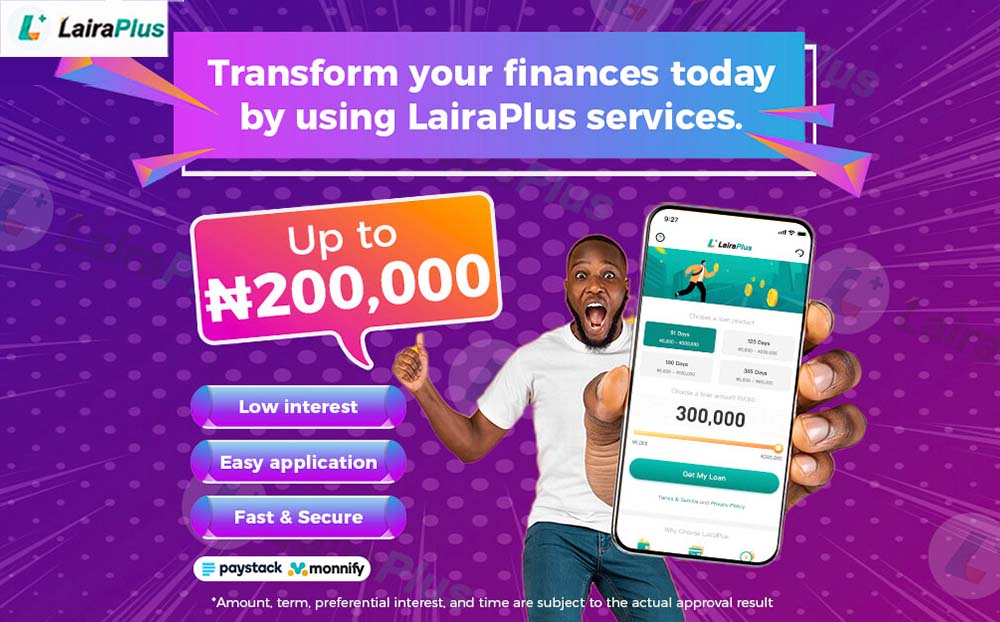

Using loan apps for personal loans in Nigeria offers several benefits, making it a convenient and accessible way to address your financial needs. Here are some of the key advantages: Speed and Convenience: Loan apps simplify the borrowing process. You

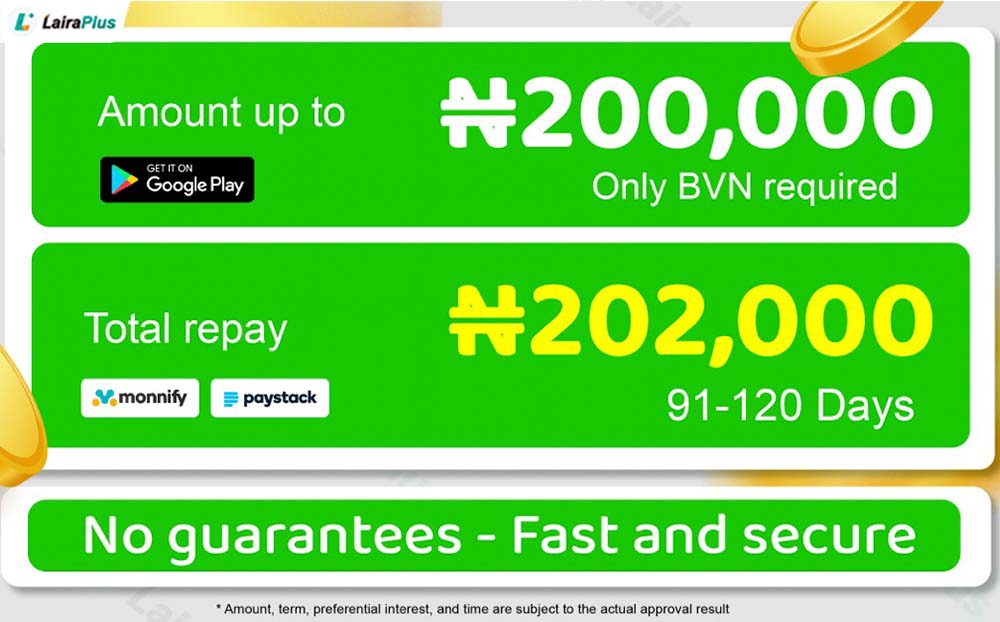

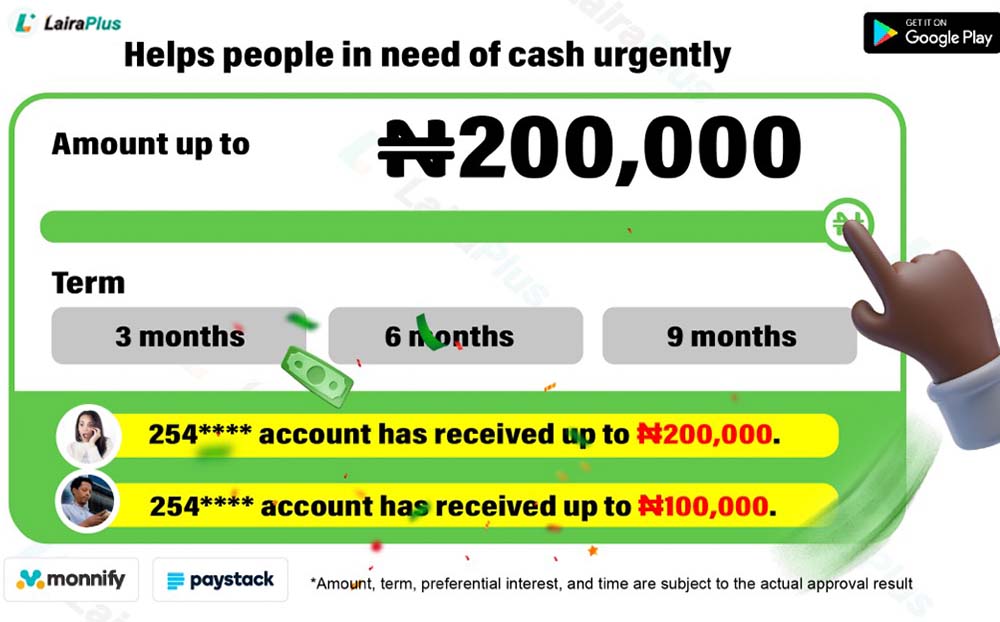

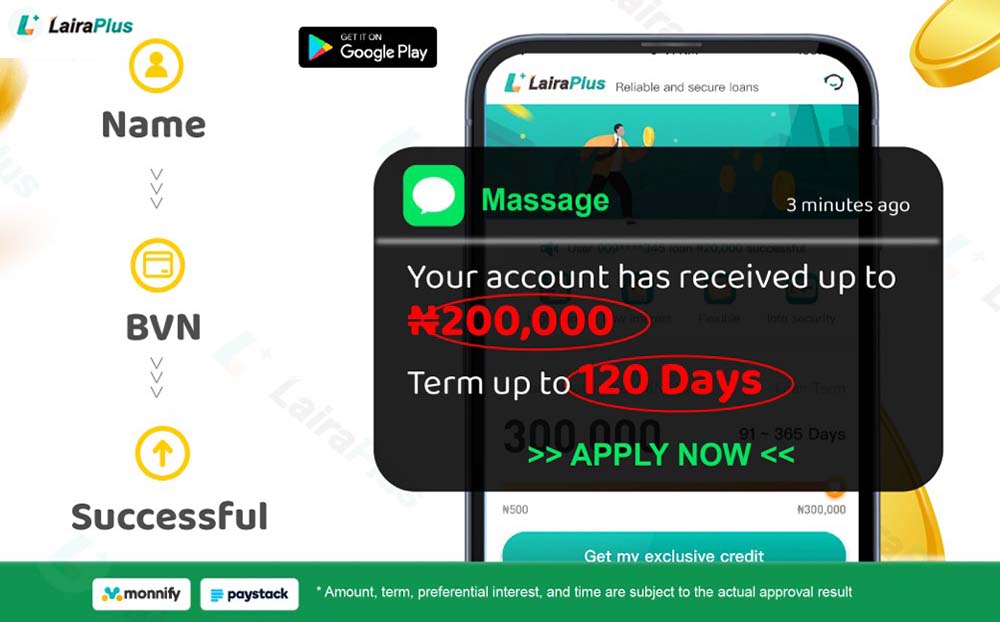

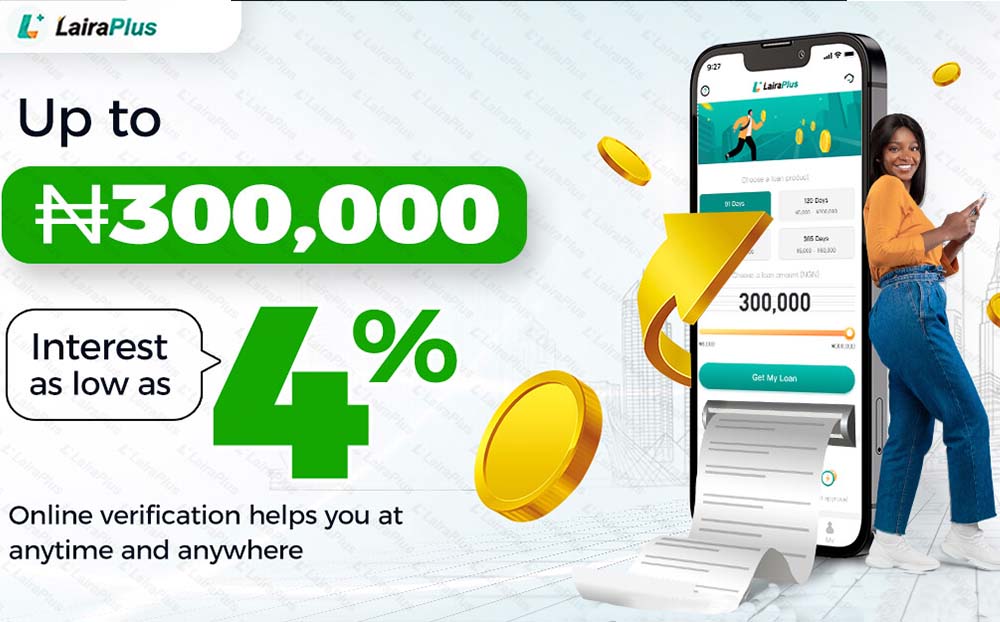

LairaPlus is indeed a reputable online lender in Nigeria that offers personal loans. While they provide a convenient and user-friendly platform for borrowers, the interest rates they offer can vary depending on several factors, including your creditworthiness and the specific

In a world where financial flexibility is essential, the need for personal loans often arises. Whether it’s for medical expenses, education, home improvement, or consolidating debt, the right online lender can make all the difference. LairaPlus, a prominent name in

The concept of what is considered a “lot” in personal loans can vary significantly depending on individual financial circumstances, regional factors, and loan purposes. What might be a large loan for one person could be a small loan for another.

The amount of a personal loan you can get depends on various factors, including your financial situation, creditworthiness, and the specific policies of the lender you approach. Here are some key factors that influence the maximum personal loan amount you

The availability of a personal loan for 20,000 depends on various factors, including your creditworthiness, income, and the specific lending policies of the financial institutions you approach. Here’s what you can do to increase your chances of obtaining a 20,000

Yes, you can take out a personal loan without a specific, predefined reason. Personal loans are typically versatile and can be used for a wide range of purposes. Common reasons people take out personal loans include debt consolidation, home improvement,

Personal loans are typically available to a wide range of individuals, but eligibility and the terms of the loan can vary based on several factors, including the lender‘s requirements and the borrower’s financial situation. Here are some key considerations: Credit

A loan is a financial transaction in which one party, typically a lender, provides money or assets to another party, the borrower, with the expectation that the borrower will repay the lender with interest over a specified period of time.

Yes, it is possible to get a loan to pay off other loans. This is commonly referred to as debt consolidation. Debt consolidation involves taking out a new loan to pay off existing debts, typically multiple loans or credit card

Obtaining a loan, especially a significant one like ₦50,000, can be a serious financial commitment, and it’s important to approach it carefully. Here are some steps to consider when looking for a loan: Assess Your Need: First, carefully assess why

The time it takes for a LairaPlus loan to be credited to your bank account after approval can vary depending on several factors, including your bank’s processing time and the payment method you choose. However, LairaPlus typically processes loan disbursements

Yes, it is possible for individuals to get a loan from a financial institution or lender in another country. This is often referred to as an “international” or “cross-border” loan. There are several ways to obtain a loan from a

Defaulting on a personal loan in Nigeria, as in many countries, can lead to various consequences. However, the specific consequences can vary based on the terms and conditions of the loan agreement and the policies of the lending institution. Here

Paying off an overdue loan quickly is a crucial step in regaining control of your finances and preventing further damage to your credit. Here are some strategies to help you pay off an overdue loan as efficiently as possible: Contact

The number of personal loans someone can apply for is not strictly limited, but it is subject to various factors, including the individual’s creditworthiness, income, and the policies of the lending institutions. Here are some key points to consider: Creditworthiness:

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeriad