Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Personal loans are typically available to a wide range of individuals, but eligibility and the terms of the loan can vary based on several factors, including the lender‘s requirements and the borrower’s financial situation. Here are some key considerations:

Credit History: A strong credit history is often a crucial factor in obtaining a personal loan. Lenders use your credit score to assess your creditworthiness. Individuals with higher credit scores are more likely to qualify for loans and receive better terms, including lower interest rates.

Income and Employment: Lenders may require proof of a stable income and employment as part of the loan application process. This helps demonstrate your ability to repay the loan.

Debt-to-Income Ratio: Lenders consider your debt-to-income ratio, which is the percentage of your income that goes toward debt payments. A lower debt-to-income ratio is generally more favorable.

Collateral: Some personal loans are unsecured, meaning they don’t require collateral. Others, like secured loans, may require you to pledge assets (e.g., a car or savings account) to secure the loan.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Lender’s Policies: Each lender sets its own eligibility criteria. Some lenders specialize in serving borrowers with lower credit scores or unique financial situations, while others have more stringent requirements.

Legal Requirements: You must meet legal requirements and be of legal age to enter into a loan agreement, which often means being at least 18 years old.

Residency Status: Lenders may require borrowers to be legal residents or citizens of the country where they are seeking the loan.

While personal loans are available to a wide range of individuals, the terms and interest rates offered to borrowers can vary significantly based on the factors mentioned above. If you have a strong credit history and financial stability, you are more likely to have access to personal loans with favorable terms. If your financial situation is less secure or your credit score is lower, you may still be able to obtain a personal loan, but the interest rates may be higher, and the terms less favorable.

It’s essential to shop around and compare offers from different lenders to find the best terms that suit your individual financial situation and needs. Additionally, working to improve your credit score and financial stability can increase your chances of obtaining more favorable loan terms in the future.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

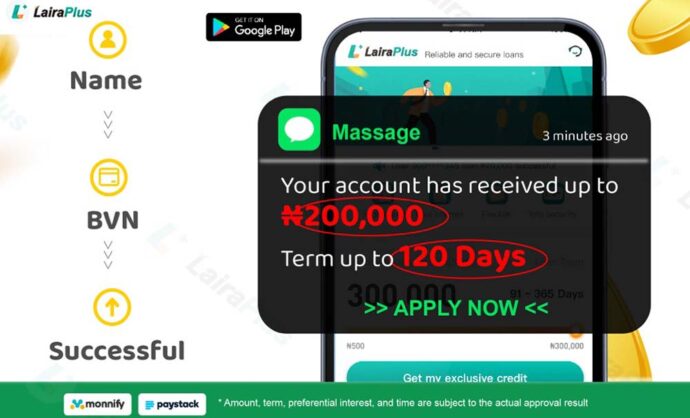

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT