Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Defaulting on a personal loan in Nigeria, as in many countries, can lead to various consequences. However, the specific consequences can vary based on the terms and conditions of the loan agreement and the policies of the lending institution. Here are some potential outcomes of not paying a personal loan for one year in Nigeria:

Accrued Interest and Late Fees: Most lenders will charge significant interest and late fees for each month that you miss a payment. This can substantially increase the overall amount you owe.

Negative Impact on Credit Score: Late or missed payments are reported to credit bureaus and can have a severe negative impact on your credit score. A lower credit score can make it more challenging to obtain credit in the future.

Debt Collection Efforts: The lender or a debt collection agency may start contacting you to collect the outstanding debt. They may send letters, make phone calls, or even visit your home or workplace to request payment.

Legal Action: If the debt remains unpaid, the lender may take legal action to recover the funds. This can result in a court judgment against you, which could lead to wage garnishment or asset seizure.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Blacklisting: Your name may be reported to credit bureaus or the Credit Bureau Association of Nigeria (CBAN). Being blacklisted can make it extremely difficult to access credit or obtain financial services in the future.

Asset Seizure: Depending on the terms of the loan and any collateral involved, the lender may have the right to seize assets or property secured against the loan.

Restrictions on Banking Services: Non-payment of a loan could lead to restrictions on your ability to use certain banking services, such as obtaining new loans or opening new accounts.

Immigration Restrictions: In some cases, debt defaulters may face immigration restrictions, which can affect their ability to travel.

It’s essential to understand that the consequences of defaulting on a personal loan can be severe and can have long-lasting effects on your financial and personal life. If you’re experiencing financial difficulties and are struggling to make loan payments, it’s advisable to contact your lender as soon as possible to discuss your situation and explore possible alternatives, such as loan restructuring or a new repayment plan. Seeking legal advice or assistance from a credit counseling agency may also be helpful in dealing with overdue personal loans in Nigeria.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

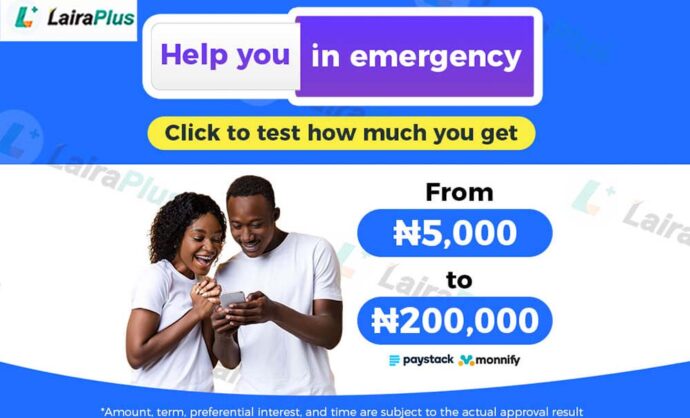

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT