Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

Yes, you can still get approved for a personal loan even if your credit score is not high. Many lenders, including online lenders and some traditional banks, offer personal loans designed for individuals with varying credit profiles. Here are some options to consider if you have a less-than-perfect credit score:

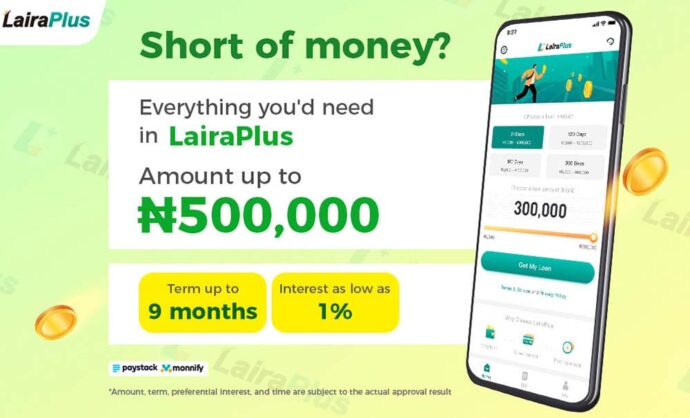

Online Lenders: Online lenders, such as LairaPlus and others, often have more flexible lending criteria than traditional banks. They may consider factors beyond just your credit score when making lending decisions. Some online lenders specialize in providing personal loans to borrowers with less-than-ideal credit.

Secured Personal Loans: If your credit score is low, you might consider a secured personal loan. Secured loans require collateral, such as a savings account, vehicle, or other valuable assets. The collateral provides security for the lender, making it easier for individuals with lower credit scores to qualify for loans.

Cosigner: If you have a trusted friend or family member with a good credit history, they may be willing to cosign the loan. A cosigner essentially agrees to take responsibility for the loan if you fail to make payments. This can improve your chances of approval and may lead to more favorable loan terms.

Credit Unions: Credit unions are known for their community-oriented approach to lending. They may be more willing to work with members who have lower credit scores. Consider joining a local credit union and discussing your personal loan options with them.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Improving Your Credit: If possible, take steps to improve your credit score before applying for a personal loan. This can include paying down outstanding debts, making on-time payments, and addressing any errors on your credit report. Even a small increase in your credit score can open up more borrowing opportunities and potentially lead to better interest rates.

Alternative Lenders: Some alternative lenders focus on providing personal loans to borrowers with imperfect credit histories. While these loans may come with higher interest rates, they can be a viable option when traditional lenders decline your application.

Peer-to-Peer Lending: Peer-to-peer lending platforms connect individual investors with borrowers. These platforms may be willing to fund loans for individuals with less-than-perfect credit, and interest rates can be competitive.

It’s essential to be cautious when borrowing with a lower credit score, as interest rates may be higher, and the terms may be less favorable. Ensure that you can comfortably manage the loan payments before proceeding, and carefully review the terms and conditions of any loan offer.

Additionally, remember that successfully repaying a personal loan can help improve your credit score over time, which can open up more financial opportunities in the future.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT