Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

in Nigeria

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

The number of personal loans someone can apply for is not strictly limited, but it is subject to various factors, including the individual’s creditworthiness, income, and the policies of the lending institutions. Here are some key points to consider:

Creditworthiness: The primary factor that will determine whether you are approved for a personal loan is your creditworthiness. Lenders assess your credit score, credit history, and debt-to-income ratio. If your credit is strong, you may have an easier time obtaining multiple personal loans.

Income: Your income plays a significant role in your ability to qualify for personal loans. Lenders want to ensure that you have the financial means to repay the borrowed funds. If you have a stable and sufficient income, you may be more likely to secure multiple loans.

Lender Policies: Different lenders may have varying policies on how many loans you can have simultaneously or how frequently you can apply. Some lenders may be more willing to extend credit to individuals with existing loans, while others may have stricter limits.

Loan Purpose: The purpose of the loan can also impact how many loans you can obtain. For instance, you may be able to get multiple loans for different purposes (e.g., one for home improvement and another for debt consolidation).

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

for Android

Debt-to-Income Ratio: Lenders typically calculate your debt-to-income (DTI) ratio to assess your ability to handle more debt. If your DTI is high due to existing loans, it may affect your ability to qualify for additional personal loans.

Loan Amounts: The total amount of loans you can secure also depends on your financial situation. Lenders may be more willing to grant multiple smaller loans rather than a single large loan.

State and Federal Regulations: There may be state or federal regulations that affect the number of loans you can obtain. Some states have restrictions on the total interest rates and fees that can be charged on loans.

Responsible Borrowing: It’s essential to borrow responsibly and only take on loans that you can comfortably manage. Applying for multiple loans at once may raise concerns with lenders and negatively impact your credit score.

It’s crucial to be cautious when applying for multiple personal loans, as taking on too much debt can lead to financial strain and affect your creditworthiness. Before applying for any loan, consider your financial situation, your ability to repay, and your long-term financial goals. If you’re unsure about the number of loans you can apply for or how it might impact your financial health, it’s advisable to consult with a financial advisor or credit counselor.

Free

In Nigeria V1.0.1.2

5.0 (1 million +)

Security Status

in Nigeria

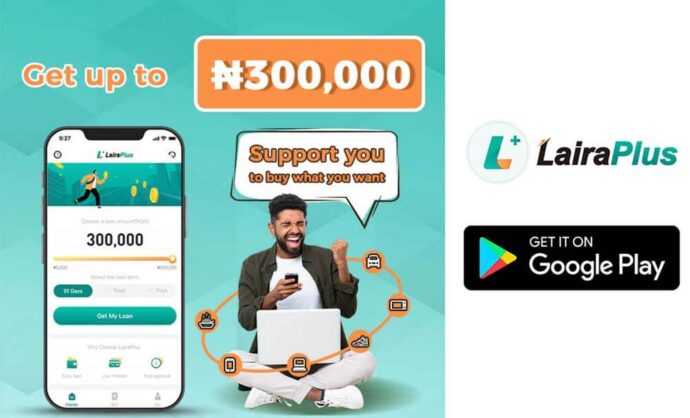

In Nigeria, accessing loans through mobile applications has become increasingly popular due to its convenience and accessibility. LairaPlus, one of the leading loan apps in Nigeria, follows a streamlined approval process to provide users with quick and efficient access to

In the digital age, where financial transactions are increasingly conducted online, security is paramount, especially when it comes to loan applications. Nigerian loan apps like LairaPlus prioritize the safety and security of their users’ personal and financial information. This article

In Nigeria, accessing financial assistance has become increasingly convenient with the emergence of loan apps like LairaPlus. These platforms offer individuals a streamlined and accessible way to apply for loans, eliminating the need for lengthy paperwork and tedious processes. This

LairaPlus stands out as one of Nigeria’s premier loan apps, offering convenient and accessible financial solutions to individuals seeking quick and hassle-free access to credit. To ensure a smooth application process and responsible lending practices, LairaPlus has established specific eligibility

In Nigeria’s fast-paced financial landscape, accessing loans has become more convenient and accessible than ever, thanks to innovative fintech solutions like LairaPlus. This article provides a comprehensive guide on how to navigate the loan application process using LairaPlus, Nigeria’s premier

In the dynamic landscape of financial technology (fintech) in Nigeria, LairaPlus stands out as one of the premier loan apps, offering a range of distinctive features tailored to meet the diverse borrowing needs of its users. This article explores the

LairaPlus is one of the best loan apps in Nigeria with low interest.

Contact:+2349053621749

Contact:+234 704 247 5161

MAIN BUSINESS

APPLY FOR LOAN

SERVICE SUPPORT